Forex Market Size A Traders Advantage

Post on: 4 Май, 2015 No Comment

Talking Points

- The Forex market is the largest and most liquid market in the world. The US dollar makes up the majority of Forex transactions The Forex markets deep liquidity is advantageous to traders by allowing them to enter and exit the market instantaneously

According to the Bank for International Settlements, foreign-exchange trading increased to an average of $5.3 trillion a day. To put this into perspective, this averages out to be $220 billion per hour. T he foreign exchange market is largely made up of institutional investors, corporations, governments, banks, as well as currency speculators. Roughly 90% of this volume is generated by currency speculators capitalizing on intraday price movements.

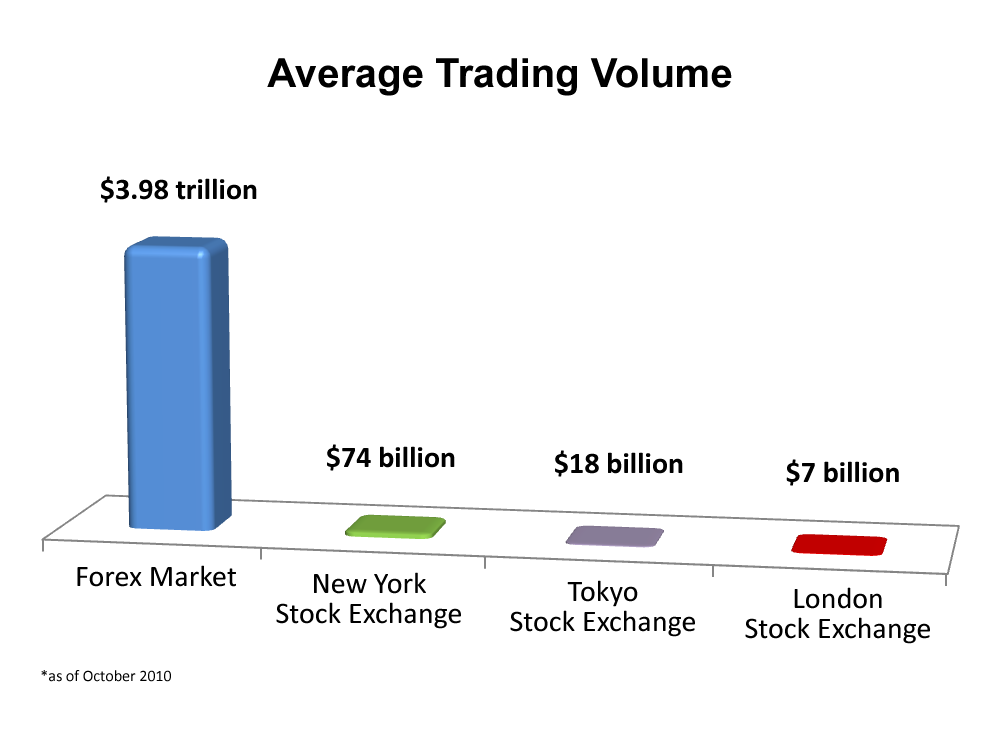

Unlike the stock and futures market that are housed in central physical exchanges, the Foreign exchange market is an over-the-counter market, decentralized market completely housed electronically. Banks from Hong Kong to Zurich and from London to New York. Though most investors are familiar with the stock market, they are unaware how small in volume it is in relation to the Forex market.

In the diagram above, it can be easily seen how the FX markets $5.3 trillion per day in trading volume dwarfs the equities and futures markets. In fact, it would take thirty days of trading on the New York stock exchange to equal one day of Forex trading!

Traders from other markets are attracted to the Forex because of this extremely high levels of liquidity. Liquidity is important as it allows traders to get in and out of a position at with ease 24 hours a day 5 days a week. It allows large trading volumes to enter and exit the market without the large fluctuations in price that would happen in less liquid market. This means that if you will never get in a position because of the lack of a buyer. This liquidity can vary from one trading session to another and one currency pair to another as well.

As the most traded currency, the US dollar makes up 85% of Forex trading volume. At nearly 40% of trading volume, the euro is ahead of the third place Japanese yen that takes almost 20%. With volume concentrated mainly in the US Dollar, Euro and Yen, Forex traders can focus their attention on just a handful of major pairs. In addition, the greater liquidity found in the Forex market is conducive to long, well-defined trends that respond well to technical analysis and charting methods.

In sum, the Forex market size and depth make it the ideal trading market. This liquidity makes it easy for traders to sell and buy currencies. This is why traders from all different asset classes are turning to the Forex market.

—Written by Gregory McLeod Trading Instructor

To contact Gregory McLeod, email gmcleod@dailyfx.com.

To be added to Gregs e-mail distribution list, please click here.

In this article you learned the benefits of the Forex market size and liquidity to Forex traders. If you are brand new to Forex trading or need a review, enroll now in a free New to FX trading course. A short 20-minute review of the basics may be all you need to get your trading back on track!

Watch Greg McLeod at 9:30 ET in the DailyFX+ Live Classroom

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.