Form of Restricted Stock Unit Award Tax Withholding Election Form

Post on: 16 Март, 2015 No Comment

Tim Morones, Vice President – Treasury and Administration

As you know, the Company has previously granted you restricted stock units (“RSUs”) reflecting the right to receive shares of Company common stock as set forth on Exhibit A attached hereto, subject to the terms and conditions of the Company’s Restated 1996 Flexible Stock Incentive Plan (the “Plan”) and your applicable award agreement.

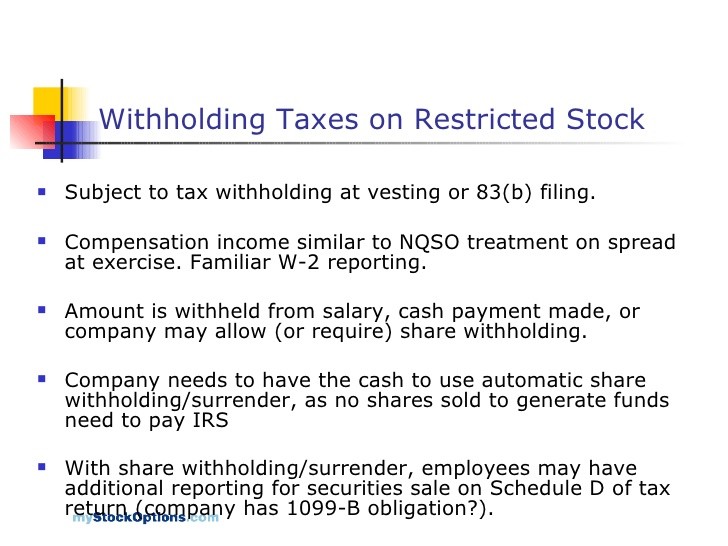

As the shares subject to your RSUs vest, the Company must withhold applicable income, employment and other taxes before the Company delivers any such shares to you. Under your current award agreement the Company is allowed to satisfy your minimum tax withholding obligations by retaining a sufficient number of shares subject to your vested RSUs.

The Company is now offering you the opportunity to elect to satisfy a higher rate of income tax withholding through your election to withhold a larger number of vested shares subject to your RSUs.

For example, assume that you have 100 shares subject to RSUs that vest when their aggregate value is $1,000.00. The required minimum tax withholding is 25%, and the Company would usually retain 25 of the 100 shares subject to RSUs that vested (a value of $250). However, if you elect to have an additional 10% tax withholding (for a total tax withholding of 35%), then the Company would retain 35 of the 100 shares subject to RSUs that vested (a value of $350), and the $100 overpayment would be paid on your behalf by the Company to the appropriate tax authorities.

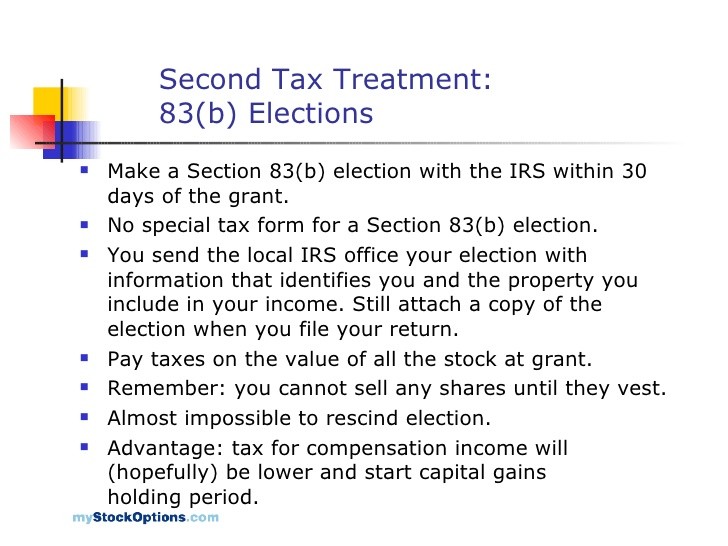

By signing below, you are electing to allow the Company to withhold vested shares subject to your RSUs that you would otherwise receive from the Company, subject to the terms and conditions of the Plan and this election. You understand that your election is irrevocable. The terms of your election are as follows:

1. RSUs to Which Election Applies. This election applies to the RSU grants set forth on Exhibit A.

2. RSU Tax Withholding Election. You agree that the Company should withhold vested shares subject to your RSUs having a value equal to your minimum tax withholding (i.e. 25%) relating to the vesting of your RSUs plus an additional % (please insert a number from 1 to 10; the total tax withholding cannot exceed 35%).

3. Filing of Election. This election form must be submitted to Tim Morones, VP-Treasury and Administration, InfoSpace, Inc. 601 108 th Avenue NE, Ste. 1200, Bellevue, WA 98004) no later than July __, 2007 to be effective.

4. Irrevocability of Election. This election will become irrevocable as of the date of your signature below.

5. Subject to Plan. This RSU election is in all respects subject to the terms and conditions of the Plan and your applicable award agreement.