Equity Is Better Than Debt In Financing Higher Education

Post on: 16 Март, 2015 No Comment

Follow Comments Following Comments Unfollow Comments

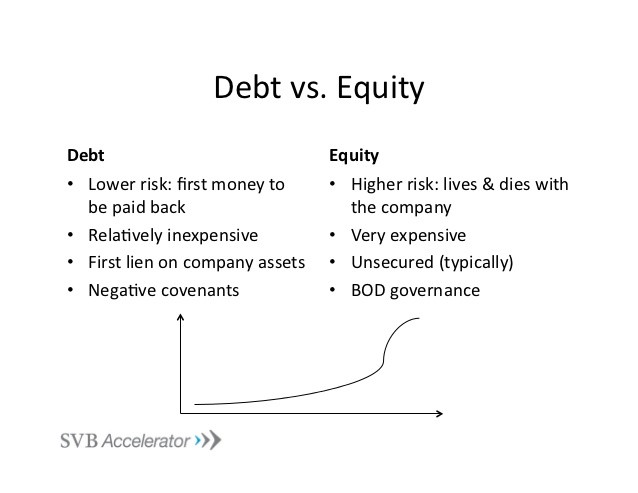

Sometimes it makes sense to borrow to finance an investment; sometimes equity is a better choice. When it comes to college education, however, borrowing (especially through the government) is usually a mistake. If we could catalyze a system of equity financing for higher education, that would be a great improvement over the status quo.

In his 1955 paper “The Role of Government in Education,” Milton Friedman suggested the idea of equity contracts to finance college education. Friedman thought that loans were not the appropriate means of financing education and argued that the better way was to advance the needed funds for college to qualified students, who would repay a percentage of their earnings for an agreed-upon number of years.

That is, instead of students borrowing money for college that must be repaid with interest, investors cover the cost of their education and later recoup their investment (perhaps making a profit but nothing would be guaranteed) as the student makes contractual payments based on his or her earnings.

Unfortunately, the concept of equity investment in students’ education has never caught on. The main reason is that the federal government began student loan programs back in the early 1970s and those programs mushroomed. With student loans easy and affordable, there was little chance for alternative finance systems to develop.

Friedman’s aversion to student loans has proven to be entirely justified by events. Politicians, eager to project a “pro-education” image, kept making college loans (as well as grants) more appealing. As the notion that college was a sure-fire investment worth borrowing great amounts for became widespread, the number of students taking out college loans grew enormously, as did their average level of debt.

Kelli Space. who wrote about the prodigious debt she racked up in pursuit of her sociology degree, is something of a poster-child for the danger of using loans to finance education, especially when the lender is the government and therefore indifferent to risk. Default rates on student loans are at historic highs, and rising.

Thus, it is certainly time for another look at the equity investment idea and a new paper published the American Enterprise Institute, “Investing in Value, Sharing Risk” by Miguel Palacios, Tonio DeSorrento, and Andrew Kelly makes a strong case for what the authors call Income Share Agreements (ISAs).

They argue that ISAs have several important virtues.

First, they would improve the efficiency of our higher education system by channeling students into high-quality, low-cost programs.

ISAs would do that because those who advance the money for students will be interested in making a profit, or at least not squandering their limited money. Because students would not be entitled to ISA funding but would instead have to strive to convince those who run the programs that they are worth taking a chance on. the focus of college education would change dramatically.

Whereas the current student loan system indiscriminately helps students to accumulate college credits. ISAs would not be offered unless the funders could foresee a probable benefit from the student’s education. Investors won’t put their limited funds behind students unless they seem likely to succeed after graduation, so ISAs would sensibly discriminate against ill-prepared, unfocused students who just seem to be looking for an easy degree.

Second, ISAs would benefit students who don’t find high-paying jobs soon after graduating. Because repayment would be based on their earnings, the severe difficulty that many graduates now find themselves facing—large loan bills due at a time when they have little income—would be eliminated.

No doubt that sounds very appealing to students who are aware of the bind that many others, like Kelli Space, have found themselves in. But the apparently gentle, income-based repayment nature of the ISA contract only applies to those who manage to get one.

In the pool of accepted students, some of them will probably have unexpectedly low earnings to start, just as some will have unexpectedly high earnings. The crucial point, however, is that students with poor prospects are not apt to get ISA funding in the first place. Few of them will “benefit” from the protection of easy payments because investors won’t put their money behind students unless they show promise.

Third, ISAs will open up space for educational innovations that currently have trouble gaining traction because they are not federally accredited. Currently federal student aid can only go to students enrolled in schools accredited by a select few accrediting bodies. There would be no such restriction on ISAs, which would do their own “accrediting” to decide whether an educational program appears good enough to merit risking money on a student.

Undoubtedly, many schools that are accredited (and especially dubious departments within them) would never be deemed worth risking a nickel on, while innovative programs that appear to add human capital would quickly get attention. As ISAs develop, managers would steer students away from accredited programs where they would probably be wasting their time (and investors’ money) and into ones that have good records.