Failed Platinum Negotiations Could Fuel Upside Break

Post on: 21 Июль, 2015 No Comment

Fundamental bias: bullish

Key takeaways:

- Union and producers meet in an attempt to bring an end to platinum strike

- Government will remove itself from negotiations today if a resolution is not met

- This offers up a nice long set up in the price of platinum

- Look for a failure to reopen the mines to catalyze a upside break, with a medium-term target of yearly close highs at 1489.39

Throughout the day on Monday members of South Africas AMCU union and representatives of the major platinum producers in the nation met with the aim of finally bringing to an end the platinum mining strike that has now dominated industrial metal headlines for the majority of the last five months.

The meetings were especially important, as if a resolution is not arrived at today, the South African government will resign from its role as a mediator between the two parties involved.

Situation has set up a nice long opportunity in the platinum market, so heres what you need to know.

First off, its important to say that the long set up his reliant on no resolution being arrived at on Monday. There is a mirroring set up that relies on a resolution; but the impact, and in turn risk parameters, of such a setup extremely difficult to predict. The reason for this is that a large number of futures contracts long platinum at present, effectively betting on a severe supply constriction during the coming 12 months. A resolution now may come just in time to allow any hold in supply to be offset by current stockpile, and may lead to a rapid unwinding of the long contracts.

So looking at the original setup, if the two parties are unable to come to some form of agreement today the government will back out which will likely drag the strikes on for at least another month. This will start to put the mining industry in a position where current stockpile may not be suffice to meet demand during late 2014 and early 2015, and the aforementioned severe supply constriction could become a reality. For this reason, a failed resolution would almost definitely attract a large number of new platinum longs to the market. So what are the levels to watch?

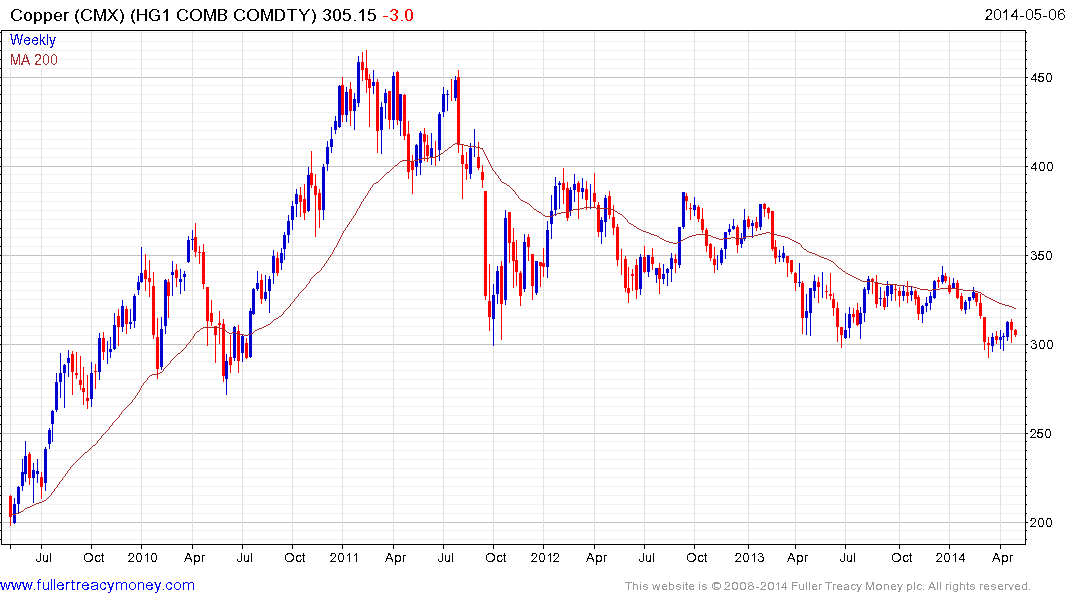

Take a look at the platinum chart below.

As the chart shows having declined throughout the latter half of may (likely as a result of short to medium term speculators unwinding positions) platinum found support against the US dollar around 1427.05. Three straight days of gain during the latter half last week saw the pair regain approximately 50% of this correction, and it is now trading just shy of in term resistance at 1463.30. If, when the news breaks early Tuesday morning, no resolution has been found, look for a sharp break towards this resistance level, with a close above bringing yearly close highs into play at 1489.39 as an upside target.