Energycommodities Welcome to the world of Energy Commodities

Post on: 25 Июль, 2015 No Comment

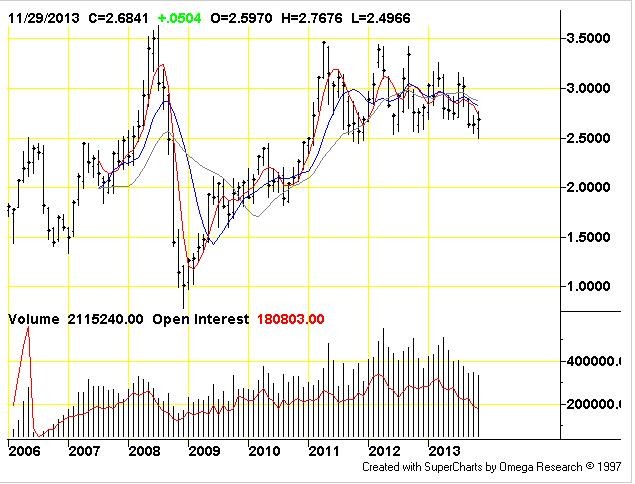

Cotton setting up for a rally of 20%

At this moment, Cotton is hovering above the psychological level of $80. It seems that Cotton (finally) found a bottom at this level and is making itself up for a fierce rally. Our projection is a rally of at least 10% to $95.

20Monthly.GIF /% Cotton Monthly

Cotton futures are being traded on the CME Globex and on ICE. The charts we present here, are based on the Cotton contracts traded at CME (Globex).

From the current level of $84 we see an upside potential of approximately of 10%. Our second target is the high of approximately $100 which is the high of 2012: rally of at least 20%.

The futures contract traded today (Tuesday 17 th of December) at $84. The contract size of a future is 50,000 pounds. Cotton futures are being traded on the CME Globex with tickersymbol TT and on Ice with tickersymbol CT, whereas the Cotton #2 is being traded. More information:

www.cmegroup.com/trading/agricultural/softs/cotton_contract_specifications.html

Respectively

Fundamentals of Cotton

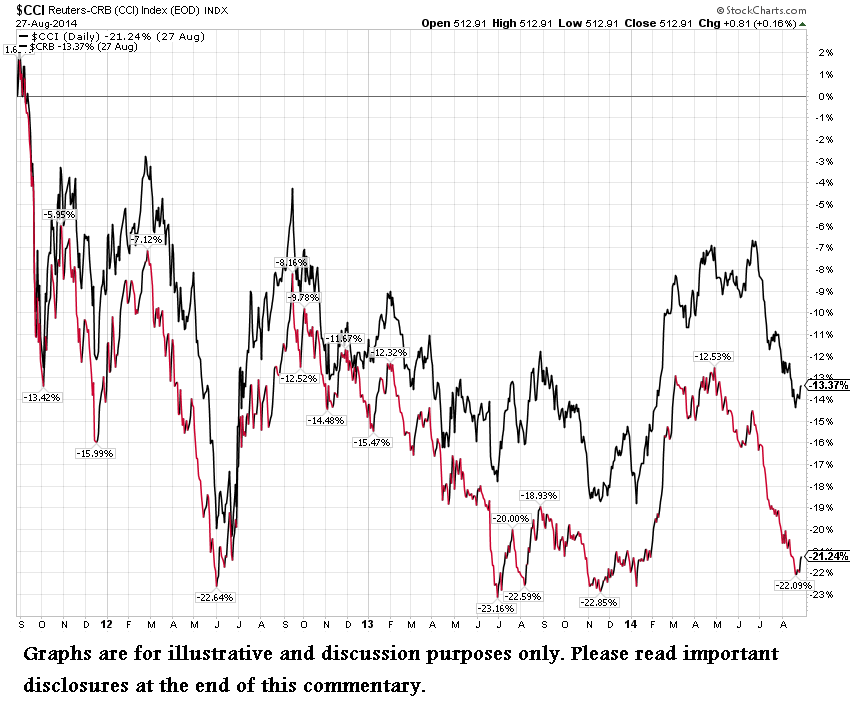

The direction of cotton prices in 2014 will largely be determined by what China decides to do with its massive reserves, and whether Chinese growers pick up production.

After the Chinese government announced that it intended to start selling cotton from its 10-million-ton stockpile cotton prices tumbled 14% this fall. But prices stabilized around 75 cents after the state-owned China National Cotton Reserves Corp. managed to sell only about half of what it offered—most of it cotton from the 2011 growing season.

Cotton producers could be in for another wild ride in 2014 as the Chinese government continues to sell down its stockpile. It also plans to announce new policies in the spring for the 2014/2015 growing season. Because China accounts for nearly half of U.S. cotton exports, its decisions will have a major influence on the fortunes of U.S. producers in 2014.

The big story of 2013 is that the quality of the stuff that China put up for sale isn’t that good. Fewer than a quarter of the domestic textile mills present for the Nov. 28 sale bought lots. Many of the rest continued to buy U.S. cotton on the open market, despite having to pay a 40% duty.

The Reserves Corp. asked for $1.33/lb. for cotton from its reserves, nearly twice the price of the futures market, according to the International Cotton Advisory Committee (ICAC).

Concern over how much and what kind of cotton would sell injected tremendous uncertainty in the market during the fall. Now that the Chinese have declared their intentions, we expect prices to go up again, with the usual rallies early in the year and during planting season. We think the Chinese government will refrain from dumping its reserves on the market for fear of undercutting the value of its reserve and hurting its domestic producers.

Projecting the 2014 Crop

In the meantime, prices will be strengthened by a decline in U.S. cotton production this year. USDA currently pegs the cotton crop at 13.1 million 480-pound bales, down 24% from last year but still higher than 2008 and 2009 levels.

Some farmers, tempted by high prices paid for corn, decided to plant corn instead of cotton this year. Too little rain in Texas, the top cotton-growing state, also negatively affected production.

The 2014 U.S. crop will be a little smaller, but the high yields that we are getting are here to stay. The seed companies are giving tremendous genetics.

The ICAC projects that world cotton production will outpace consumption by roughly 2 million tons during the 2013/2014 season. It also estimates that supply and demand will come back into alignment during the 2014/2015 season, which would bolster prices. Here are the organization’s projections: