Gann studies_1

Post on: 7 Июль, 2015 No Comment

Why I Stopped Posting Nifty Futures Trading Levels? (i.e. Temporarily)

February 5, 2011 9 Comments

Regular visitors of the blog will be aware of the fact that I post resistance and support levels for nifty futures intraday trading, based on certain mathematical calculations. However, since the past few days I am not posting this information. A few curious users emailed me asking me why I did not do it.

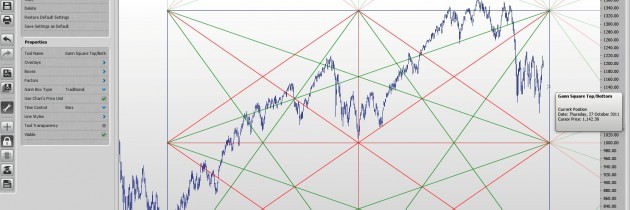

This post is specifically meant to help them rest at ease! I have always believed that the market has a geometry and it is possible to find out the relationship in between numbers if we are aware of certain primordial factors such as the previous days high, low and closing price. By combining this information with gann studies, I was able to come to certain conclusions.

The motive behind this posting is simple since the past weeks, nifty futures intraday trading levels (derived by my calculations) and the real world values (played by the market) are different. For instance, 5350 is one of the buy points while 5585 is one of the sell points. For the major portion of the week, the market has been revolving within this narrow range it is commonly known as the trading range a range where the intelligent traders would keep themselves away from.

Ever noticed how the market rises 100+ points in a day, only to shed 150+ points the next day? As I always state, Indian markets run on sentiments. I have seen a fair share of traders who do not have any notion of where the markets are heading. Even the mass media appears to be confused with the happenings. When the market rises, the so-called experts / technical analysts would appear and state the correction is over people, start buying because the nifty is going to zoom to 7000. The same entity will appear on the next day (when the market falls by 120+ points) and state I think, the market may correct itself to 4800 5200 levels. In short, no one knows what to do.*

This is why I am keeping myself away from the markets for the time being. Of course, I do experiment with certain little known strategies and I utilize mini-nifty futures for the same purpose. On certain days, it worked out to be beneficial and vice versa. As soon as the market starts to follow the desired calculations, I too would resume posting the daily levels. )

*Here is a brilliant example to enforce what I am trying to convey. Check out Mkt could rally to 5,700-5,800 in a month: Choksey and Sensex falls 450 pts to sink below 18K. In the first link the analysts states that markets could rally. The same person is stating something opposite in the second link.