Exchange Traded Notes (ETNs)

Post on: 29 Апрель, 2015 No Comment

Exchange traded notes (ETNs) were first introduced by Barclays Bank PLC, a subsidiary of global financial services provider Barclays PLC, June 12, 2006. The idea behind ETNs was to combine the most desirable characteristics of bonds with those of exchange traded funds (ETFs).

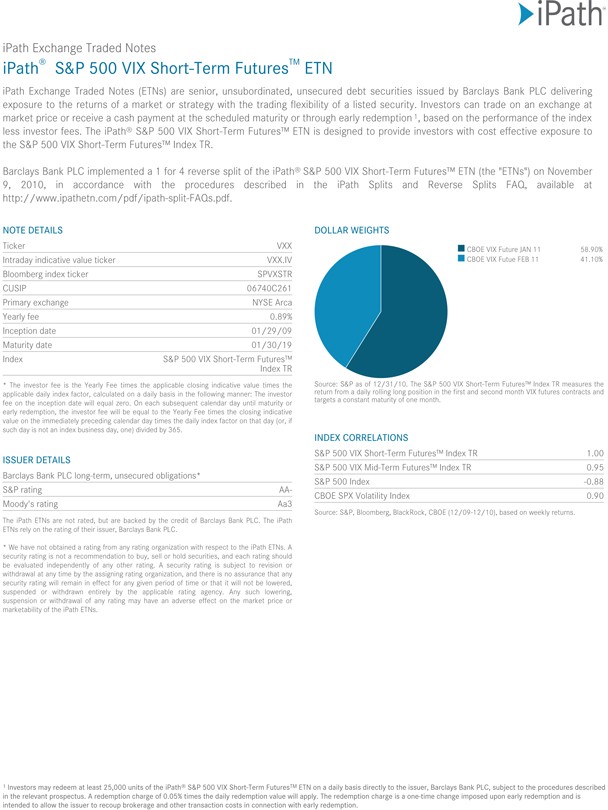

Marketed and sold under the name iPath, ETNs are issued and backed by Barclays Bank PLC. Like ETFs, they are traded during regular business hours on the stock exchange and are linked to the return of a benchmark index. One of the stated advantages of ETNs over equities or index funds is that they provide investors with convenient access to the returns of market benchmarks, minus investor fees, with easy transferability and an exchange listing, according to Barclays.

Although similar to ETFs in many ways, ETNs are debt securities as opposed to equity securities. This means that they represent loans that the borrower has promised to repay by a certain date. Bonds and certificates of deposit are also debt securities. ETFs, as equity securities, represent a percentage of ownership and a proportional claim on any assets and returns. When you buy an exchange-traded fund, youre buying a slice of a diversified portfolio of stocks. When you buy an ETN, youre buying a promisespecifically, the promise that the issuer will pay the note according to the terms laid out in the ETNs prospectus, John Waggoner, a personal finance columnist for USA Today. wrote in a recent article.

The home page of the iPath site offers additional information and various ETN options

Some ETNs may track the index better than their ETF counterparts. A fund has to use futures and other investments to track the commodity index. Because a note isnt a fund, it doesn’t have to line up investments that mirror the index. All it needs is the promise to pay according to the indexs movements, according to USA Today .

There are four types of ETNs: commodities, currencies, emerging markets and strategies, according to Barclays. Commodities ETNs include categories such as energy, industrial metals and precious metals. Currencies ETNs include the euro. the British pound and the Japanese yen. The only emerging market option now listed by Barclays is the India Index ETN. The strategies ETN is linked to the performance of the S&P 500 BuyWrite Index. Each ETN carries an annual fee, which varies depending on the category.

Because ETNs are unsecured debt, investors assume the credit risk. Returns on ETNs are primarily based on the return of the tracked index and the creditworthiness of Barclays itself. So if the credit rating of Barclays Bank were to suffer a downgrade then the value of the ETN would also suffer, according to Money-Zine.com.

Barclays, which has been in operation for 300 years, has a AA credit rating from Standard & Poors and more than $1.5 trillion in assets. Even so, it is not as safe as if the notes were backed by a central bank, and investors should realize that even seemingly reputable banks can suffer unexpected losses. For example, Barings Bank in London had been in operation for over 200 years and was considered extremely reputable until it was forced to shut down in 1995 after losing millions of dollars speculating.

When originally introduced, the difference between the purchase price and the selling price of an ETN could be treated as capital gain come tax season. But a recent IRS ruling has altered the tax treatment of ETNs and may make things more difficult for investors who wish to buy them. In December 2007, the IRS decided that financial instruments linked to a single currency would be treated as debt. As a result of this ruling, gains realized on currency ETNS can be taxed as ordinary income at a much higher rate than capital gains. The IRS may be considering revising tax treatment of other ETNs as well.

For some, simple ETNs may be a good investment solution, but others may be wiser to stay away. ETNs. go by names such as BOXES, LUNARS, MITTS, PERQS and PISTONS. Except for the plainest of plain-vanilla ETNs, you should handle them like XPLOSIVs, according to Waggoner.