Foreign Exchange Futures Marking to Market For Dummies

Post on: 7 Май, 2015 No Comment

After you get a futures contract, you need to keep an eye on the spot rate every day to see whether you want to close your foreign exchange (FX) position or wait until the settlement date. The value of a futures contract to you changes with two things: changes in the spot rate and changes in the expectations regarding the future spot rate at the settlement date.

If the spot rate of a currency increases over a period, futures prices are likely to increase as well. In this case, purchase and subsequent sale of futures may be profitable. Conversely, if the spot rate declines, the futures rate would also decline, which would lead to a loss.

Before introducing the numerical example, you need to know about how FX futures work in reality:

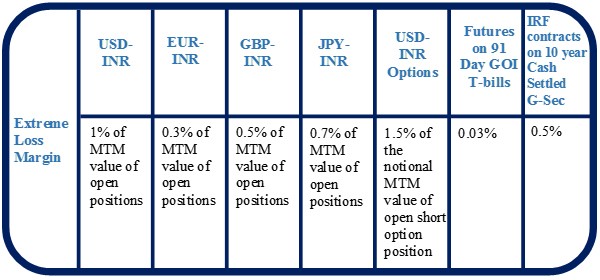

Credit risk: If you buy or sell futures, money is not exchanged until the settlement date. To keep the credit risk in check, the buyer or seller of a futures contract must deposit funds into a margin account. In other words, there is an initial margin r e quirement. This requirement is typically between $1,000 and $2,000 per currency contract.

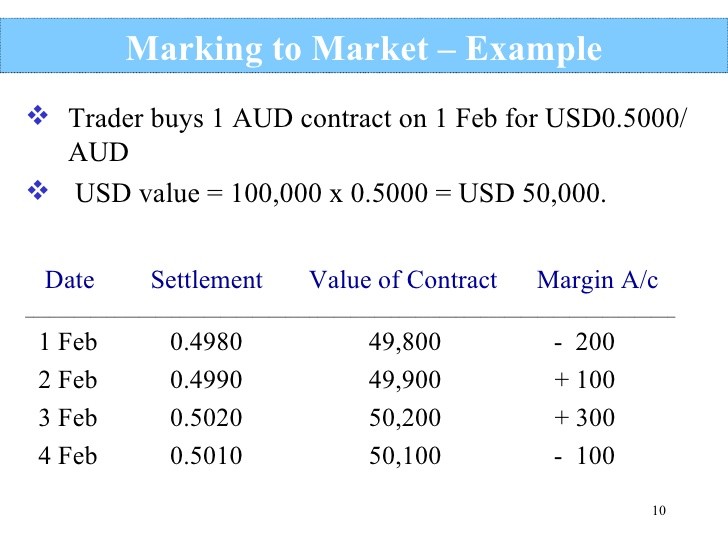

Marking-to-market: After the futures contract is obtained, as the spot exchange rate changes, the price of the futures contract changes as well. These changes result in daily gains or losses, which they are credited to or subtracted from the margin account of the contract holder. This is called the marking-to-market process. This process reduces the credit risk to brokerage firms as well as to the CME.

Maintenance margin: Holders of FX futures are required to maintain a minimum level of margins. If their margin accounts are below the maintenance margin, they receive a ma r gin call from their brokers to increase their funds on their margin account.

In the numerical example, you consider British pounds. As indicated before, futures contracts are standardized, which mean that the number of currency units per contract is predetermined. For example, a futures contract on the euro and the Mexican peso has 125,000 and 500,000 units, respectively. In the case of the British pound, there are 62,500 units per contract.

Suppose in May you buy a June futures in British pound, which means “going long in June British pound.” While youll gain from the appreciation of the British pound against the dollar, youll take losses if the British pound depreciates.

The table summarizes the changes in the spot rate for a couple days and the associated gains/losses. Time t on the table indicates the day when you buy the British pound futures. t + 1, t + 2, and so on, shows the subsequent days afterwards. Futures price indicates the daily exchange rate that settles the futures market. As indicated before, changes in the spot rate derive the changes in the futures price.

Suppose an initial margin of $2,000 and a maintenance margin of $1,500.

FX Futures: A Marking-to-Market Example

Time

Futures Price ($/€)