Financing Higher Education The Cost and Debt Dilemmas—and Possible Solutions

Post on: 16 Март, 2015 No Comment

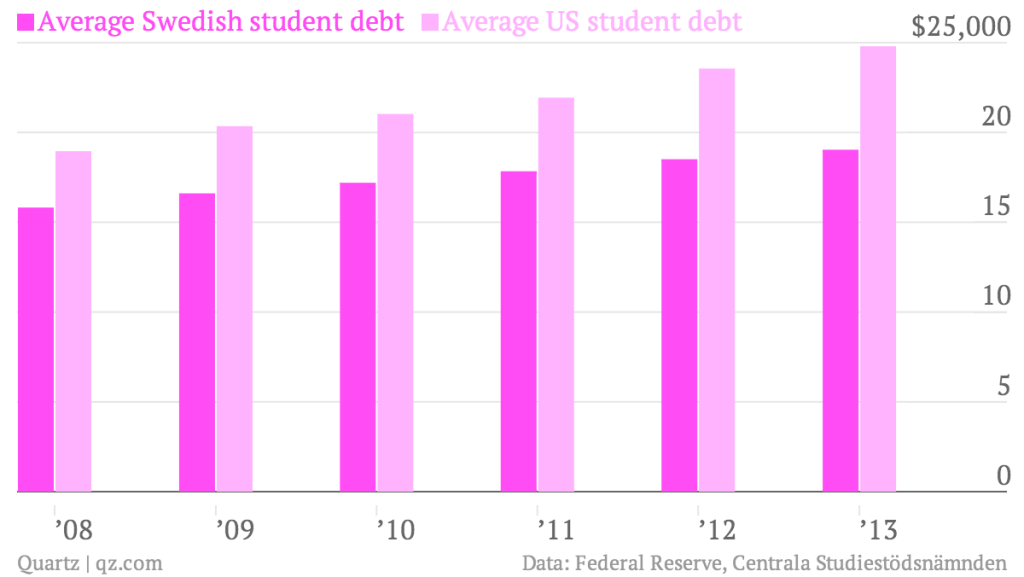

Lucia DiPoi, a first generation college student, owed more than $84,000 when she graduated from Tufts University in 2005—$19,000 in federal loans and $65,000 in private loans that charged interest rates higher than her government loans, (Clemmitt, 2008). With an interest rate exceeding 13% on some of her notes, she now pays more than $900 per month to service her college debt (Clemmit, 2008). Similarly, after six years, four schools, two states, and many course credits, Erin Sandonato graduated from the University of West Florida in 2002 with more than $40,000 in debt (Price, 2003). These two examples illustrate the financial liability that some college students must repay after they graduate. Moreover, these are not isolated examples: fully 70% of seniors graduating in the Class of 2012 did so owing an average of $29,400 (Reed and Cochrane, 2013, p. 1). In 2010, for the first time ever, total student loan debt in the United States exceeded outstanding credit card debt (Essig, 2011; Lewin, 2011). It topped $1 Trillion at the end of 2011 and swelled another 20% by May 2013 (Chopra, 2013). Statistics like these beg the questions, “Why?” and “What can be done about it?”

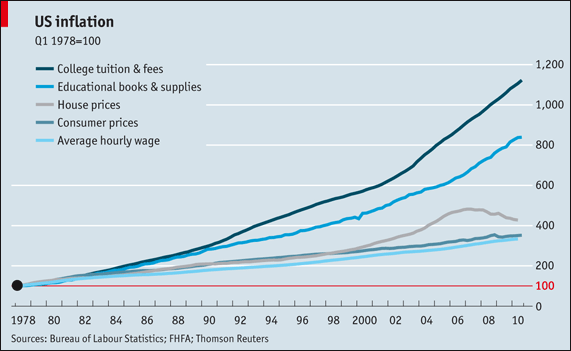

The short answer to “Why?” is that the cost of higher education has accelerated and that public colleges and universities have been shifting those increases to students (or their parents), requiring them to pay a higher percentage of the total cost of their degree. For public institutions particularly, this trend has developed as state support for higher education has plummeted in recent years. For example, in one study of cost, price and government support at public institutions between 2003 and 2008 researchers found that costs increased modestly, but that price increases accelerated as subsidies declined markedly (Delta Project, 2010). In essence, “tuition increases were caused by cost shifting. rather than by cost increases. as the student share of costs increased relative to declines in state subsidies” (Delta Project, 2010, p. 2).

The long-term trends in the cost of higher education are discouraging. In the past 30 years, the data show that tuition and fees at public institutions, when adjusted for inflation, have increased more than 350% (Baum & Ma, 2010, p. 13; see Figure 1). Additionally, although state support for higher education increased by 13% from 1980 to 1998 in constant dollars, tuition increased by 107% during that same period, resulting in a net real decline in state support for higher education (NCPPHE, 2002, p. 9). Students, families, and others who pay for public higher education are paying more today than in the past.

When asked in 2000 to explain the causes of increasing higher education costs, state policy makers—including individuals in the executive and legislative branches and campus officials—offered responses that Mumpher has grouped into five composite narratives (2001) and these arguments remain salient today:

- The States Made Prices Rise : Rising costs and tuition prices are a result of a long-term decline in state support for higher education. As they have responded to budget pressures lawmakers have elected not to increase higher education funding relative to other state budget priorities. So, to fill the gap left unfilled by state appropriations, public university officials have responded by increasing tuition. This narrative paints campus leaders as victims of state budget decision-maker choices (Mumpher, 2001, pp. 45-47).

- Medicaid and Prisons Made Prices Rise : This perspective focuses blame for the rise in the price of public higher education on mandated expenditures such as Medicaid, corrections, or transportation that require state appropriations. For most state lawmakers, these items take precedence over higher education spending, which is often viewed as discretionary. Moreover, state appropriators realize universities have a mechanism with which to replace insufficient state funds: tuition. (Mumpher, 2001, pp. 48-51).

- Quality Programs Cost Money : The changing spending patterns of public colleges and universities are the cause of rising costs. Public institution officials’ increased spending patterns are a response to the changing needs of universities. Certain expenditures are required to maintain a quality educational environment. Adequate funding for competitive salaries, maintenance, recreation, and support services is key to providing high-quality programs that attract and retain students (Mumpher, 2001, pp. 51-53).

- Those Unaccountable Public Colleges Made Prices Rise : In this view college officials alone are responsible for their institutions’ increased costs. Colleges and universities are paying more to be all things to all people without making difficult decisions about spending priorities thereby increasing tuition. In this narrative the crux of the issue is a disagreement about priorities: university faculty prize research and national rankings while state officials emphasize undergraduate education and job training. This viewpoint shows lawmakers in a favorable light, contending they are working to ensure federal/state appropriations are spent productively (Mumpher, 2001, pp. 53-58).

- It Only Looks Like a Problem : Tuition inflation is not a real problem. Tuition increases should only be a concern if they impede students’ ability to enter college. Most students and parents can afford to attend college and those who cannot can obtain generous financial aid (Mumpher, 2001, pp. 58-60).

Unfortunately, while each of these narratives purports to explain the fact of rising college costs, they do little to address its causes: those offering these explanations talk past one another and do little to change the system of higher education finance fundamentally. Since that has been so, public policy makers at all levels have typically chosen the path of least resistance—raising tuition.

Among other possible solutions to this student debt/higher education cost dilemma, two unique possibilities exist. First, a proposal offered by the president of the University of Oregon (U of O) would ensure state funding to that public university by endowing it with $800 million in money borrowed by Oregon (Blumenstyk, 2010). Under this arrangement, U of O would promise to match that state contribution, dollar-for-dollar. The resulting $1.6 billion endowment would generate enough revenue to fund the university at average current levels (provided the assumptions of nine percent investment return and four percent annual payout rate are achieved). At the conclusion of the state’s 20-year bond obligation, no further general fund revenues would be appropriated for the university since the state’s previous share of support would now arise from the university’s endowment (Blumenstyk, 2010). This proposal would further change the basic system, structure and character of public higher education.

Another possible solution involves providing an alternative to student loans through Income Share Agreements (ISAs). ISAs do not replace financial aid or state funding, but they do provide an alternative for students’ financing their education. Through an ISA, investors fund students’ education and in return those individuals promise to return a certain percentage of their future income to their backers during a fixed period to repay the obligation (Palacios, DeSorrento, & Kelly, 2014). Over time, the student may pay more or less than the amount financed, depending on his or her financial success. This arrangement provides students with financing but protects them from the risk if their educational investment fails to pay off as they envisaged. Investors, meanwhile, could pool and diversify their risk in this framework, thereby mitigating any potential loss. At the same time, ISAs allow financiers to offer better terms to students studying for careers that promise higher returns or for students studying in higher quality programs, thus guiding students to high-quality, high yield programs. Likewise, ISAs incentivize investors to provide students with support such as advising, mentoring, or counseling designed to increase their success during and after their studies. And income agreements have the advantage of being open to any and all, regardless of their economic background or family circumstances—and without government guarantees or subsidies (Palacios, DeSorrento, & Kelly, 2014).

Higher education in the United States is frequently admired for its accomplishments, especially in quality and accessibility. However, the current rising cost and debt problems attending higher education represent a threat to those accomplishments. In order to survive and prosper, federal and state governments and higher education institutions will need to better control costs, increase revenues, and minimize student debt while continuing to promote access and quality. Delaying reform in higher education finance will increase future social trauma by more radically reducing accessibility or quality, or both. The time to act to save higher education financially is now.

References

trends.collegeboard.org/college_pricing

chronicle.com

www.consumerfinance.gov/newsroom/student-debt-swells-federal-loans-now-top-a-trillion/

library.cqpress.com/cqresearcher/

www.deltacostproject.org/sites/default/files/products/issuebrief_01.pdf

chronicle.com/blogs/brainstorm/debt-for-diplomas/34196

www.nytimes.com/

Mumpher, M. (2001). The paradox of college prices: Five stories with no clear lesson. In D.E. Heller (Ed.), The states and public higher education policy: Affordability, access, and accountability (pp. 39-63). Baltimore: The Johns Hopkins University Press.

www.highereducation.org/reports/losing_ground/ar.shtml

www.aei.org/files/2014/02/26/-investing-in-value-sharing-in-risk-financing-higher-education-through-inome-share-agreements_083548906610.pdf

library.cqpress.com/cqresearcher/

projectonstudentdebt.org/files/pub/classof2012.pdf

Jerald H. Walz is a PhD candidate in Higher Education at Virginia Tech currently researching academic freedom in colleges & universities. He has earned a B.A. from Asbury College, a M.A. from the Johns Hopkins University, and two graduate certificates from Virginia Tech. Before coming to Virginia Tech, while working at the Institute on Religion and Democracy, Jerald taught Public Policy for Pepperdine University’s Washington D.C. program. With his wife, Anita, he enjoys reading, classical music, light gardening, travel, and activities at The River Anglican Church.