Five Important Lessons For ETF Investors

Post on: 30 Март, 2015 No Comment

by Stoyan Bojinov on April 30, 2012 | Updated July 9, 2014

Innovation remains a dominant and exciting theme in the ETF universe, although as with any financial instrument, with growth and evolution also comes increasing complexity and newly discovered nuances. The towering lineup of over 1,600 exchange-traded products is probably intimidating for many investors who are new to industry and arent exactly sure where (or how) to start looking for a product that suits their investment objective and risk tolerance

.While theres certainly no one right way to go about looking for an ETF that fits your needs, it may be helpful to start by considering some of the noteworthy differences across similar products. ETF education is an ongoing process, and as such, there are a number of important lessons to keep in mind, and while some are fairly basic, many of the important ones are often times overlooked.

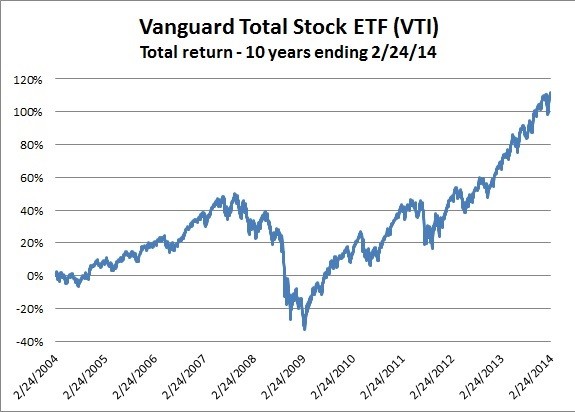

Below, we highlight five important distinctions to understand when investing in ETFs, complete with visual illustrations of actual performance histories from ETFs:

1. Spot ≠Futures

The Lesson: Some investors assume that ETPs that utilize futures contracts will offer exposure to the underlying assetfor example, that ETFs holding natural gas futures contracts will mimic movements in spot natural gas prices. That simply isnt true; futures based strategies are often impacted significantly by the slope of the futures curve [see Spot Vs. Futures ].

The Proof: The following chart shows performance for the spot VIX, a popular measure of anticipated equity market volatility, compared to VXX. an ETN that replicates the performance of an index comprised of VIX futures:

Click to Enlarge

2. Currency Impact Matters

3. Small Cap Difference

The Lesson: When using ETFs to achieve international equity exposure, investors now often have a choice between large cap and small cap stocks. While these two choices may seem very similarthey target the same countrythere can be some significant differences in the risk and return profiles realized [see Small Cap ETFdb Portfolio ].

The Proof: The following table shows two India ETFs; SCIN holds small cap stocks, while INP is linked to an index comprised of larger companies. Small cap stocks tend to exhibit more volatility on both the upside and downside; though the losses have been more significant over the period shown below, small cap Indian stocks did very well in early 2012 as this market rallied, pulling ahead of their larger counterparts.

Click to Enlarge

4. Tracking Error, Expenses Matter

5. Style vs. Pure Style

The Lesson: For investors looking to target value or growth stocks, there are different options available in the ETF universe. Some products cast relatively wide nets, including significant portions of the broader universe. Others are more targeted in nature, selecting only the individual securities that exhibit the strongest value and growth characteristics [see our Pure Value and Pure Growth ETFdb Portfolio ].

The Proof: The table below compares two ETFs that offer exposure to very similar baskets of stocks: the iShares S&P MidCap 400 Value Index Fund (IJJ ) and the Guggenheim S&P MidCap 400 Pure Value ETF (RFV ). The historical performance is pretty interesting; RFV, which holds a much more targeted portfolio, has delivered huge returns in certain environments:

Disclosure: No positions at time of writing.