Equity Trailing Stop When Do I Stop Trading for the Day

Post on: 16 Март, 2015 No Comment

Instructor

Many times I hear traders say they just want to make a certain amount of money per day trading, perhaps they are happy with $200, $500 etc. For most of them, I find out they are coming into trading from a career where they received a regular paycheck for some pre-set amount. Unfortunately, trading does not offer any guaranteed income levels. Most traders with this pre-defined profit target find themselves behind in trading on a regular basis and are putting excess pressure on themselves. For example, lets say you want to make $200 per day. The first day you trade and make $200. You are at par for the week. Now the next day, you lose $150 for the day. This means that when you come in to trade the next day, you will need to make $350 just to stay at par. If your strategy and or comfort level of trading is only designed to make $200 per day, you will find yourself having to take extra risk to make up this loss. This leads to making trading decisions based on money and not the market structure.

At the same time, setting a pre-defined profit target will limit your full profit potential if the market wants to give you more money that day. How many times have you been trading and hit your profit target for the day, and then later in the day, if you had kept trading, you would have seen twice or three times as much profit? As the old market saying goes, Let your profits run and cut your losses short, is still a good rule to follow.

Then there are traders who lose a very large amount of money early in the day and then they spend the rest of the day scratching and clawing their way back to break even. And history proves very few traders are able to do this consistently. This is why it is so very important to have a maximum dollar amount you are willing to lose per day and then immediately stop trading once you lose that amount. Your maximum dollar loss must be written in your trading plan. Do not just have a mental number in your head. This is much like the mental stops people use in the market. Once the price starts trading near their mental stop, they come up with reasons to hold onto this trade, just hoping and praying it comes back, and most of us know that more times than not, it does not come back. Many traders find they begin making emotional trading decisions after they have lost a lot of money in the market. They stop following their trading plan and become very impulsive with trade selection. Once they lose even more, they turn into revenge traders who are just angry and trying to get their money back any way they can. This usually means they start doubling up in the size of contracts traded, taking risky trade setups that normally they would have passed on, trading markets they are not familiar with just because they are desperate to find a trade, etc At this point of the vicious cycle, the trader is only a short step away from financial ruin. Even if you do not find a need for this Equity Trailing Stop I am going to show you, please have a maximum loss amount per trading day written in your trading plan. If you dont have a plan, then write it on a Post-It note and place it on your monitor.

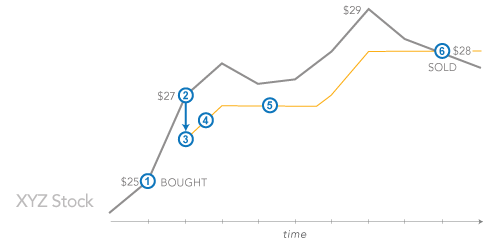

Now, I want to show you something I call an Equity Trailing Stop. The premise of this strategy is based on that saying we discussed earlier about letting our profits run and cutting our losses quickly. This tool will take into consideration what the market is willing to give or take on that particular trading day.

Figure 1

Figure 1 shows us a day where the market was sideways and did not offer much in the way of big profits. The Equity Trailing Stop probably would take you out of a market like this rather quickly because there is no apparent profit potential other than selling rallies and buying dips. This is fine until buying that dip turns into a bottomless pit, then all of those nice small profits are gone if you did not protect yourself with a stop.

Figure 2

Figure 2 shows us a day the market just ran in one direction, offering traders who stayed with the trend a very handsome profit. For those traders who took their $200 profit early in the morning and stopped trading, congratulations for following your plan. But look at the profit potential you gave up because you had a pre-defined profit target. Lets look at this Equity Trailing Stop and see if it can help you stay in the market until the market tells you to stop trading.

This strategy probably will impact traders who trade several times a day more than the trader who trades once or twice a day, but any trader can use this to their advantage.

Lets go through a trading day, entering some trades with both profits and losses, and see just when the markets tell us to stop trading. Remember, the most important part of trading is controlling losses. In the end, the only thing we can control is losses. There is no way we can tell the market how much we will make, but we certainly can tell the market how much we are willing to lose per trade. So have that maximum loss per day written down somewhere you can see it each trading day. I nicknamed this maximum loss for the day a circuit breaker, much like the circuit breakers in our houses that are designed to turn off before a fire starts and burns down the entire house. This financial circuit breaker is designed to stop your losses for the day and allow you to come back tomorrow and trade. When we are having a bad day trading, we just need to know when to stop trading. Do not continue trading and searching for why you are having a bad day; this is not important at the moment. Just stop trading. Later, after the emotions have calmed down, and trust me when you lose a lot of money, there will be emotions, then analyze what went wrong.