Equinox Chesapeake Strategy Fund Provides Mutual Fund Investors With Access to Expertise of_1

Post on: 2 Апрель, 2015 No Comment

Equinox Chesapeake Strategy Fund Provides Mutual Fund Investors With Access to Expertise of Legendary Turtle Trader, Jerry Parker

February 14, 2014 09:00 ET | Source: Equinox Funds

PRINCETON, N.J. Feb. 14, 2014 (GLOBE NEWSWIRE) — In September 2012, Equinox Funds, a leading provider of alternative investments, teamed with legendary trader, Jerry Parker, to launch the Equinox Chesapeake Strategy Fund (the Fund) (Nasdaq:EQCHX ). The Fund provides access to a long-term trend-following strategy managed by Chesapeake Capital Corporation. The strategy utilizes robust trading systems across a broadly diversified set of futures markets with the goal of providing capital preservation and positive annual returns. As of December 31, 2013, the Fund returned 10.47% annualized since inception and 25.86% for the year, a period when most futures trading strategies struggled.

Jerry Parker is regarded as perhaps the most successful of the original group of 23 ‘Turtle Traders’, commented Robert J. Enck, President and CEO of Equinox Funds. The term Turtle Traders originated from a bet between legendary traders Richard Dennis and Bill Eckhardt on whether or not trading skills were home grown, much like turtles on a turtle farm, or innate — much like the bet between Mortimer and Randolph in the classic comedy movie Trading Places. In 1983, at about the same time the movie was released, ads were running in the Wall Street Journal looking to hire individual traders for a training program run by Mr. Dennis and Mr. Eckhardt.

The turtle traders seemed to prove that trading skill could be learned. In five years, the 23 trader trainees earned significant profits employing systems taught to them by Mr. Dennis and Mr. Eckhardt. One of the trainees was Jerry Parker. Jerry was one of thousands of hopeful candidates who had responded to the Wall Street Journal advertisements. Screened applicants were given a true-false test, and a select few were interviewed for employment. After five years of successful trading for Richard Dennis, Jerry founded Chesapeake Capital Corporation and launched the Chesapeake’s Diversified Program in 1988.

Prior to the launch of the Equinox Chesapeake Strategy Fund, our trading expertise was only available to institutional money managers and high net worth individuals through private funds and separately managed accounts, explained Jerry Parker. We are now pleased to offer mutual fund investors what we believe to be a compelling combination of pedigree, performance and price, added Mr. Enck. The price reference refers to Equinox Funds and Chesapeake’s recent decision to significantly reduce overall Fund fees, making it a potentially more attractive option for investors, especially fee-sensitive institutions and large RIAs. Mr. Enck continued, The Equinox Chesapeake Strategy Fund offers investors access to, in our view, Jerry Parker’s legendary and time-tested pure trend-following systems, resulting in potentially compelling performance through a competitively priced mutual fund investment that seeks daily liquidity.

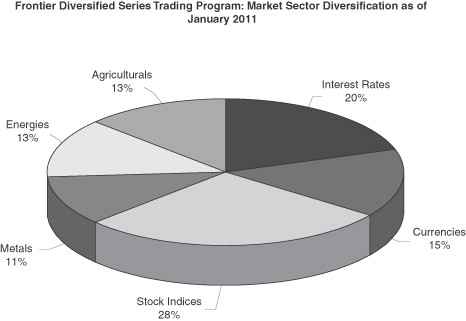

Equinox Funds has been an innovator in alternative investment product development and distribution since its founding in 2003. In December 2009, Equinox launched the Equinox MutualHedge Futures Strategy Fund, the first actively managed mutual fund with exposure to Commodity Trading Advisor programs. Equinox also sponsors the Equinox EquityHedge US Strategy Fund, the Equinox Alternative Strategy Platform, a menu of single commodity trading advisor programs offered in a mutual fund format, and Equinox Frontier Funds, a public managed futures family of funds with daily liquidity.

Chesapeake Capital Corporation is a diversified, systematic, long-term trend following Commodity Trading Advisor (CTA).  Formed in 1988 by Jerry Parker, Chesapeake is headquartered in Richmond, Virginia, and regulated in the U.S. by the Commodity Futures Trading Commission as a Commodity Trading Advisor and Commodity Pool Operator.

Performance is shown net of fees and without loads. Source: PerTrac Financial Solutions. Below are the fund’s average annual total returns with all distributions reinvested for periods ended December 31, 2013.

Class I - 1 year: 25.86% 3 years: N/A since inception: 10.47%

The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. Past performance is no guarantee of future results. The Fund’s investment adviser has contractually agreed to reduce its compensation and/or reimburse expenses for the Fund, to the extent necessary to ensure that the Fund’s total operating expenses, excluding taxes, any class-specific fees and expenses, interest, extraordinary items, Acquired Fund Fees and Expenses (as defined in the Prospectus) and brokerage commissions, do not exceed 1.10% (on an annual basis) of the Fund’s average daily net assets. The Adviser has contractually agreed to reduce its fees and/or reimburse expenses of the Fund until at least January 31, 2015. This agreement may be terminated only by the Fund’s Board of Trustees on 60 days written notice to the Adviser. Please review the Fund’s Prospectus for more detail on the expense waiver. Results shown reflect the waiver, without which the results could have been lower. A Fund’s performance, especially for very short periods of time, should not be the sole factor in making your investment decisions. For performance information current to the most recent month end, please call toll-free 1-888-643-3431.

A Trend-Following Strategy seeks to capitalize on momentum or price trends across global asset classes by taking either long or short positions as a trend is underway. Price trends are created when investors are slow to act on new information or sell prematurely and hold on to losing investments to long. Price trends continue when investors continue to buy an investment that is going up in price or sell an investment that is going down in price.

Alternative investments are not suitable for all investors. There is no guarantee that the investment objectives of the Equinox sponsored funds will be achieved or maintained.

The successful use of forward and futures contracts draws upon Chesapeake Capital’s skill and experience with respect to such instruments and is subject to special risk considerations. Futures and forward contracts have a high degree of price variability and are subject to occasional rapid and substantial changes. The possible lack of a liquid secondary market for a forward or futures contract and the resulting inability to close a forward or futures contract when desired.

The use of futures contracts, forward contracts and derivative instruments will have the economic effect of financial leverage. Financial leverage magnifies exposure to the swings in prices of an asset class underlying an investment and results in increased volatility.

International trading activities are subject to foreign exchange risk. As a general rule, there is less legal and regulatory protection for investors in foreign markets than that available domestically. Additionally, trading on foreign exchanges is subject to the risks presented by exchange controls, expropriation, increased tax burdens and exposure to local economic declines and political instability.

Investors should carefully consider the investment objectives, risks, charges, and expenses of the Funds. These and other important information about the Funds are contained in the applicable Prospectus, which can be obtained by calling 1-888-643-3431. The Prospectus should be read carefully before investing.

Securities offered through Equinox Group Distributors, LLC, Member FINRA. 47 Hulfish Street, Suite 510, Princeton, NJ 08542 1-877-837-0600

Equinox Chesapeake Strategy Fund is distributed by Northern Lights Distributors, LLC, Member FINRA.

Equinox Financial Group, LLC, Equinox Fund Management, LLC, Equinox Group Distributors, LLC, Equinox Financial Solutions, LLC, Equinox Institutional Asset Management, LP, and Chesapeake Capital Corporation are not affiliated with Northern Lights Distributors, LLC

EASP728 / 0536-NLD-02/05/2014

Related Articles