Gann Theory For Big Gains MetaTrader Expert Advisor

Post on: 21 Май, 2015 No Comment

Gann Theory and Gann angles have been used by successful forex traders for many years, and they continue to grow in popularity as a way to analyze and predict currency price moves. Gann angles make ideal predictive indicators because, in a sense, they can incorporate past, present and future price characteristics all in the same indicator.

When used with mechanical trading systems, Gann indicators can help traders be more successful in chaotic, fast-moving forex markets. Best of all, they’re easy to understand and simple to program.

What is Gann Theory?

Gann Theory is named after William Delbert (W.D.) Gann, who became wealthy by trading commodity futures in the early part of the 20th Century. Gann first published the basis for his theory in a thirty-three-page trading course in 1935.

Gann developed his theory about price movements over a period of many years, by watching and assessing the characteristics of important short-term and long-term market tops and bottoms, then drawing angles according to the observed changes in trend.

He spent much time looking for repeated, predictable relationships and actionable trade patterns. Gann believed that geometry and natural mathematical relationships could be found to explain price movements. In particular, he relied on squares and angles to determine price points.

For example, Gann found that if a trend is upward and price stays within the area above the ascending angle without breaching it, it indicates that the market is strong. And, during a downtrend, if the price stays under the descending triangle without breaching it, the market price will weaken.

Since then, successive generations of traders have discovered and learned to successfully apply his Theory across a variety of asset markets, most recently in the field of currency trading with mechanical trading systems.

Gann angles

The basic premise of Gann Theory is that a series of angles can be used to predict price and timing through mathematical patterns. These angles are drawn according to price points.

A fundamental concept of Gann angles is that past, present and future price characteristics are all represented within the same angle. When the trading system detects that a price reaches the appropriate point on the subject angle, a trade is signaled.

Gann angles are geometric constructions or extended lines which divide currency price and time into proportionate figures. A Gann angle is calculated by expressing the number of price units which are trending up or down in terms of the amount of time needed for that price move to occur.

In simple terms, Gann angles are calculated by finding the derivatives of lines connecting price points on charts.

In the old days, traders figured these angles by eyeballing paper charts, but today’s forex traders instead use mechanical trading systems to calculate and assess Gann angles very quickly in real time, in the form of ready-made trading indicators.

The first and most important Gann angle is known as the 1 x 1 or 45° angle. This represents a single unit of price over a single unit of time.

This concept can be illustrated by drawing a perfect geometric square, then drawing a diagonal line inside the square from one corner to another. This angle moves up or down by one unit per day or other trading time-frame.

Other important Gann angles are 2 x 1 (which moves up two units per time-frame), 3 x 1, 4 x 1, 8 x 1, and 16 x 1.

Likewise, other commonly-used Gann angles have a shallower slope, such as 1 x 2, in which the price rises at half the rate yet the price move occurs in the same amount of time as a 1 x 1 Gann angle. As well, 1 x 8 and 1 x 4 are often used.

Stated differently, the 1 x 1 angle indicates the angle is moving a single unit of price for each unit of time, and the 1 x 2 angle is moving by two units of price for each unit of time.

When these angles are calculated and assessed as a group, they’re called a “Gann fan” since they appear to spread out in a radial fashion across price and time. Gann angles can be calculated as either ascending from given price lows, or as descending from price highs.

Whether calculating Gann angles with a mechanical trading system or viewing them on a chart visually, it’s important to use the appropriate charting scale. The original, pre-computer Gann charting was drawn on square paper instead of typical rectangular paper to ensure that the primary angle (1 x 1) and all subsequent angles were all “square.”

Yet, many charting scales are drawn without a true 1:1 perspective, especially when rendered visually on an electronic monitor screen. So, it’s important for purposes of the Gann calculations that the X and Y axes be denominated in true one-to-one unit scale; otherwise, degree-type calculations would be inaccurate.

Why do Gann angles work?

Forex traders who are new to Gann Theory often ask which Gann angles are most effective in predicting price/time movements. The answer depends on the particular market. Finding the most effective ratio is a subjective exercise that can most easily be determined by using a well-built expert advisor (EA) and optimized mechanical trading system.

Gann angles and indicators are counter-intuitive to proponents of the “efficient market hypothesis” which holds that past price moves cannot accurately predict future price moves. In fact, Gann Theory offers winning predictive tools for traders experienced in their use.

In short, the price shows its current relative weakness or strength according to the calculated angles above or below. As an example, if a currency price is observed to be above the 2 x 1 angle, this is a far more bullish sign than if the price were merely above the 1 x 1 angle.

The short explanation about why Gann Theory works is that when up-trending prices reverse and then breach and fall below the nearby ascending angles, those prices will usually then drop down to the next-closest angle below.

Likewise, when down-trending prices reverse direction and then breach upward through the nearby descending angles, those prices will tend to continue upward and achieve the price level of the next-closest angles above them.

Comparing Gann angles with trend lines

Gann angles are sometimes confused with trend lines, yet there are important differences. The most significant difference is that a Gann angle is formed by a diagonal line which advances at a uniform rate of price and time.

In contrast, a trend line is determined simply by connecting together the successive bottoms of an uptrend, or the successive tops of a downtrend.

A basic trend line is generally formed by connecting 2 or 3 lows during a bull market, or 2-3 highs during a bear market. Of course, the standard definition of a “change in trend” is that the price moves beyond the limits of the trend line.

The advantage of Gann angles over trend lines is that the angles move at a constant rate of change for price/time.

This valuable characteristic provides traders and mechanical trading systems with predictive power in order to forecast a point where the price is expected to be at a particular time in the future.

Gann Theory goes far beyond the concept of a trend line by asserting that two factors, namely price and time, establish a more accurate “trend line” in a given market.

Stated in terms of angles and slopes, the price movement (or “rise”) is the primary factor, while time (“run”) is the second factor. Therefore, a Gann angle is a form of trend line that reflects the value of price over time.

Gann angles aren’t always perfectly exact in their predictions. Still, they can help predict the direction and strength of a trend with uncanny accuracy. So, experienced forex traders armed with appropriately-adjusted mechanical trading systems find them to be extremely valuable.

On the other hand, trend lines in forex markets have little predictive value over mid-term price moves because of the frequent short-term adjustments to the trend line.

Using Gann angles

Forex traders use Gann angles in several ways—

Determining a bull or bear market

• When the price remains above the up-sloping 1 x 1 Gann angle, it shows a rising/bullish trend

• When the price stays below a down-sloping 1 x 1 Gann angle, it signals a falling/bearing trend

Predicting turning points, tops and bottoms

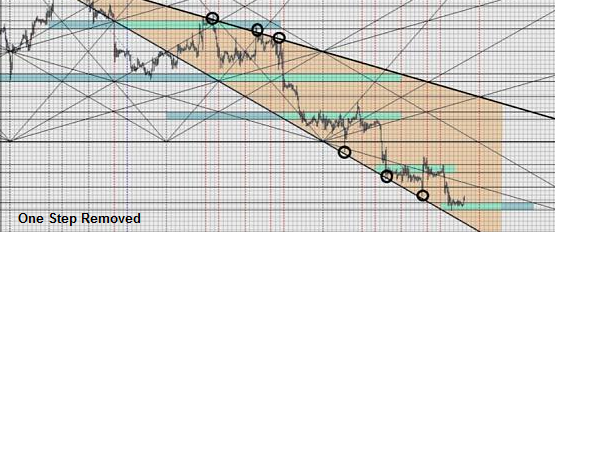

Turning points in price movements can be predicted using a series of overlaid Gann angles, usually at least 6 or 7 Gann angles calculated from each important high or low.

Although it’s not necessary for purposes of mechanical trading, when forex traders visually chart multiple Gann angles they typically use a different color for each Gann angle, to help the eye distinguish between them.

To predict turning points, each intersection of the lines from different Gann angles indicates a potential turning point in price, time-wise. The number of Gann angles and their slopes show the expected probability for a trend-change to occur at that point.

For example, when the lines from 1 x 1, 2 x1 and 8 x 1 Gann angles intersect at a single point in time, it indicates that there is a significantly greater chance for a change in trend at that particular point than if, say, only the lines from a 2 x 1 angle and 1 x 8 angle were to intersect there at the same time.

In order to predict tops, bottoms and changes in trend, some forex traders program their mechanical trading systems to use the mathematical technique called squaring. The idea is that the price is expected to change direction once it reaches an equal unit of both time and price, whether up or down.

When used alone, this indicator works best on mid-term charts such as daily or weekly, since shorter time-frames have more bottoms, tops and ranges to be analyzed.

As an alternative for increasing the accuracy when squaring of Gann angles for short-term trading time-frames, this indicator can be used together with other time-indicators to filter the number of signals.

Overall, when Gann angles are coupled with other indicators, traders can more easily identify the likeliest points at which price trends will change.

The most popular use for Gann angles is to predict support and resistance points. Once the mechanical trading system is configured according to the appropriate trading time-frame (i.e. minutely, hourly, daily or monthly) and the number levels are appropriately scaled, the system simply calculates at least three or more principal Gann angles (for example 1 x 1, 1 x 2, and 2 x 1).

The up-trending Gann angles show the support points, while down-trending angles indicate the resistance. Since the mechanical trading system recognizes the orientation of each particular angle, it can determine the appropriate points to buy at support or sell at resistance.

An important tenet of Gann Theory is the premise known as the “Rule of All Angles.” As codified by W.D. Gann, this means that when the price breaches one angle, it will invariably move toward the next angle. Stated differently, this means “old resistance become new support” and vice versa.

Some forex traders use the following basic rules for calculating support and resistance points:

• During a bull market, when price is rising upward and breaches the line created by a 4 x 1 angle, this indicates that the price will reach support at or near the next-lower Gann angle, which in this case is a 2 x1 angle

• During a bear market, when the price is dropping downward and breaks through the line of the 4 x 1 angle, it indicates that the price will meet resistance at or near the next-higher Gann angle, which is 2 x 1

• As indicated earlier, the simplest rule is that when a price breaches the line from a 1 x 1 angle, whether rising or falling, it means that the major trend will soon change

Other traders determine support and resistance levels by combining Gann angles together with horizontal lines. For example, frequently a down-trending Gann angle crosses the fifty-percent retracement level. This intersection then becomes a point of key resistance.

This effect can often be seen on long-term charts, where many Gann angles tend to occur near or at the same price point over time. These points are known as “price clusters” and they offer price levels for trading with strong confidence of success.

In short, the more Gann angles at a given price level, the stronger the support or resistance there.

Seeing the past, present and future in a single indicator

In conclusion, the key advantage of using Gann angles is the fact that past, present and future are all embodied together within these angles. Notwithstanding this, Gann angles are usually used to predict future support and resistance, strength of price movement, and the timing of bottoms and tops and changes in trends.

Gann angles are the basis for valuable tools that offer predictive power, especially when used in conjunction with other timing indicators. At the same time, mechanical trading systems must be fine-tuned in order to determine the best Gann angles to be used in particular forex markets, especially with regard to volatility and price scale.

When the power of these simple angles is leveraged by knowledgeable traders, there are plenty of “gains from Gann.”