ETFs and VIX The Facts and the Risk

Post on: 9 Август, 2015 No Comment

Key Points

- The VIX is known as the fear index and may spike during market turmoil. Investors can’t own the VIX directly—they can only buy futures contracts. Because of the impact of contango, VIX futures portfolios often underperform the VIX.

Investors often worry about market volatility—especially the kind of big negative moves seen during the credit crisis of 2008 or the summer of 2011. It’s natural to look for investments that increase in value when markets decline in order to get some downside protection, which is why some investors start looking toward the VIX® —a volatility index published by the Chicago Board Options Exchange 1. You can’t buy the VIX itself, though, and the exchange-traded products that use VIX futures have some big risks that investors should understand before buying.

What is the VIX, and why would you want it?

The name VIX is an abbreviation for volatility index. Its actual calculation is complicated, but the basic goal is to measure how much volatility investors expect to see in the S&P 500® Index over the next 30 days, based on prices of S&P 500 Index options. When options traders think the stock market is likely to be calm, the VIX is low; when they expect big swings in the market, the VIX goes up.

Source: Morningstar, as of February 28, 2014.

During times of high market turmoil, the VIX has tended to rise. As you can see in the chart above, the VIX index moved steadily higher as the market approached the peak of the late 1990s technology bubble, calmed down during the steady growth period of 2003-2007, then spiked during the 2008 credit crisis and in the latter half of 2011. Because of this pattern of behavior, the VIX is sometimes referred to as the fear index—when market participants are worried about the market, the VIX tends to rise.

Investors who see the VIX having increased sharply while the market went down might be tempted to seek an investment in the VIX as a source of potential protection during market turbulence. If only it were so simple!

The problem with futures

Like all indexes, the VIX is not something you can buy directly. Moreover, unlike a stock index such as the S&P 500, you can’t even buy a basket of underlying components to mimic the VIX. Instead, the only way investors can access the VIX is through futures contracts .

A futures contract is an agreement to deliver something at a certain point in the future for a price that’s agreed upon in the present. The first futures contracts were for commodities such as wheat and corn, and they’re available for many commodities now, including oil and natural gas.

Index futures, such as those tied to the value of an index like the S&P 500 or the VIX, do not involve actual delivery of anything when the futures contract matures. Instead, they use a cash delivery tied to the value of the index on the delivery date.

The potential problem, as with any futures contract, is contango —when the futures price for something is higher than its current price. For instance, if VIX is at 15 today and a one-month VIX futures contract is trading at 16, then the VIX futures market is in contango.

Why is this a problem? Well, imagine that your goal is to always have a certain part of your portfolio invested in VIX futures. If the futures contracts are always more expensive than the current VIX level, then you pay a premium every time you buy futures. You’re essentially buying high and selling low, which erodes the value of your investment over time.

Contango in action

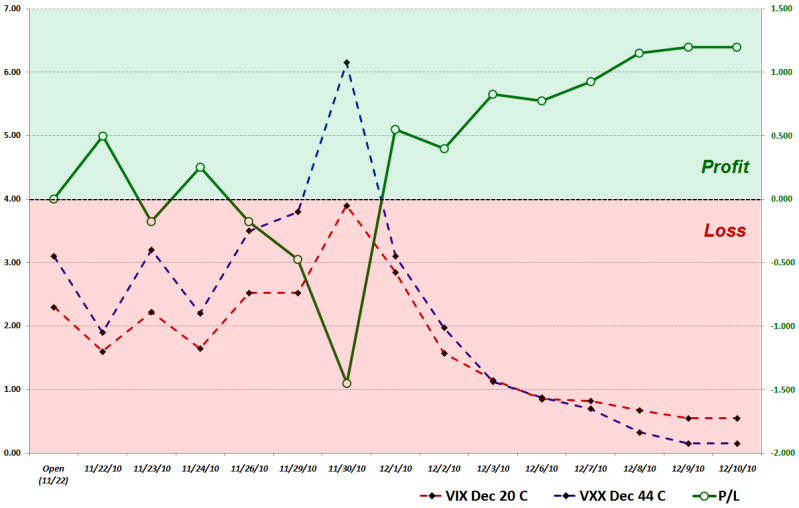

The contango problem isn’t purely academic; VIX futures contracts have often been more expensive than the VIX index. According to Bloomberg, in 70 of the past 91 months, the three-month VIX futures contract was above the VIX level. You can see the effect in action in the chart below.

Value of $10000 invested in VIX or in VIX futures portfolios

Source: Morningstar, as of February 28, 2014. The example is hypothetical and provided for illustrative purposes only.

In this figure, you can see what $10,000 would be worth if it had been invested in the VIX itself (which, as mentioned earlier, is impossible), a portfolio of short-term VIX futures contracts or a portfolio of medium-term VIX futures contracts. These portfolios are based on actual exchange-traded funds that buy VIX futures contracts.

As you can see, since April 2011 the futures contracts have lagged significantly behind the value of the VIX index. By the end of the time period, the value of $10,000 hypothetically invested in the VIX itself would fallen to $7,200 while the portfolios of futures contracts were worth $830 to $2,700. Had an investor actually been able to buy the VIX, the investment would have lost some money, but the actual investable instruments lost significant amounts of money.

Just because an investment has VIX in its name doesn’t mean that it will move in line with the VIX index. Furthermore, as the charts show, the VIX itself can be extremely volatile—the index lost 64% of its value between September 2011 and March 2012. Investors cannot really own the VIX, and even if they could, it would be an investment with a great deal of risk.

1. The Chicago Board Options Exchange Volatility Index® (VIX®) reflects a market estimate of future volatility. VIX is constructed using the implied volatilities of a wide range of S&P 500 index options. This volatility is meant to be forward-looking and is calculated from both calls and puts.