Exchangetraded funds The midas touch Professional Adviser IFAonline

Post on: 8 Июль, 2015 No Comment

Jason Toussaint

The World Gold Council’s Jason Toussaint on innovations in the ETF sector providing investors more opportunities to enjoy the allure of gold

Todays investment environment has created many interesting opportunities for the global ETF industry. Providers of ETFs which are essentially securities tracking an index, commodity or basket of assets like an index fund, but that trade like a stock on an exchange are very active in the current market.

Product development

The net result is an industry in growth mode and within this significant and growing market, one segment in particular stands out in todays economic environment: gold ETFs.

Cost effective

Gold ETFs are a cost-effective investment vehicle through which an investor can track the price of gold. An ETF offers a simple and transparent means for investors to gain exposure to gold without trading futures or taking physical delivery.

This flexibility and ease of access has generated interest in gold as an asset class among a broad range of market participants, many of whom did not previously invest in gold.

Indeed, in a period of just over seven years, from the inception of the first gold ETF in 2003 to recent figures as of August 2010, the global market for gold ETFs has grown to a multi-billion dollar industry.

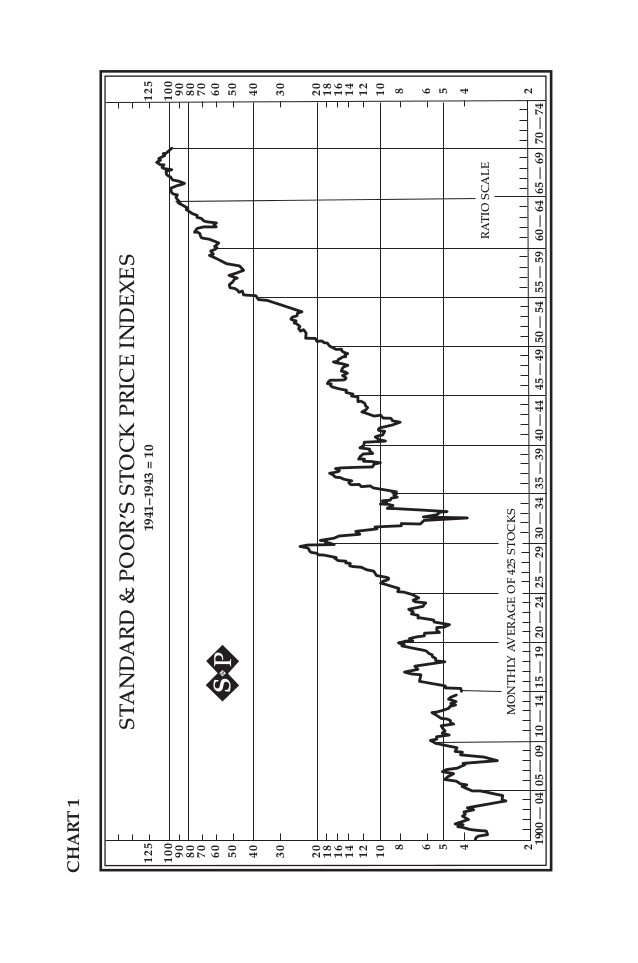

The table below shows that gold ETF holdings breached the $80bn mark for the first time in the second quarter of 2010, hitting $81.6bn at close of the quarter-end London PM fix. Launched in November 2004, GLD is the largest gold ETF with AUM of more than $53bn and is the second largest ETF globally.

Growth

The growth trend of gold ETFs is both startling and sustainable investor appetite shows no sign of easing. Broader gold demand trends based on figures published quarterly by the World Gold Council, show that total identifiable gold demand in the second quarter of 2010 amounted to 1,050.3 tonnes, or $40.4bn, a 36% increase over Q2 2009 levels.

The average second quarter gold price of $1196.74/oz was 30% above the average for the second quarter of 2009.

This demand increase has been driven predominantly by a strong rise in investment demand, which rose 118% to 534.4 tonnes compared with 245.4 tonnes in the second quarter of 2009.

An interesting point to note is that within this strong investment demand growth the largest contribution to this rise came from the ETF segment, which grew by 414% to 291.3 tonnes, the second highest quarter on record.

This brought total gold ETF holdings to a new high of 2,041.8 tonnes, worth US$81.6bn at the quarter-end.

The message from investors is clear the advent of gold ETFs has massively contributed towards establishing gold as an attractive portfolio asset and a tool that can be used to reduce overall portfolio risk while providing a store of value when other asset classes are failing.

The World Gold Council has played a major part in developing the global market for gold-backed ETFs, working with partners in a number of different countries.

After developing the structure of the world’s first gold ETF, launched in Australia in 2003 by Gold Bullion Securities (now ETF Securities), the World Gold Council, through its wholly owned subsidiary World Gold Trust Services, sponsored the listing of SPDR Gold Shares (GLD) on the New York Stock Exchange in November 2004.

Just six years on, GLD is now the second largest ETF in the world, with current assets under management of over US$53bn, second only to the SPDR S&P 500 ETF, which was established in 1993.

Gold ETF products have effectively eliminated many of the barriers which had prevented individual investors from using gold as an asset allocation and trading tool, including the logistics of buying, storing and insuring gold.

The introduction of GLD and the other gold ETFs that followed, have radically changed the way in which gold can be accessed, offering investors an innovative, cost efficient, transparent and secure way to access the gold market through the trading of a security on a regulated stock exchange.

One of The World Gold Councils core missions is to make gold fundamental to investment decision making, long-term saving, financial planning and financial product design.

With the proliferation of new products and the ongoing innovations of the global gold ETF sector, investors have more opportunities than ever before to enjoy the benefits of gold.

Jason Toussaint is managing director, US of the World Gold Council