EquityLinked Note (ELN)

Post on: 16 Март, 2015 No Comment

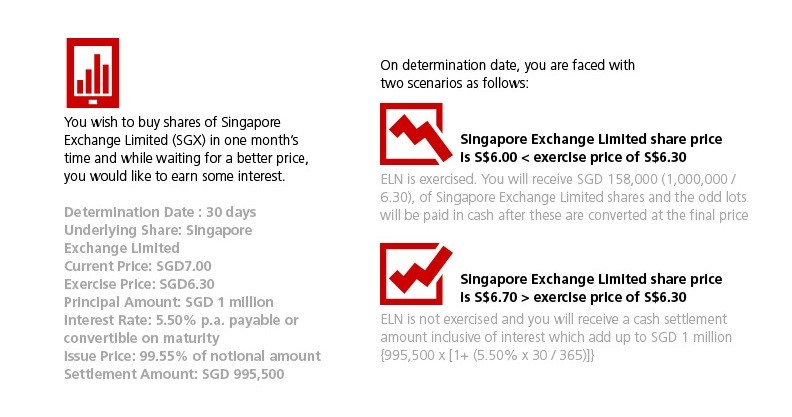

An equity-linked note combines the characteristics of a zero or low coupon bond or note with a return component based on the performance of a single equity security. a basket of equity securities, or an equity index. In the latter case, the security would typically be called an equity index-linked note. Equity-linked note s come in a variety of styles. The minimum return may be nil with all of what would normally be an interest payment going to pay for upside equity participation. Alternatively, a low interest rate may be combined with a lower rate of equity participation. The participation rate in the underlying equity instrument may be more or less than dollar for dollar over any specific range of prices. The participation may be open ended (the holder of the note participates proportionately in the upside of the underlying security or index, no matter how high it goes), or the equity return component may be capped. Other things equal, a capped return will be associated with a higher rate of participation up to the cap price. Various versions of this instrument are known as capital Guarantee note. Equity-Linked Debt placement. Equity-Linked Certificate of Deposit (ELCD or ECD), Equity Participation note s (EPNs), Indexed note s, Index- Linked bond s or note s, Equity Index Participation note. Equity Index-Linked note. Equity Participation Indexed Certificates (EPICs), Index principal return note. All-Ordinaries share Price Riskless Index note s (ASPRINs), Geared Equity capital Units (GECUs), Performance Index paper (PIP), Customized Upside Basket security (CUBS), Structured Upside Participating Equity Receipt (SUPER), portfolio Income note (PIN), Market Index Deposits (MIDs), Market Indexed note (MINE), Market Index Target-Term security (MITTS), stock Index Growth note s (SIGNs), stock Index Insured Account, stock Index return security (SIRS), stock Performance Exchange-Linked bond s (SPELbond s), Guaranteed return Index Participation (GRIP), Guaranteed return on Investment (GROI) Certificate, Index Growth-Linked Units (IGLUs), Index Participation Certificate, Protected Equity note (PEN), Protected Equity Participation (PEP), Protected Index Participation (PIP), Safe return Certificate, or as a variety of ‘money back’ certificates. While the names may provide a clue to the structures, each issuer seems to have at least one proprietary name for some version of these instruments. Investors must look at the structure and pricing of the units offered and compare them with more familiar names and structures.

Similar financial terms

U.S. government debt with a maturity of one to 10 years.

Written promise to pay.

Project notes are issued by municipalities to finance federally sponsored programs in urban renewal and housing and are guaranteed by the US Department of Housing and Urban Development.

A detailed set of notes immediately following the financial statements in an annual report that explain and expand on the information in the financial statements.

An agreement by which a syndicate of banks indicates a willingness to accept short-term notes from borrowers and resell these notes in the Eurocurrency markets.

A contract for privately placed debt.

Debt instruments with initial maturities greater than one year and less than 10 years.

Short-term notes issued by municipalities in anticipation of tax receipts, proceeds from a bond issue, or other revenues.

Publicly traded issues that may be collateralized by mortgages and MBSs.

A corporate debt instrument that is continuously offered to investors over a period of time by an agent of the issuer. Investors can select from the following maturity bands: 9 months to 1 year, more than 1 year to 18 months, more than 18 months to 2 years, etc. up to 30 years.

Zero-coupon, callable, putable, convertible bond invented by Merrill Lynch & Co.

Notes issued by states and municipalities to obtain interim financing for projects that will eventually be funded long term through the sale of a bond issue.

A term deposit in a bank. Deposit notes, like medium-term notes, may serve as the basis for an equity or currency-linked risk management structure.