Forex Players

Post on: 20 Май, 2015 No Comment

Market players are in the first place commercial banks executing orders from exporters, importers, investment institutions, insurance and retirement funds, hedgers and private investors. Commercial banks also perform trading operations in their own interests and at their own expenses. Daily turnover of the largest banks often exceeds several billions of U.S. Dollars and many make their main profit by speculative operations with currency.

Brokerage houses are also playing an important role of contractor between large numbers of banks, funds, commission houses, dealing centers, etc.

Commercial Banks and Brokerage Houses do not only execute currency exchange operations at prices set by other active players, but come out with their own prices as well, actively influencing the price formation process and the market life. That is why they are called market makers.

In contrast to the above, passive players cannot set their own quotations and make trades at quotations offered by active market players. Passive market players normally pursue the following aims: payment of export- import contracts, foreign industrial investments, opening of branches abroad or creation of joint ventures, tourism, speculation on rate difference, hedging of currency risks (insurance against losses in case of unfavorable price changes), etc.

The composition of the participants witnesses that this market is actively used by serious business and for serious purposes. That is not all market participants are working on Forex for speculative purposes. As already mentioned, a change in currency exchange rates may lead to huge losses in export-import operations. Attempts to protect against currency risks force exporters and importers to apply certain hedging instruments: forward deals, options, futures, etc. Moreover, even a business that is not associated with export-import operations, may incur losses in case of changes in currency exchange rates. Therefore, the study of Forex is a mandatory component of any successful business.

Market players can be divided into several groups:

Central Banks

Their main task is exchange regulations in the foreign market, namely, the prevention of spike rates of national currencies in order to prevent economic crises, maintaining the exports and imports balance. Central banks have a direct impact on the currency market. Their influence can be direct — in the form of currency intervention, or indirect – via regulation of money supply and interest rates. Central bank may act in the market on their own to influence the national currency, or together with other central banks to conduct a joint monetary policy in the international market or for joint interventions. Central banks are normally entering the Forex market not for profit, but to verify the stability or correct the existing national currency exchange rate for it has a significant impact on the home economy. Central banks may not be attributed to either Bulls or Bears, because they can play bullish as well as bearish, depending on the particular challenges facing them at the moment. Central banks may also enter the currency market through commercial banks. Although profit is not the main purpose of these banks, unprofitable operations do not attract them either, so the central banks’ intervention are normally disguised and carried out through several commercial banks at the same time. Central banks of different countries sometimes join together for coordinated interventions. The greatest influence on world currency markets were:

- U.S. Central Bank — US Federal Reserve (Fed)

- European Central Bank (ECB)

- Bank of England (also known as the Old Lady)

- Bank of Japan

Commercial Banks

They execute most of foreign exchange operations. Other market participants carry out conversion and deposit-lending operations through accounts opened in commercial banks. Banks accumulate (via transactions with clients) the aggregate market demand for currency conversions, as well as for fundraising or investment to fulfill them in other banks. Apart from dealing with clients’ requests, banks may operate independently and at their own expense.

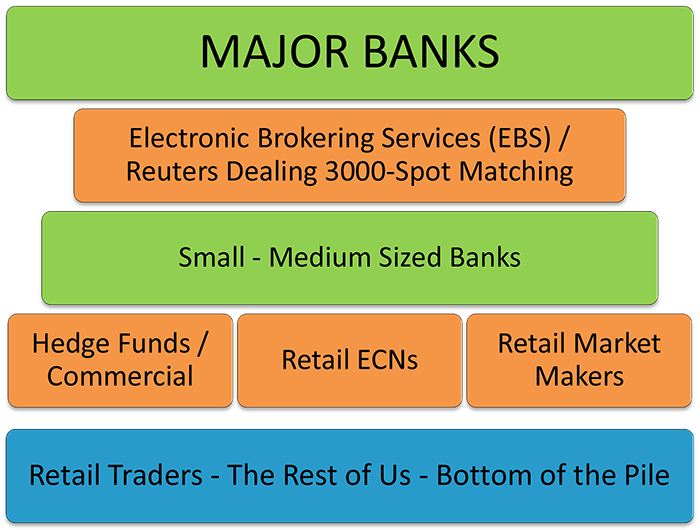

Foreign exchange market at the end of the day is a market of interbank deals, therefore speaking of the movement of exchange or interest rates, we will have the interbank foreign exchange market in mind. International exchange markets are most of all affected by major international banks with daily volume of transactions estimating in billions of US Dollars. These are Deutsche Bank, Barclays Bank, Union Bank of Switzerland, Citibank, Chase Manhattan Bank, Standard Chartered Bank and others. Their main difference is large volume of transactions, frequently causing significant changes in quotations.

Big players may act as either Bulls or Bears.

- Bulls are those market participants who are interested in enhancing the value of currency.

- Bears are interested in reduction of currency value.

The market is permanently in equilibrium between the bulls and the bears, so currency quotations fluctuate within fairly narrow limits. However, when either of the group prevails, exchange rates change in a rather dramatic and significant way.

Firms Performing Foreign Trade Operations

Companies, participating in international trade constantly demand foreign currency (importers) or supply foreign currency (exporters), as well as place or attract free currency volumes in form of short-term deposits. These participants do not have a direct access to the currency market and realize their conversion and deposit transactions via commercial banks.

Firms Carrying out International Investment

Investment Funds, Money Market Funds and International Corporations and companies, represented by various international investment funds, implement the policy of diversified management of assets portfolios by placing money in securities of governments and corporations of different countries. They are simply called funds in dealer slang. The best known funds are Quantum of George Soros executing successful exchange speculations, or a Dean Witter fund. Major international corporations engaged in foreign industrial investments: creation of subsidiaries, joint ventures and the likes, such as, for example, Xerox, Nestle, GE (General Electric), BP (British Petroleum) and others are also a part of this group.

Currency Exchange

In some countries with transition economies there are currency exchanges, whose functions include currency exchange for businesses and adjustment of market exchange rates. The state is usually actively regulating the exchange rate, taking the advantage of the exchange market size.

Brokerage Firms

Brokerage firms are bringing together buyers and sellers of foreign currency and conduct conversions, as well as lending and depositing operations. Brokers charge commission for their intermediary services in form of a percentage per transaction.

So called ECN (Electronic Communication Network) brokers have been widely developing recently. ECN is a trading platform where currency exchange requests from various contractors are brought together. Their clients are large banks, brokerage firms and private clients. The access to such brokers is not available to the most of private investors because of high standard. It is assumed that ECN brokers do not act as counterparties with clients, that is they are not market makers and charge only a commission.

Individuals

Individuals realize a wide range of non-trade transactions in the sphere of foreign tourism, transfers of salaries, pensions, royalties, buying and selling of cash.

With the introduction of margin trading individuals have received an opportunity to invest free funds in the Forex market with the aim to make profit.