Energy ETFs and Oil Prices What s the Connection

Post on: 23 Май, 2015 No Comment

Over the last few years, dramatic moves in commodity prices have attracted both traders and investors. In our sector trading program we do not make direct investments in commodities, but several of the ETFs we follow are closely tied to these prices. Sometimes the link is exaggerated, providing a great opportunity for investors.

We spot these opportunities in two ways— our fundamental analysis of sectors, and the ratings from our sector model. The model tracks trends, cycles, and incorporates a bit of anticipation as applied to ETFs. (Thus the TCA-ETF model. For new readers, there is a more complete description of our methods and ratings at the end of the article.)

Spotlight on Oil Service Stocks

The most dramatic move in our ratings last week was in the Dow Jones U.S. Oil Equipment & Services Index Fund (NYSEARCA:IEZ ). It moved from #48 out of 57 listings to the #3 spot. Another energy ETF (NYSEARCA:IEO ) made a similar move. Both funds also earned very high ratings. This is especially surprising given the reports about declining oil prices.

One third of the IEZ fund is represented by the two oil service leaders, Schlumberger, Ltd. (NYSE:SLB ) and Halliburton (NYSE:HAL ). The specific holding percentages drop off rapidly, but investors should be under no illusions. This ETF has a beta of 1.79, so there is plenty of volatility, especially in the current market. The P/E ratio is about 7, essentially suggesting that there is little confidence in future earnings.

The TCA-ETF model emphasizes technical analysis, looking at price and volume with sophisticated filters to enhance signal-to-noise. A stock chart gives us a look at the raw data.

The model has identified a multi-month pattern of basing, with good risk/reward on a rebound.

Oil Prices and Oil Stocks

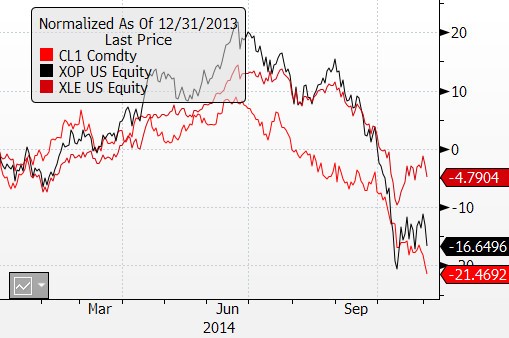

The oil ETFs often trade in lockstep with the front month oil futures contract. Those trading the ETFs often behave like commodity traders. People who do not have a futures account trade the stocks as a proxy. Everyone has an opinion about oil prices, and the energy ETFs provide a way of expressing your views.

This means that there are many rookie commodity traders involved in these stocks. Perhaps it is a source of opportunity.

Investor Mistakes

Energy investors often make two mistakes — ignoring the forward curve and misunderstanding how the earnings of energy companies relate to oil prices.

The forward curve represents the series of futures prices for months, and even years, in the future. A futures buyer or seller can trade in oil at prices extending up to nine years. By looking beyond the near-term prices, an observant investor can track the prices a few months out looking at free quotes from the New York Mercantile Exchange (NYMEX). These quotes show that the February contract, the current front month, settled at $40.83/barrel in the last session. (In the futures world, the February contract expires three business days before January 25th, allowing for physical delivery in a timely fashion.)

A look at other prices is interesting. The March contract trades more than five dollars higher than February. The February 2010 contract last settled at $60, almost $20 higher than current prices. You do not see this information on CNBC, where there is a fixation on the front month, and only occasional explanations of the expiration effects.

Energy Earnings

The earnings prospects of energy companies vary widely, depending upon the nature of the business. Exploration companies, contract drillers, oil service companies, refiners, and integrated oil companies are all very different. Some need to replace reserves, and would benefit from cheaper oil. Sometimes refining margins, called the crack spread get squeezed. The energy ETF prices seem to ignore these disparities, treating all stocks as alike.

The Opportunity for Investors

The knee-jerk trading in energy stocks creates an opportunity for investors. Eventually the individual prices come into line. On a fundamental basis, we like the upstream oil companies like Transocean, Inc. (NYSE:RIG ). They have locked-in contracts with penalties for those wanting to cancel. The integrated oil companies have been using proven reserves faster than replacing them. They need lead time to get drilling, and the futures curve says that prices will be higher.

The TCA-ETF model has a shorter time frame, about one month. We are therefore getting a strong signal that confirms our fundamental analysis of these upstream stocks like drillers and oil services.

Weekly TCA-ETF Rankings

The ratings reflect prices and signals as of Thursday night, January 8th. In our daily trading program (for accredited and institutional investors) we buy the top eight sectors. In our weekly program for individual investors (free report available upon request) we stick with the top six sectors. It was a tough week for the market, and we lost a bit against our benchmark S&P 500. This is business as usual in sector investing. When we get some good moves we gain a lot of edge in a short time.

Based upon the current ratings, we continued our bullish stance in theTicker Sense Blogger Sentiment poll. Fifty of our fifty-seven sectors are in the buy range.

Note for New Readers

Our weekly ETF Update is designed to assist both investors and traders interested in ETF’s and Sector Rotation. Before turning to the current rankings, let us undertake a review for readers new to this series.

Our Method. In this past article. we described our basic methodology and why we believe the rankings are useful for fundamental traders and technical traders alike. While we urge readers to check out the entire article, the key point is that ETF’s pose challenges and opportunities different from investment in individual stocks. The fundamentals may be more difficult to assess. Even with a good grasp on fundamental trends, there is a lot of technically-based trading in ETF’s. This means that those trading with a fundamental approach (and we do this as well) want to monitor the hot money moves. Here is an article on that point .

The system synopsis. We look at Trending sectors, Cyclical Sectors, and build in an element of Anticipation for both entry and exit — thus the name of the model, TCA-ETF. While we do not reveal the exact methodology for spotting trends and cycles, the system is not a black box. The basic elements are used by many, and widely reported. We even discuss the need for human analysis as opposed to black box trading.

We report the rankings each week, now on the weekend with a one-day delay, using the Thursday output from the model. We monitor and trade this daily, and offer a free report (request via the email address on the top left of the site) for those interested in our weekly trading program.