Foreign Currency Forex Trading Currency Futures EMicro FX Futures

Post on: 28 Май, 2015 No Comment

1. History of FX Futures

Throughout the first seven decades of the twentieth century, the futures industry remained essentially as it had been — a secondary, little understood corner of business activity, mired in esoteric economics and focused on the trading of futures on agricultural products. For most of its history it attracted many detractors and few supporters, and at best, was considered a distant cousin to the orthodox temples of finance. But in 1971 a remarkable change occurred in the financial industry, one that altered the destiny of markets around the world. It happened at the Chicago Mercantile Exchange: The introduction of futures based on financial instruments.

In December of 1971, under the direction of its principal architect, Leo Melamed, chairman of the CME, the exchange chartered the International Monetary Market (IMM), a newly created independent division specifically designed to exclusively specialize in futures trade of instruments of finance. To fully comprehend the innovative impact of the International Monetary Market on the history of markets, one must understand that from its inception the IMM represented both a specific and general revolutionary departure from traditional futures. In the narrow sense, by launching FX futures contracts, the first financially based futures product, the IMM led futures markets into the financial arena. However, in a macroeconomic sense, it represented a much more significant transformation: it ushered in the era of financial derivatives and its modern risk management applications.

The creation of the IMM as a separate exchange for the exclusive trading in instruments of finance, was perhaps as important a factor in its success as was the revolutionary introduction of financial instruments themselves. The participants coveted by our new financial contracts — corporate treasurers, financiers, multinational corporations, pension fund managers, and a whole array of financial decision-makers in business — were entities and individuals who most likely never before participated in futures markets. They were not likely to begin putting their funds into markets trading in such commodities as live cattle, pork bellies or frozen turkeys — products about which they were both richly inexperienced and wholly disinterested. Under the influence of our agricultural origins, we simply were not offering futures denominated in instruments understood by corporate America. For these participants a separate financial exchange was clearly preferable. (In 1986, the IMM was merged into the CME. However, the divisional concept it represented remained a permanent part of the exchange’s structure to this very day.).

During the first decade its existence, the IMM initiated a series of revolutionary financial innovations in foreign exchange, interest rates, and equity indices, upon which the superstructure of the modern CME was built. It ultimately catapulted the Chicago Mercantile Exchange as the foremost futures market in the world. Concurrently, these new markets served as a catalyst to accelerate the movement toward financial engineering, the development of OTC products, and spawned financial futures exchanges in every corner of the globe-from Argentina to Australia, from Italy to India, from London to Kuala Lumpur. Virtually every currently successful exchange-traded financial derivative is a simple translation of one of the IMM initiated products to a geographically different underlying market.

In 1986, precisely fourteen years after its inception, Nobel Laureate in economics, Merton H. Miller, nominated financial futures as the most significant financial innovation of the last twenty years (Miller 1986).

2. How FX Futures Work

If you are new to futures this section is for you. The history of modern futures trading is traced to the grain trade in the Midwest U.S. in the 1800s. Grain merchants developed the first formal marketplace in 1848 in Chicago. These merchants were looking for a system to standardize trading transactions. While forward contracts were initially utilized, these privately negotiated agreements were not standardized and sometimes counterparties defaulted. In an effort to improve the reliability of the system, futures contracts were developed, which were standardized for quality, quantity, and time and place for delivery of the agricultural products that were being traded.

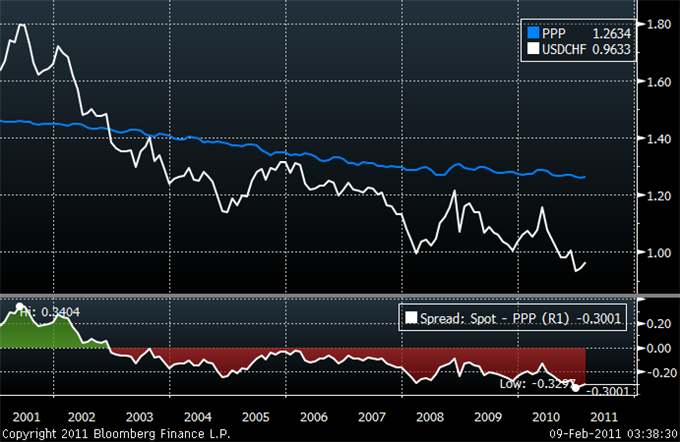

Chicago Mercantile Exchange (CME) pioneered the first currency futures contracts in 1972. In March 2003, the total notional value of FX trading at CME was U.S. $347.5 billion. Currency futures are derivatives on the interbank cash and forward exchange rates.

A futures contract is a legally binding contract to buy or sell a commodity or financial instrument at a certain price at a specified date in the future. Futures markets thrive because they attract two types of traders: hedgers and speculators. Hedgers, such as producers and processors of commodity products, seek to protect against adverse changes in the underlying cash price that may impact their business. Speculators include investors and traders who want to profit from price changes. Speculators accept the price risks and rewards that hedgers wish to avoid. Futures markets provide the forum in which speculators can buy or sell contracts quickly and — just as quickly — exit their positions to react to market changes.

At CME, a U.S. government-regulated marketplace, currency futures trade via open outcry on the CME trading floor and on CME’s electronic trading platform. These CME FX markets are integrated by floor traders via wireless e-trading to provide customers with efficient, fluid access to both pricing pools.

CME benefits foreign exchange participants, including individual investors, large banks, hedge funds and multinational corporations. All of these players come together at CME to speculate and hedge on currency market fluctuations.

CME delivers efficient, transparent trading venues for rapid FX trade execution supported and monitored by experienced industry professionals. CME FX customers access liquid markets, efficient clearing services, and 24-hour-a-day customer support. Futures commission merchants facilitate customer trading at CME in exchange for brokerage fees.

Most currency contracts at CME are traded on the March quarterly cycle and go through a physical delivery process four times a year on the third Wednesday of March, June, September and December. However, the Mexican peso and the South African rand are traded on all 12 calendar months. There are two cash-settled contracts — the Brazilian real, traded on all twelve calendar months, and the Russian ruble, traded on the March quarterly cycle.

SOURCE: CME (Chicago Mercantile Exchange) publications: How FX Futures Work. These publications are available in full upon request.

CME does not offer or provide any investment advice or opinion regarding the nature, potential, value, suitability or profitability of any product or investment strategy. All matters pertaining to rules and specifications for CME products are made subject to and are superseded by official CME rules. Current CME rules should be consulted in all cases concerning contract specifications.

Chicago Mercantile Exchange and CME are trademarks of Chicago Mercantile Exchange Inc. All other trademarks are the property of their respective owners.

Cannon Trading is registered with the Commodity Futures Trading Commission and a member of the National Futures Association, the US Chamber of Commerce, and the Beverly Hills Chamber of Commerce.

Futures Risk Disclosure

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.