Fast Stochastic Oscillator indicator explained calculation

Post on: 16 Март, 2015 No Comment

Follow MoneyMunch.com Technical Analysis Directory and Learn Basic Education of Technical Analysis on the Indian Stock Market (NSE/BSE)

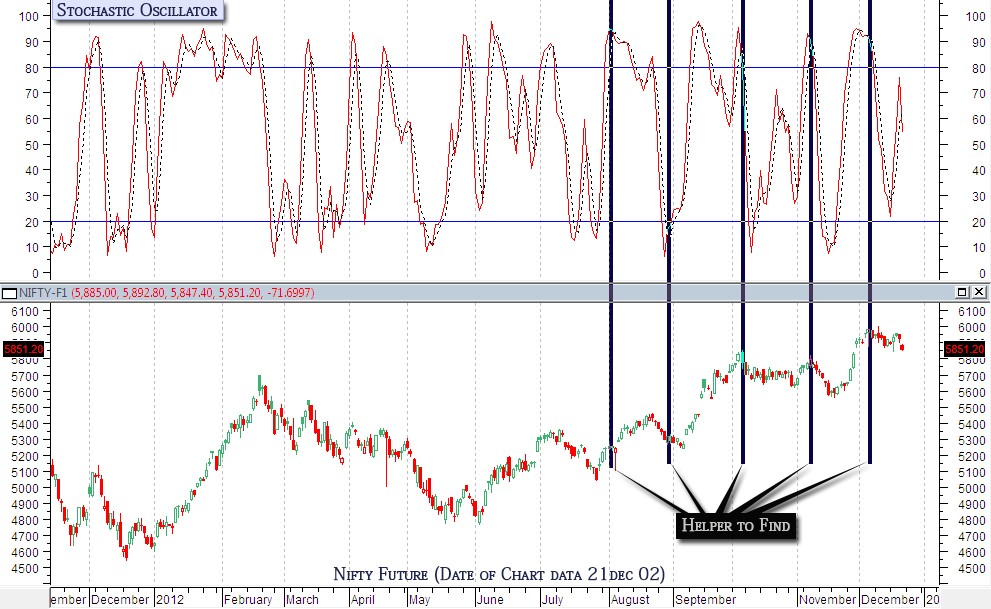

Fast Stochastic Oscillator

Effect of Fast Stochastic Oscillator

Recognize identifies a strong event for a fast stochastic oscillator when:

For fast stochastics, the %K value is calculated as follows:

%K = 100 [(C-L)/(H-L)]

Where

C is the latest closing price of the extra stock

L is the lowest price of the stock for the period that you are monitoring. Recognia utilizes a 14-day period since the period observe.

H is the best price of the extra stock for the period you are spying. Recognia takes advantage of a 14-day period like the period to monitor.

For fast stochastics, the %D value is based on top of a 3-period moving average of the %K value. The %D value is determined because follows:

H is the sum of C-L inside the endure three times

L is the sum of H-L inside the final 3 periods

Pring identifies a option to distinguish the %K line from the %D occupation will be keep in mind that %K represents Kwick motions, whilst %D performances movements which Dawdle. Therefore, Edwards and Magee note which [ordinarily], the %K Line could change movement prior to the %D Occupation. However, whenever %D line changes movement just before the %K occupation, a slow and also steady Reversal is usually indicated.

This point identifies that explain trading decisions using stochastics. It must be pointed out, which numerous technical analysts utilize stochastics in combination along with other patterns or oscillators. John J. Murphy, for instance, indicates that [one] way to combine daily and regular stochastics will be to utilize weekly signals to determine the marketplace direction and also daily signals for timing. Its another good tip to add together stochastics with RSI.

As soon as you are using stochastics with price charts, keep the following factors in mind:

Extremes

Once the %K line nears the 100% or perhaps 0% occupation a potent move is set to occur. Some technical analysts equate the extremes with overbought or oversold circumstances, and also which prices are unable to get any sort of a lot higher or perhaps lower. However, Edwards and also Magee identify which this is certainly not real in all circumstances, and that the extremes instead portray the resilience of a price move.

Divergences

A divergence is mentioned to have happened once the price and oscillator trend lines move in different directions. A price reversal may follow.

Lane referred to a flattened %K or %D occupation since hinges. A hinge might indicate that the uptrend or downtrend is actually exhausted, and a price reversal may take place.

Crossovers

Whenever the price has got reached 70 or much higher, and additionally a divergence possess occurred, a crossover is the provide alert. To summarize Lane, Robert W. Colby writes which the sell alert is a bit more trustworthy when %D has got already flipped down when %K crosses below %D.

Similarly, when the price possess reached twenty or perhaps lower, and additionally a divergence has happened, a crossover turns out to be the purchase signal. Robert W. Colby writes that the buy alert is a bit more trustworthy whenever %D possess undoubtedly up down when %K crosses above %D.

Message for you(Trader/Investor): Google has the answers to most all of your questions, after exploring Google if you still have thoughts or questions my Email is open 24/7. Each week you will receive your Course Materials. You can print it and highlight for your Technical Analysis Training.