Fearful of another flash crash You can protect your ETFs

Post on: 23 Апрель, 2015 No Comment

By John Waggoner, USA TODAY

With any investment, your first question should be, What’s the worst that could happen?

Investors in exchange traded funds founds found out during the May 6 flash crash, when some ETFs sold for a penny a share. Could it happen again? Hard to say. But the stock exchanges are taking steps to prevent another ETF meltdown. And you can take some more steps to protect yourself.

What happened?

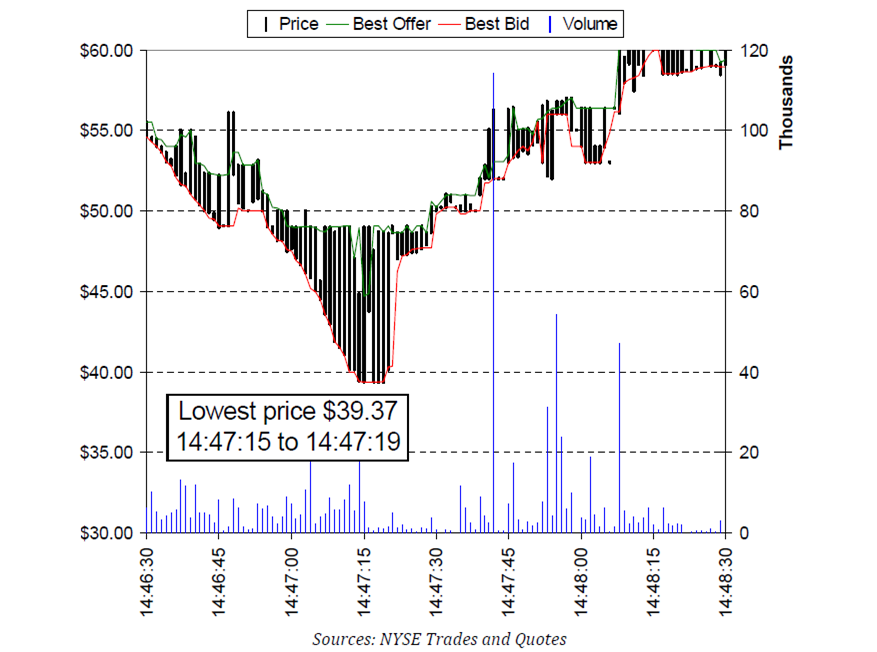

On May 6, the Dow Jones industrials plunged 998.5 points in about 20 minutes, only to regain much of those losses by the end of the day. A joint report by the Securities and Exchange Commission and the Commodity Futures Trading Commission issued on Sept. 30 said a large futures trade by an unnamed mutual fund company widely reported to be Waddell & Reed triggered the flash crash.

Exchange traded funds have a mechanism designed to help them track their designated indexes. If the price of the fund goes too far astray from its index, large institutional investors can buy or sell big blocks of the stocks in the fund, which will bring the fund’s price back in line with its index.

For several funds, however, the ETF mechanism didn’t work. The iShares Russell 1000 Growth Index fund, for example, opened on May 6 at $51.42 a share. Its low: 1 cent. Other ETFs saw their share prices plunge to less than 15 cents a share during the tumultuous trading that day.

What happened? According to SEC/CFTC study, one problem rested with the way ETFs are traded. When a sell order for a stock hits the market, the market maker matches the sell order with the buyer whose bid is the closest to the most recent price. As sell orders mount, the market maker fills them with progressively lower bids.

For most stocks, there are plenty of sell orders within 0.1 to 5 percentage points of the last price, the report says. But ETF orders, which are dominated by professional traders, tend to be fewer, and clustered more closely around the last price. And in times of market turmoil, many of those traders cancel their orders and get out of the way.

When there are no more ETF buy orders, some ETFs hit so-called stub quotes. These are placeholder quotes put in by market makers because there has to be a quote for every stock. But stub quotes are typically ridiculous: Say, offers of a penny to buy an ETF and $1 million to sell.

During the tumult of May 6, several ETFs hit stub quotes meaning that panicked investors got a penny per share for their ETFs, or that lucky bidders bought ETFs for a penny a share. The SEC canceled trades for stocks or ETFs whose price was 60% less than their 2:40 p.m. price on May 6, but that still left some investors with enormous losses.

Is it fixed yet?

Yes and no. The SEC has started a trial program that will halt trading in a select group of ETFs if their price falls 10% or more in a five-minute period. The exchange will halt trading for five minutes to allow ETF trading to settle down. Currently, there are 344 ETFs in the program, which will end Dec. 10 at which point, the SEC will make the decision on whether to make the program permanent.

We can have a lot of confidence; these circuit breakers are effectively addressing some of the causes that caused the flash crash, says Michael Johnston, senior analyst for ETF Database, an internet site that tracks ETF news. I don’t see any way this doesn’t become a permanent program.

Another option being considered: trading collars, much as those used in the futures markets. For example, during a highly volatile period, an ETF trading at $10 might have an upward collar of $11 and a downward collar of $9 for a set period of time.

Other fixes being discussed, according to Laura Morrison, head of U.S. ETF listings at NYSE Euronext include eliminating stub quotes and making rules to toss out clearly erroneous trades.

ETF experts are generally pleased with the SEC’s efforts to safeguard ETF trades. We’d rather have the exchange stop trading than to allow bad prices, says Timothy Strauts, ETF analyst at Morningstar, the Chicago investment trackers. The SEC is running a similar program that covers all stocks in the Russell 1000, as well as the Standard and Poor’s 500, which will also help ETFs.

The SEC program does have limits. The ETFs chosen had a $2 million average daily volume from Jan. 1 through May 5, 2010. Most of those are U.S. stock ETFs. All the ETFs that fell more than 60% during the flash crash were stock ETFs, however, indicating that other ETFs that invest in futures contracts, bonds or precious metals may not be at risk in another flash crash. They also don’t cover leveraged funds, which aim to give two or three times the daily return of certain indexes.

You can also take a few steps to protect yourself:

Change stop orders to stop-limit orders. A stop order is an instruction to your broker to sell a security if it falls below a certain price. Normally, that’s considered a prudent way to limit losses: Once your ETF falls below your set price, you sell at the next bid. For many investors during the flash crash, however, the next bid was far below the stop-loss price. People who thought it prudent to have a 10% stop loss hurt themselves much worse during the flash crash, Morningstar’s Strauts says.

Instead, consider a stop-limit order, which specifies the price at which you’ll sell, as well as the minimum price you’ll accept. For example, you could put in a stop-limit order to sell when the ETF drops below $10 (the stop) but at no lower than $9.50 (the limit). It’s not a guarantee: The market could plunge below your stop and your limit, which means you’d still own the stock. In addition, your broker may charge you extra for a stop-limit order.

Be cautious. ETFs that have volume of less than $1 million a day may have only one market maker and no regular institutional traders, Strauts says. If the market maker steps away, there is nothing there.

Don’t get carried away. If you’re playing ETFs to the level that you have to monitor them every minute of the day, be sure that you’re only investing money that you could lose in another flash crash.