ES Emini Day Trading When to Exit a Trade Using Average True Range Indicator The Fractal Futures

Post on: 24 Июнь, 2015 No Comment

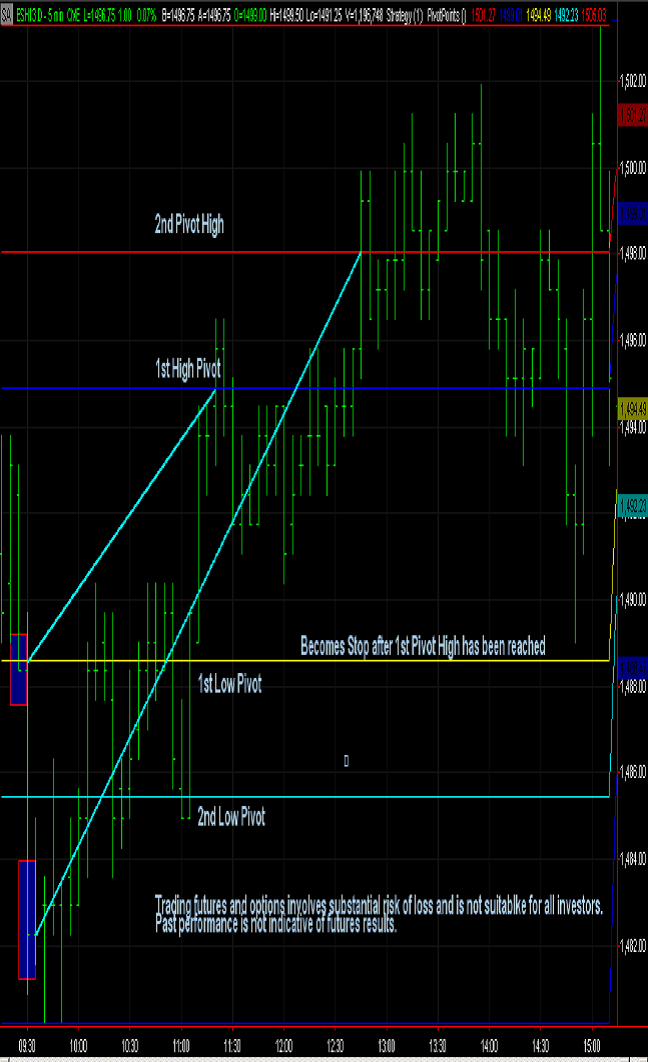

When do you exit a futures trade? Day trading related literature is chocked full of trade setups, but the advice on trade exits is very general, almost non-specific. Ironically, I find proper exits more challenging than entries when trading the ES emini.

When do you cut your losses? When do you trade out of a winning position ES Emini position?

From the onset, let me say that I often trade a simple 12 tick bracket on my positions. This strategy is a good one for general trading, and I dont know that you can go wrong with it, if you understand that you dont have to stop or limit out to exit a position. That is to say, if you are clearly on the wrong side of a trade, and your indicators indicate the price action is in the opposite side of your position, why not exit? Save yourself some money.

So we have established that you do not have to stop out or limit out in order to exit a position, is there a great way to know how much to let a trade run, both for a profit or a loss?

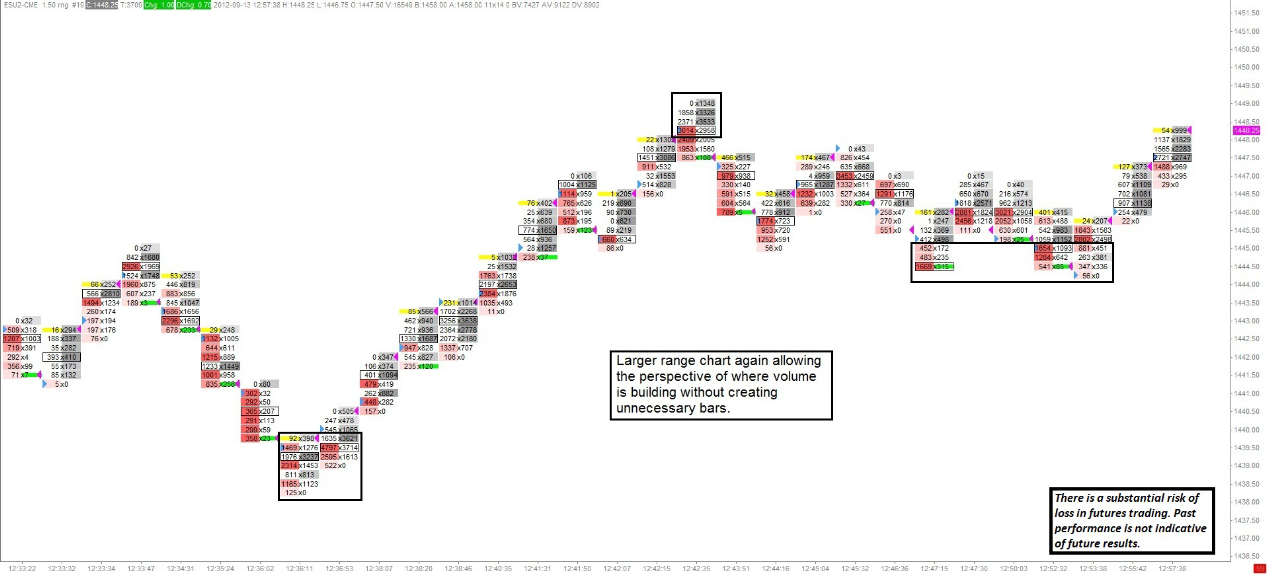

There is an indicator called the average true range that I have found most helpful. This indicator has been used for a variety of purposes in trading over the years. Some of the uses have included entry timing, exit timing, and the indicator wasnt always effective. So it has received a some bad press.

Average True Range is just one of the wonderful ideas in Wells Wilders New Concepts in Technical Trading The Average True Range is an exponential moving average, and gives a trader a good idea as to the volatility of the market. I generally trade a preset multiple of fraction of the market. The idea is simple, really. I want to avoid getting stopped out by the market noise of the day, but still retain the chance of pocketing some great gains.

For example; lets say the Average True Indicator is 2 (using a 14 period time setting), and I was setting my stops at 2X the Average True Range, my stop loss would be set at 4. In very volatile markets I may decide to trade at .75 of true range, which is what I did last year during those volatile months mid-year.

Whether you bracket your trades or use the Average True Range Indicator, it is important to have a sound exit strategy. A well-thought out strategy, not a strategy that the market dictates. Your exit strategy is in your control.

Oh, and never let a winning trade become a losing trade.