Frontier Market Correlation Matrix

Post on: 16 Март, 2015 No Comment

Are Frontier Markets Correlated to Developing Markets?

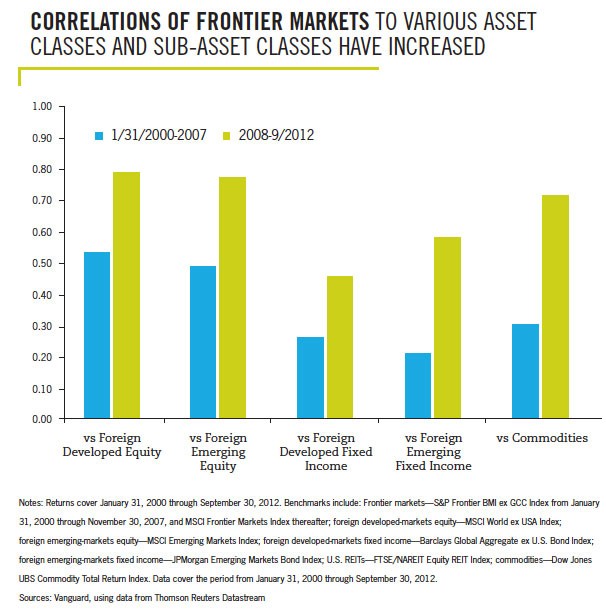

Frontier markets are supposed to be a great way to diversify portfolios. However, with global equity markets becoming more correlated in an increasingly globalized world, does this major benefit of frontier markets still hold true?

From our current calculations, the answer is still a resounding yes .

To test this we calculated correlations using the weekly close on major exchanges over a 50-week period. Please ensure Javascript is enabled and that your proxy is not blocking SkyDrive, in order to see the tables. The results are downloadable by clicking on the Excel icon below every table!

Developed and Emerging Stock Market Correlations:

To establish a baseline of how correlated markets are, we first looked at the correlations for major developed markets around the world along with main emerging markets (BRICS):

A quick look at the high correlation for MSCIs Frontier Emerging Markets Index seems to suggest that frontier markets are actually highly correlated with developed markets. We know better to use that as a proxy for frontier markets though. Average correlation of non-US markets to US markets was 0.518, with the BRICS to US correlation at 0.364.

Lets move on to the real frontier markets!

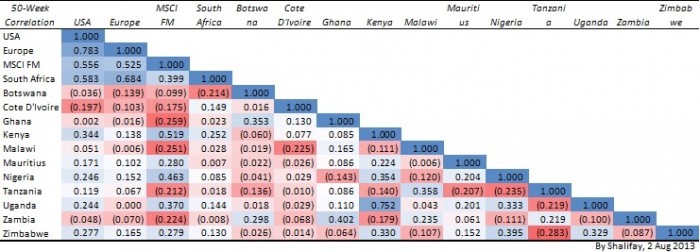

African Frontier Market Correlation

The first group we look at are frontier markets in Africa. Weve used the S&P 500 Index to represent the US, and the Euro Stoxx 50 Index for Europe:

You can immediately see the difference in correlation for frontier markets.

- Average African frontier market correlation was 0.107 to the US and 0.026 to Europe

- South Africa and the MSCI Index have a correlation to the USA and Europe of over 0.500

- Kenya had the high mark at 0.344

- Cote DIvoire had an incredible -0.197 correlation to the US with similarly negative correlations to Europe and the MSCI Frontier Market Index

The Americas Frontier Market Correlation

Next we look at the Americas, where we expected a higher correlation due to the closer proximity to the US.

- Average Americas frontier market correlation was 0.202 to the US and 0.230 to Europe

- South American countries like Argentina and Peru did indeed have high correlations to developed markets

- Central American/Caribbean countries were surprisingly uncorrelated with the rest of the market

- Not only did they show little correlation to developed markets, but they had little relation to South American markets as well

- Panama stands out as not only a great country for offshore bank accounts, but for brokerage accounts as well due to its low correlation

Central Asian & European Frontier Market Correlation

We grouped Central Asia and Europe together (with apologies to Mongolia) for our next correlation matrix:

- Average Central Asia & European frontier market correlation was 0.132 to the US and 0.119 to Europe among these frontier markets

- The countries most correlated to developing markets (Croatia, Kazakhstan, and Romania standout), are actually more correlated to the US than to Europe

- Markets were generally better correlated to Russia than to the US or Europe with an average correlation of 0.138

- Pair Slovakian and Bulgarian equities together; they had the lowest correlation of two markets at -0.299

- Lower size = lower correlation, with Malta (population of about 400,000) having an average correlation of -.018 to the rest of the market

Middle Eastern Frontier Market Correlation

- Average Middle Eastern frontier market correlation of just 0.031 to the US and 0.045 to Europe, but with a wide range

- Larger developed countries such as Oman, Qatar, and Saudi Arabia were generally very correlated to developed markets although Kuwait is the clear outlier along with Bahrain to a certain extent

- Palestine is the least correlated market to the US and Europe out of all our frontier markets, and has a -0.074 correlation to the rest of the region too

Asian Frontier Market Correlation

- Average Asian frontier market correlation was 0.120 to the US but just 0.033 to Europe

- The Philippines was the most highly correlated to developed markets (and highly correlated to the MSCI index at 0.648), with an overall correlation higher than China

- Laos was the least correlated to developed markets, although it is interesting that it currently has a negative correlation to neighbouring Cambodia (-0.061) as well

- The difference between emerging and frontier markets when it comes to correlation to developed markets is stark

- Frontier markets continue to offer a highly valuable opportunity to diversify portfolios

- Africa and half of the Middle East are your best bets for finding non-correlated stock markets