Free VIX Webcast Series Aug 25 27 CBOE Options Hub

Post on: 27 Май, 2015 No Comment

In just over one week The Options Institute at CBOE will be offering three free webcasts discussing different aspects of the CBOE Volatility Index or VIX. On Monday August 25 th I’ll start out with the basics of volatility indexes and introducing exactly what VIX is measuring. In addition we will look at how the index has historically behaved relative to the S&P 500. The following day I will discuss VIX futures and options which are two of the most common methods of gaining exposure to market volatility. Finally on Wednesday we will wrap things up on Wednesday with a discussion of trades that are appropriate for any market outlook.

Here is a more extensive description of each webcast –

Monday 8/25/2014 – Noon – Introduction to VIX – What is VIX? – In this webcast which kicks off three days of VIX education, Russell Rhoads, CFA and Senior Instructor from The Options Institute will introduce the CBOE Volatility Index, commonly known as VIX. Whether you are relative new to option and volatility trading or have been trading VIX futures and options for years and want a refresher on how VIX behaves this webcast will be of benefit to you. Russell will explain how VIX is calculated, the unique pricing relationship that VIX has with the S&P 500® Index, and how broad based index implied volatility behaves differently than other types of market volatility.

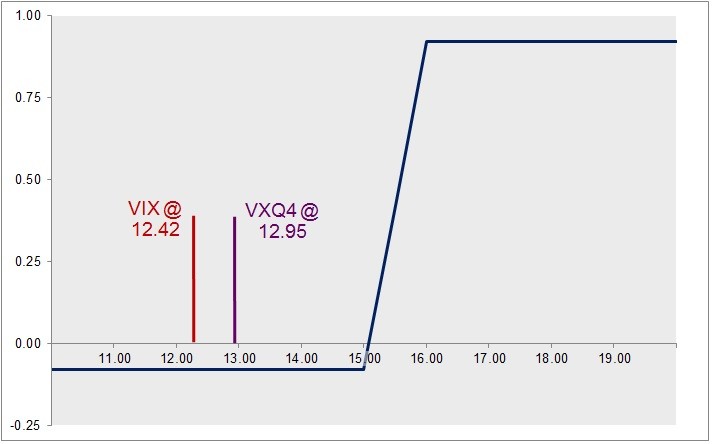

Tuesday 8/26/2014 – Noon – Volatility Trading with VIX Futures and Options – In Part 2 of the VIX education series of webcasts Russell Rhoads, CFA from The Options Institute will introduce two of the most common instruments used to gain exposure to expected market volatility. VIX futures will be introduced with a discussion of just how these instruments trade relative to VIX. Following up on VIX futures Russell will introduce and discuss the unique price behavior of VIX options.

Wednesday 8/27/2014 – Noon – Bullish, Bearish, and Neutral Trading with VIX Futures and Options – in the final part of our VIX education series Russell Rhoads, CFA will cover trades that make sense for either a bullish, bearish or neutral outlook for expected market volatility. Russell will show how traders take an outlook and translate it into a trade using VIX futures, VIX options, or even a combination of both.

To attend one, two or even all three of these free webcasts you can register at www.cboe.com/webcasts