ETFs Versus Mutual Funds

Post on: 30 Март, 2015 No Comment

ETFs Versus Mutual Funds

If you’re new here, you may want to subscribe to my RSS feed. Thanks for visiting!

Exchange traded funds (ETFs) versus open-ended mutual funds.

In general, I prefer ETFs for investors.

The exception tends to be for extremely small investors. It may be more cost-effective to pay higher annual expenses, but no transaction fees, with a no-load mutual fund, than to pay commissions on minimal ETF acquisitions. Also, many no-load mutual funds allow for very small purchases of funds and reinvestment of distributions.

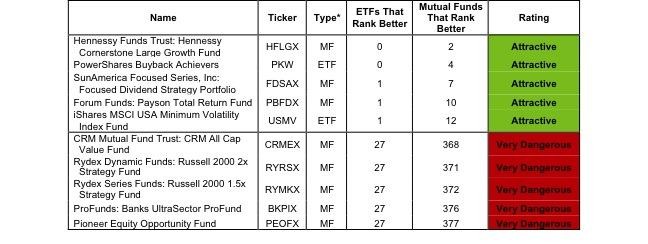

Today, three graphs comparing the current state of ETFs with open-ended mutual funds.

If you read some of my previous posts see Related Posts in the far right column you know the reasons why I prefer ETFs for most investors.

Total ETF Assets Vs. Total Mutual Fund Assets

Driven by lower expenses, lower taxes, intraday tradability as well as access to various non-traditional asset classes, more money managers and individual investors are making the switch over from mutual fund holdings into ETFs. Simply put, ETFs have seen growth, while mutual fund assets have started to dwindle.

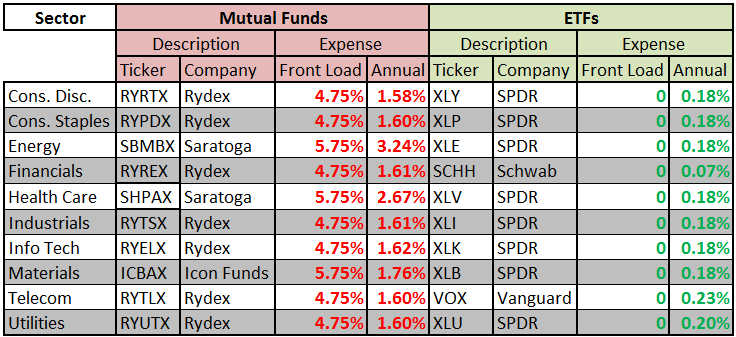

Average Annual Expense Ratio of ETFs Versus Mutual Funds

The difference in costs is truly striking as the average traditional mutual fund is more than one full percentage point costlier than the average ETF. These expenses grow when investors factor in some mutual funds’ front-end sales loads, 90-day redemption fees and 12B-1 marketing fees.

The other points made in this section are very true. But while some mutual funds do have high thresholds, an increasing number of no-load mutual funds allow for reasonable initial purchase amounts (e.g. $1000) and very low subsequent acquisitions (e.g. $100).

The Total Number Of ETFs

Nearly every investment theme, asset class and strategy has been tackled by ETF sponsors. Adding up all the funds across the United States, Canada, Europe and Asia–the latter three regions’ funds are available to some investors with global brokerage accounts–there are more than 4,700 different ETFs. This provides plenty of opportunities to diversify a portfolio.

The multitude and variety of ETFs allows for investors to create well diversified portfolios on a cost-effective basis. A couple of cautions though.

One, there is a direct correlation between complexity (or exoticness) of an ETF and its annual expense ratio. While, on average, ETFs annual expenses are lower than mutual funds, there are some pricey ETFs out there.

Two, you can get pretty much everything with ETFs. But that may not always be a good thing. Be careful with ETFs that alter the basic risk-return profile. For example, leveraged ETFs can enhance your upside, but can also enhance your downside risk. And usually they will be more expensive than the identical non-leveraged ETF.

Also, ETFs (and mutual funds) are excellent vehicles to create diversified portfolios. Within a broad portfolio strategy, alternative asset or exotic ETFs can improve overall diversification. However, an individual ETF may have little to no diversification on its own. For example, if you load up on a futures-based corn ETF, that ETF itself will have poor diversification.