Forex Indicator Tips Buy and sell signals

Post on: 16 Март, 2015 No Comment

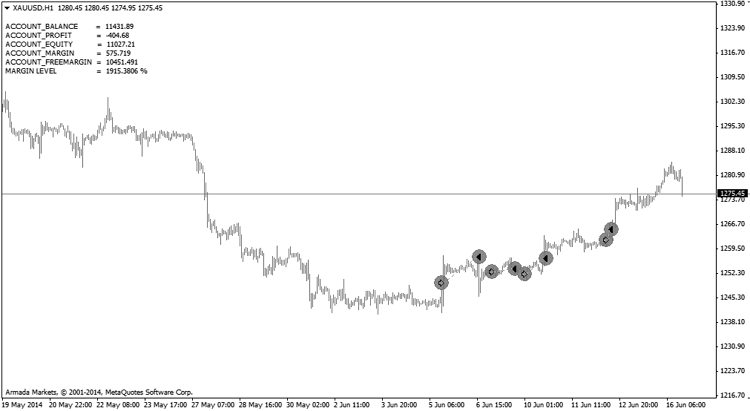

Buy and sell signals

To trade occupied with technical analysis indicators are buying or selling currencies. In fact, there are several indicators that can be used, including stochastic, the Relative Strength Index (RSI), Parabolic SAR, and the moving average convergence divergence (MACD). Of course there are less frequently buy and sell signals that the directional movement index (DMI), which are used to determine the direction of an asset in determining the price action. For purposes of this article we will discuss the first 4 indicators, but more popular.

Amazing Stock Trend Signal Software catches stock trend change signal and alerts stock buy sell signal when stock trend is changing. You know when to buy or sell

The moving average convergence divergence

Unlike the other three is considered a lagging indicator MACD. He does not say the dealer, in which direction the trend is likely to move. Rather, it is used to confirm that the trend is already underway. Because it is based on movements in real prices, the MACD is one of the most reliable signals buy and sell today. It is able to price movements in the short term and fake outs (ie explosions observed are not real and is a precedent for other trends) on the site. The MACD consists of three lines — one calculated from short-term moving average and the other long-term moving average — and a histogram. The third line is the average of two lines and is often referred to as the signal line. The decision to buy or sell a currency depends on the position of the AMM in the short term compared to long-term control and the signal line. Finding stock buy and sell signals that are reasonably accurate most of the time is not that hard if you realize how to set up your indicators correctly.

Stochastic Stochastics Buy Signal. When the Stochastic is below the 20 oversold line and the %K line crosses over the %D line, buy. Stochastics Sell Signal

The stochastic determine the dealer said, could end up where a trend. By the method of calculation are a broker who can use this indicator to determine if the market is overbought or oversold, the sure signs of reversal. Stochastics are scaled from 0 to 100. If the lines are over 80, then it means that the market is overbought and prices will very soon. On the other hand, if the pipes are under 20, the market is oversold and there is a good idea to start buying foreign currency.

Parabolic SAR, The buy and sell signals system in INO’s Market Club are called Trade Triangles. There are a variety of metrics a trader or investor can apply to make buy, sell,

Like Stochastics, Parabolic SAR tells the dealer, where the trend is over. He puts points on a graph and price points can occur when reversing the display. It’s really easy to use. If the points raised about the chandelier, then traders should sell. On the other hand, if the points are in the middle of the candles, then it is a buy signal.

Relative Strength Indicator

The Stochastic RSI is like because they determine the location, conditions of overbought and oversold market currency trading. If the RSI is below 30, then the markets are oversold and traders should begin to buy foreign currency, because it is a great opportunity for a reversal. On the other hand, if the RSI is above 70, while the markets are overbought and is a clear signal to sell. Unlike the stochastic, but the RSI is able to determine the training pattern.