ETF versus Mutual Fund Taxes

Post on: 28 Апрель, 2015 No Comment

Your e-mail has been sent.

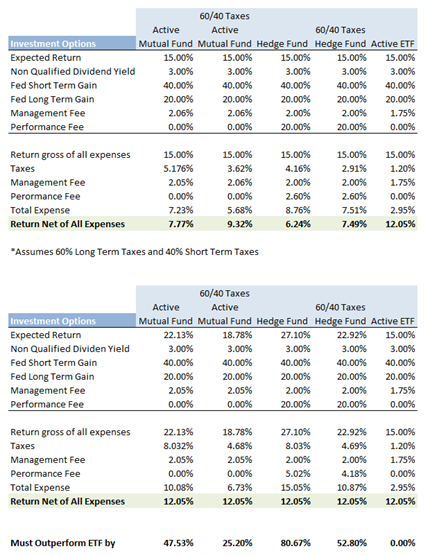

ETFs can be more tax efficient compared to traditional mutual funds. Generally, holding an ETF in a taxable account will generate less tax liabilities than if you held a similarly structured mutual fund in the same account.

From the perspective of the Internal Revenue Service, the tax treatment of ETFs and mutual funds are the same. Both are subject to capital gains tax and taxation of dividend income. However, ETFs are structured in such a manner that taxes are minimized for the holder of the ETF and the ultimate tax bill – after the ETF is sold and capital gains tax is incurred – is less than what the investor would have paid with a similarly structured mutual fund.

In essence, there are – in the parlance of tax professionals – fewer “taxable events” in a conventional ETF structure than in a mutual fund. Here’s why:

A mutual fund manager must constantly re-balance the fund by selling securities to accommodate shareholder redemptions or to re-allocate assets. The sale of securities within the mutual fund portfolio creates capital gains for the shareholders, even for shareholders who may have an unrealized loss on the overall mutual fund investment.

In contrast, an ETF manager accommodates investment inflows and outflows by creating or redeeming “creation units,” which are baskets of assets that approximate the entirety of the ETF investment exposure. As a result, the investor usually is not exposed to capital gains on any individual security in the underlying structure.

To be fair to mutual funds, managers take advantage of carrying capital losses from prior years, tax-loss harvesting, and other tax mitigation strategies to diminish the import of annual capital gains taxes. In addition, index mutual funds are far more tax efficient than actively managed funds because of lower turnover.

ETF Capital Gains Taxes

For the most part, ETF managers are able to manage the secondary market transactions in a manner that minimizes the chances of an in-fund capital gains event. It is rare for an index-based ETF to pay out a capital gain; when it does occur it is usually due to some special unforeseen circumstance.

Of course, investors who realize a capital gain after selling an ETF are subject to the capital gains tax. Currently, the long-term capital gains tax is 15%, but it is slated to rise to 20% in 2012. The important point is that the investor incurs the tax after the ETF is sold.

Taxation of ETF Dividends

ETF dividends are taxed according to how long the investor has owned the ETF fund. If the investor has held the fund for more than 60 days before the dividend was issued, the dividend is considered a “qualified dividend” and is taxed anywhere from 5% to 15% depending on the investor’s income tax rate. If the dividend was held less than 60 days before the dividend was issued, then the dividend income is taxed at the investor’s ordinary income tax rate. This is similar to how mutual fund dividends are treated.

Exceptions to the Rules

Certain international ETFs, particularly emerging market ETFs, have the potential to be less tax efficient than domestic and developed market ETFs. Unlike most other ETFs, many emerging markets are restricted from performing in-kind deliveries of securities. Therefore, an emerging-market ETF may have to sell securities to raise cash for redemptions instead of delivering stock –which would cause a taxable event and subject investors to capital gains.

Leveraged/inverse ETFs have proven to be relatively tax-inefficient vehicles. Many of the funds have had significant capital gain distributions — on both the long and the short funds. These funds generally use derivatives — such as swaps and futures — to gain exposure to the index. Derivatives cannot be delivered in kind and must be bought or sold. Gains from these derivatives generally receive 60/40 treatment by the Internal Revenue Service (IRS), which means that 60% are considered long-term gains and 40% are considered short-term gains regardless of the contract’s holding period. Historically, flows in these products have been volatile, and the daily repositioning of the portfolio in order to achieve daily index tracking triggers significant potential tax consequences for these funds.

Commodity ETPs have a similar tax treatment to leverage/inverse ETFs due to the use of derivatives and the 60/40 tax treatment. However, commodity ETPs do not have the daily index tracking requirement, use leverage/short strategies, and have less volatile cash flows simply due to the nature of the funds.

Exchange Traded Notes

The most tax efficient ETF structure are Exchange Traded Notes. ETNs are debt securities guaranteed by an issuing bank and linked to an index. Because ETNs do not hold any securities, there are no dividend or interest rate payments paid to investors while the investor owns the ETN. ETN shares reflect the total return of the underlying index; the value of the dividends is incorporated into the index’s return, but are not issued regularly to the investor. Thus, unlike with many mutual funds and ETFs which regularly distribute dividends, ETN investors are not subject to short-term capital gains taxes. Like conventional ETFs, however, when the investor sells the ETN, the investor is subject to a long-term capital gains tax.