ETF Preview ETFs Futures Lower as Investors Mull Fed Decision to End BondBuying Program;

Post on: 6 Июль, 2015 No Comment

SPDR S&P 500 ( SPY ): -0.34%

iShares MSCI Emerging Markets Index ( EEM ): +0.10%

Market Vectors Gold Miners ( GDX ): -1.07%

iShares Russell 2000 Index ( IWM ): -0.47%

iPath S&P 500 VIX Short Term Futures ( VXX ): +2.26%

Broad-Market Indicators

Broad-market exchange-traded funds, including SPY, IWM, IVV and others, were weaker. Likewise, actively traded PowerShares QQQ (QQQ) is down 0.54%.

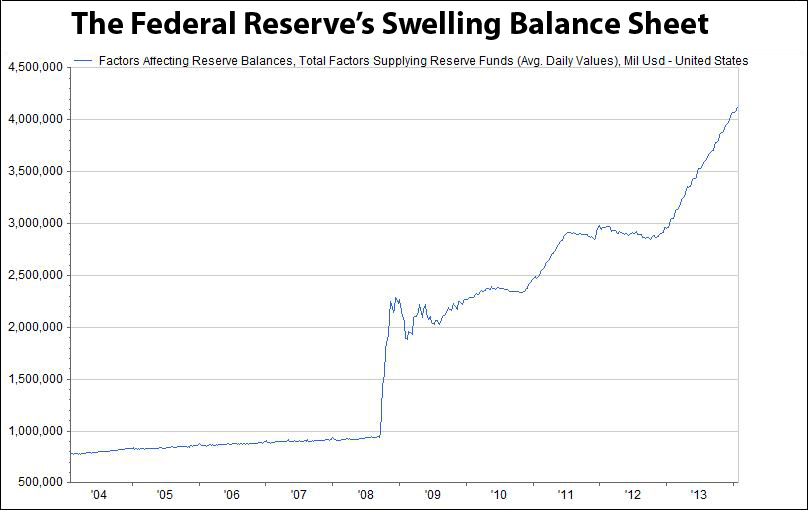

U.S. stock futures were lower as investors digested the Federal Reserve’s decision to end its bond-buying stimulus program. The Fed said Wednesday that it will cut purchases of Treasuries and mortgage-back securities to zero from $15 billion starting on Nov. 1.

Earnings results are also in the spotlight, with a MasterCard Inc. (MA), ConocoPhillips (COP) and Glu Mobile (GLUU) among companies seeing active trade following the release of their quarterly results.

In economic data news, U.S. weekly jobless claims increased by 3,000 to 287,000 versus expectations for a decline to a seasonally adjusted 281,000. Continuing claims increased by 29,000 to a seasonally adjusted 2.38 million.

Meanwhile, Q3 GDP grew at a 3.5% annual pace, aided by a surge in exports and a big jump in military spending. Forecasts had called for GDP to expand by a seasonally adjusted 3%.

Power Play: Technology

Technology Select Sector SPDR ETF (XLK) was up 0.83% while other tech funds iShares Dow Jones US Technology ETF (IYW), iShares S&P North American Technology ETF (IGM) and iShares S&P North American Technology-Software Index (IGV) were inactive. SPDR S&P International Technology Sector ETF (IPK) was also unchanged.

Semiconductor ETFs SPDR S&P Semiconductor (XSD) and Semiconductor Sector Index Fund (SOXX) were also flat.

Glu Mobile (GLUU) was down 15.23% after it said late Wednesday that for Q3, or the quarter ended Sept. 30, 2014, earnings were better than expected, while revenue fell short of analysts’ expectations; it provided guidance for Q4 below Street estimates. The company, which designs, markets and sells mobile games, reported Q3 GAAP net income of $10.6 million or $0.10 per share, compared with the prior-year period’s net loss of $8 million or $0.11 loss per share. Non-GAAP net income was $17.5 million or $0.17 per share, versus net loss of $4.7 million or $0.07 loss per share in the same quarter the previous year. The Capital IQ analyst estimate is for $0.11 earnings per share. Revenue was $83.6 million, up 270% from $22.6 million in the same quarter last year. Analysts were expecting revenue of $85.19 million. The company expects Q4 EPS of $0.01 — $0.03, ex non-recurring items, on revenue of $60 million — $65 million. The Street view is for $0.04 EPS on revenue of $65.48 million.

Winners and Losers

Financial

Select Financial Sector SPDRs (XLF) was down 0.21%. Direxion Daily Financial Bull 3X shares (FAS) was down 1.2% while its bearish counterpart, FAZ was up 1.49%.

Mastercard (MA) was up 2.42% after the payments-processing company reported higher Q3 earnings that surpassed analysts’ expectations as revenue also rose more than expected, boosted by strong growth in gross dollar volume. Net income climbed to $1.02 billion, or $0.87 per diluted share, from $879 million, or $0.73 per diluted share, a year earlier. The company noted acquisitions diluted its EPS by $0.02 per share; excluding that effect, it would have earned $0.89 per share in the latest quarter. Analysts polled by Capital IQ were looking for a profit of $0.78 per share. Net revenue rose 13% to $2.50 billion, above the Street’s consensus estimate of $2.45 billion. The company posted a 12% increase in gross dollar volume, on a local currency basis, to $1.2 trillion, while cross-border volume jumped 15% and processed transactions climbed 10%.

Energy

Dow Jones U.S. Energy Fund (IYE) was flat while Energy Select Sector SPDR (XLE) was down 0.91% in pre-market trading .

ConocoPhillips (COP) was up 1.49% after it reported thar Q3 adjusted earnings fell as oil prices declined and operating costs rose, but the result beat analysts’ expectations. On a GAAP basis, earnings at the oil exploration and production company were $2.7 billion, or $2.17 per share, compared with $2.5 billion, or $2.00 per share, a year ago. Excluding special items, primarily a gain from the sale of its Nigerian operations, adjusted earnings were $1.6 billion, or $1.29 per share, compared with $1.8 billion, or $1.47 per share. Analysts had been looking for $1.19. The company’s total realized price was $64.78 per barrel of oil equivalent (BOE), compared with $69.68 per BOE in the third quarter of 2013. Q4 production rose 4% to 1,473 MBOED from continuing operations, excluding Libya.

Conoco said the company is on track to meet its previously stated growth target of 3 to 5% volume and margin growth in 2014. Full-year 2014 production from continuing operations, excluding Libya, is expected to be approximately 1,525 to 1,535 MBOED.

Commodities

Crude was down 0.94%. United States Oil Fund (USO) was down 1.06%. Natural gas futures was up 0.26%. United States Natural Gas Fund (UNG) was up 0.3%.

Gold was down 1.73% while silver was down 3.5%. Among rare metal funds, SPDR Gold Trust (GLD) was down 0.92% while iShares Silver Trust (SLV) was down 2.99%.

Consumer

Consumer Staples Select Sector SPDR (XLP), iShares Dow Jones US Consumer Goods (IYK) and Vanguard Consumer Staples ETF (VDC) were inactive.

Lakeland Industries (LAKE) was up 39.29% after it said late Wednesday that as a response to the ebola crisis it has embarked on increasing its manufacturing capacity for specialty protective suits for healthcare workers. It said in a statement tonight it has been experiencing significant interest globally for its ChemMAXand MicroMAX protective suit lines. Manufacturing of select lines of these garments involves proprietary processes for specialized seam sealing, a far superior technology for protecting against viral hazards including infected body fluids than non-sealed products, the company said. It accelerated its capital investment program for new machinery to accommodate higher levels of output and increased its spending for raw materials and the hiring and training of manufacturing personnel to address the increase in product demand.

Health Care

Health Care SPDR (XLV), Vanguard Health Care ETF (VHT) and iShares Dow Jones US Healthcare (IYH) were flat. Meanwhile, Biotechnology fund iShares NASDAQ Biotechnology Index (IBB) was down 0.77%.

Astrazeneca (AZN) was down 0.06% after it said the U.S. Food and Drug Administration has approved once-daily XIGDUO XR for the treatment of adults with type 2 diabetes. XIGDUO XR is the first and only once-daily combination tablet of an SGLT2 inhibitor and metformin HCl extended-release to be approved in the United States and is indicated as an adjunct therapy to diet and exercise to improve glycemic control in adults with type 2 diabetes mellitus.