Fibonacci Tips For Emini Futures Trading

Post on: 21 Июнь, 2015 No Comment

Written by DeWayne Reeves of CFRN.net. Burton Schlichter is a partner and featured broker at CFRN.net.

FIB TIPS AND OTHER HEAD TRIPS

As traders, we are quick to put on mental shackles. Bind ourselves to a way of thinking that lives somewhere between no-sense and nonsense. No trader makes it through unscathed. We all get a little taste of the snake oil in one form or another. However, if you are going to succeed in building your trading business, you must learn how to trade. Interestingly enough, the most powerful tools available in todays hi-tech trading arena, in my opinion, arent the new ones; its the tools that are steeped in a rich history, the ancient of days.

- Candlestick Signals 400 years old

- Fibonacci Sequence Created In the beginning discovered by man recently in 1202

In our previous article, Fibonacci Tips For E-mini Futures Trading. we covered the basics of Fibonacci Retracements in the context of an uptrend. In this article, we will use the same concept and approach, but we will simply apply them in the context of a down trend. This is a large part of why Day trading E-mini Futures is so attractive. Unlike investing in a company where you often wait weeks, months, or even years for the stock to appreciate, E-mini Futures profit opportunities are as readily available in a downtrend as they are in an uptrend.

Sidebar:

Pattern day trading rules do not apply to E-mini Futures. You are not required to maintain a minimum $25k account balance as you are when trading Stocks and ETFs. Check with a licensed broker to make sure you understand the margin requirements for trades held beyond 3:15PM Central.

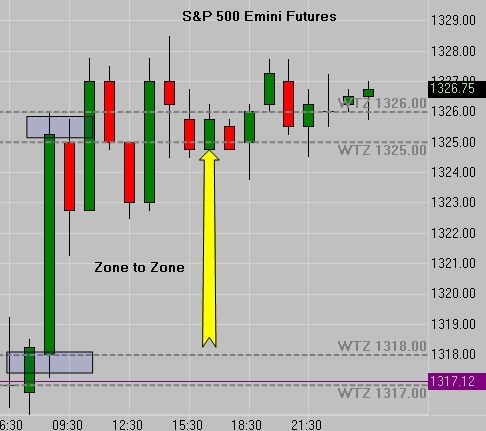

Fibonacci Retracements in a Down Trend

In a down trend, the basic idea is to be a seller in the market as price pulls back to a Fib Resistance level. In the examples below, we will use both volume and time-based charts. However, just as when we applied Fibonacci Retracements to an uptrend, any of the following chart types are acceptable.

As long as you are using the same swing low and swing high price when calculating and/or drawing your levels, the style of chart is not relevant. Different charts serve different purposes, but that is a broad subject unto itself and well beyond the scope of this article. However, choose the style of charting you are most comfortable with as we lay your foundational understanding of Fibonacci and its application in trading.

In the down trending examples, you will use your built-in fib tool and simply click the swing high and drag your cursor to the swing low and release your mouse button. You are simply reversing the steps covered in Part 1. Lets get Fibbing!

The first chart we will use is a Volume Chart:

(ES) SP500 Fib Levels

We drew from the swing high at 1459.75 down to the (at-the-time) current swing low at 1451.25. There was no way to know for sure that 1451.25 would be the swing low, but with each candle that closes lower, you simply continue to measure until you reach a level where you get a minimum 38% retracement. In this example, price pulled back to 1454.50 which was a perfect 38% retracement to the tick. In this example, the difference between the 38% and the 61.8% retracement was 2 points as opposed to our previous example which was 2 ticks. The entire area from the 38% to the 62%, or 1454.50 to 1456.50 is an area and quite suitable for this example.

We of course have the benefit of using a historical chart to present the perfect textbook example. In real time, when trading live, you must be able to think on your feet. From the 38% pull back at 1454.50, we had an initial drop to 1449.75 or 4.75 points. If we measure the entire move after the secondary pull back, we drop to 1447.75 and have a potential maximum profit of 6.75 points.

Keep in mind that we had the luxury of locating a perfect textbook example after the fact. If we had sold the 38% retracement on blind faith, what was our risk? A draw down to the 50% level would have been 1 point. A draw down to the 62% level would have been 2 points. A draw down to just above the swing high would have been 5.75 points. We want to maintain the integrity of being at least 2 ticks above the swing high which is what we recommend. The question you have to ask yourself is, does my account size and risk profile allow me to risk 5.75 points on one trade?

Although this trade ultimately made a very nice move down to 1447.75, the initial target in real time would have been the previous swing low at 1451.25. This reality check changes the dynamics. From the 38% retracement entry at 1454.50 to the previous swing low is 3.25 points. Please understand, 3.25 points profit is a very nice trade indeed; in fact, its what we call A Days Work. If you are trading 1 contract, as you should be if you are new to trading, the potential income from this trade would be $162.50 before commissions.

Sidebar:

If you are a self-directed trader who executes your own trades via an electronic platform, your transaction cost per trade should not exceed $7. That figure includes the cost to enter and exit the market per contract. This figure must be factored in as you write your Business Plan. This is a fixed cost of doing business and will also affect your written Trading Plan. In the absence of both a written Business Plan as well as a Trading Plan, you do not yet have a business you have a hobby.

The difference between trading 1 contract and 10 has nothing to do with money. It has everything to do with your maturity as a trader. Just as earning $1,625.00 on 10 contracts might seem easy on the surface, losing $1,625.00 is the alternate reality and potentially far more devastating psychologically than financially. If you are willing to risk 5.75 points for a potential profit of 3.25 points, I suggest you rethink your business plan as well as your trading plan. A risk to reward ratio negatively skewed will make it very difficult to keep the doors open on your E-mini Trading business. Sometimes we simply have to pass on the most picturesque opportunity because the numbers dont line up. As I mentioned in Part 1 of this series, moving from Retail Trader to Professional Trader will require you to recognize that no position is a valid position .

Lets look at another perfect textbook example on a Time based chart.

(ES) SP500 Fibs Hourly Chart

By using an hourly chart, we are able to readily identify a significant swing high at 1439.25 and a swing low at 1427.25. The initial pull back was to the 38% level. The 38% level failed to hold and price pulled up to the 50% retracement. The 50% level held briefly, but ultimately, the market rallied to the 61.8% level before reversing. Since we are on an hourly chart, it is not surprising but expected that the price range between levels will be significantly larger.

If you sold the 38% level on blind faith, your draw down in this example would be from 1431.75 (rounding down as the market only trades in 1/4 point increments) up to 1434.50, or a total of 2.75 points. Courtesy of this historical chart, we can see after the fact that it was all the risk we needed. In real time, the story is somewhat different. Whether we entered at the 38/50 or 62% level, a stop based on our methodology would need to be a minimum of 2 ticks above the swing high or 1439.75.

The difference between 1439.75 and 1431.75 is 8 points. In a live market, our initial target would be the original swing low that got us into the trade 1427.75. If you entered at the 38% level, your anticipated profit on 1 contract would be 4.5 points. An entry at the 50% level presents a potential profit of 6 points. If you were extremely patient and waited for the 62% level to enter, your potential profit was 7.25 points. Because we teach, train and trade an aggressive risk management methodology, the risk/reward ratio would not have met our criteria. Interestingly enough, price sailed right through 1427.25 all the way down to 1416.50. Were we shocked, stunned, dismayed, or discouraged? Did we wind up in a fetal position on the cold concrete floor of our War-Strategy-Break Room?

Not this time. We have a Business Plan and a Trading Plan which we do not deviate from. As a result, we will miss opportunities from time to time, which in the rear-view mirror, may look very handsome. The good news is, within short order, an equally appealing trade that ticks every single box on our plan will come along, and we will be prepared to act confidently and without hesitation.

Lets move on to a not so perfect textbook example:

(ES) Fibs Hourly Downtrend 62% Retracement

Our swing high is clearly established at 1434.50, and our swing low is equally as clear at 1416.50. This is a significant move of 18 points and a great place to draw some Fibs. The 38% level at 1423.38 offers no resistance. The 50% retracement at 1425.50 also offers no resistance. In this example, one hourly candle moves all the way up to the 62% retracement at 1427.62 (round it down to 1427.50) before we run into any resistance whatsoever. Price not only meets resistance, it appears to be spell bound as it remains trapped in a 2 point range for the next 4 hours. If I were looking for a place to put blind faith to work, this would be the spot. Lets see what happens next.

(ES) 62% Retracement Fails To Hold

a hard stop in place, it would take very few trades such as this one to take you out of the ball game for good. Your Business Plan and Trading Plan must both clearly address the use of a hard stop to prevent just this type of catastrophe. A few ticks above the swing high would have put your stop at 1435. We can clearly see that this was no simple pullback in a down trend this was a stone cold reversal that rocketed all the way up to 1450 and beyond. That would be a 15 point draw down or $750 on just 1 contract. You may be thinking, Surely it cant go any higher, itll come back.

Those are some famous oft spoken last words.

(ES) Pull Back Becomes a Reversal

Other than simply using a hard stop, was there any other way to address this setup? Of course, there always will be. However, no matter how many back up plans or clever ideas you have, nothing can offer the sense of safety and security that comes with having a hard stop in place on every single trade. It is the cheapest disaster insurance you will ever purchase. Dont leave home without it.

In this lesson, we have learned how to draw Fibs in the context of a down trend and how to execute while maintaining a proper stop loss. We have also evaluated how to determine if a specific setup that the market is offering meets our risk profile criteria, or whether we should be content to wait for the next opportunity to come along. We also know exactly what it looks like when a pull-back is no longer a pull-back, but instead has become a reversal.

In the 3rd and final installment of this series, we will address Fibonacci Extensions and how they can assist us in projecting price targets in our E-mini Futures Trading.

STOP ORDERS DO NOT NECESSARILY LIMIT YOUR LOSS TO THE STOP PRICE BECAUSE STOP ORDERS, IF THE PRICE IS HIT, BECOME MARKET ORDERS AND, DEPENDING ON MARKET CONDITIONS, THE ACTUAL FILL PRICE CAN BE DIFFERENT FROM THE STOP PRICE. IF A MARKET REACHED ITS DAILY PRICE FLUCTUATION LIMIT, A LIMIT MOVE, IT MAY BE IMPOSSIBLE TO EXECUTE A STOP LOSS ORDER.

Learn to Trade the E-mini S&P 500

Learn to Trade the E-Mini S&P 500 as well as other futures markets in a live trading environment with professional traders. Test drive the online platform for a full week with the Christian Financial Radio Network (CFRN). These virtual classes are led by seasoned traders whose guidance and experience will allow you to grow in an educational setting. By the end of the course, you will be taught to look for helpful indicators that may improve your trading strategies. This is live training in live markets. Get started now!

The risk of loss in trading futures contracts or commodity options can be substantial. View the risk disclosures below.

Risk Disclosure

This material is conveyed as a solicitation for entering into a derivatives transaction.

This material has been prepared by a Daniels Trading broker who provides research market commentary and trade recommendations as part of his or her solicitation for accounts and solicitation for trades. Daniels Trading, its principals, brokers and employees may trade in derivatives for their own accounts or for the accounts of others. Due to various factors (such as risk tolerance, margin requirements, trading objectives, short term vs. long term strategies, technical vs. fundamental market analysis, and other factors) such trading may result in the initiation or liquidation of positions that are different from or contrary to the opinions and recommendations contained therein.

Past performance is not necessarily indicative of future performance. The risk of loss in trading futures contracts or commodity options can be substantial, and therefore investors should understand the risks involved in taking leveraged positions and must assume responsibility for the risks associated with such investments and for their results.

You should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources. You should read the risk disclosure webpage accessed at www.DanielsTrading.com at the bottom of the homepage. Daniels Trading is not affiliated with nor does it endorse any trading system, newsletter or other similar service. Daniels Trading does not guarantee or verify any performance claims made by such systems or service.

3A%2F%2F0.gravatar.com%2Favatar%2Fad516503a11cd5ca435acc9bb6523536%3Fs%3D70&r=G /%

About Burton Schlichter

Burton “Burt” Schlichter has 17years of futures trading experience, including educating, mentoring, and executing for retail and institutional clients. He places a strong emphasis on trading the markets from a technical standpoint and on utilizing spread trading. Additionally, for traders interested in buying and selling options on futures contracts, Burt has extensive knowledge of options trading strategies.