Emerging Markets Are a Strong Dollar Higher Rates a Catalyst for a Selloff Emerging Markets Daily

Post on: 16 Март, 2015 No Comment

By Ben Levisohn

We always here about how emerging markets have stronger balance sheets and better trade balances than developed marketsbut thats not always the case.

AP

Three countries in particularIndia. Turkey and South Africa have large current account deficits, and while that hasnt been a problemit could quickly turn into one, says the strategists at Pavilion Global Markets. The reason: The end of the deleveraging cycle in the U.S.

The strategists write:

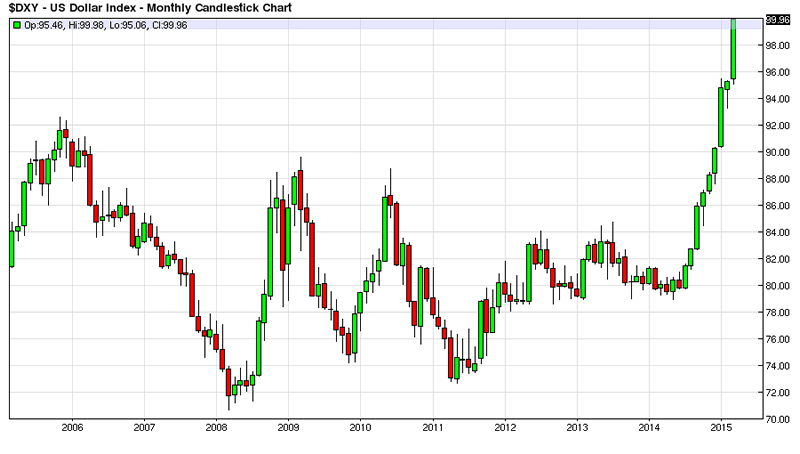

If we are correct and the end of the private sector deleveraging process is indeed upon us, the negative real interest rates that characterize well-managed deleveraging periods will no longer be necessary. The private and public sectors will begin to crowd each other out for investment and real rates will slowly begin to grind higher. This should benefit the dollar against other G10 currencies, especially the European ones, where we expect deleveraging to last significantly longer.

But it wont just be the G10 who feel the impact of a strong dollar. Historically, when the dollar has been strong and U.S. rates heading higher, the currencies of emerging-market countries with current account deficits have been hammered, Pavilions strategists say. They note:

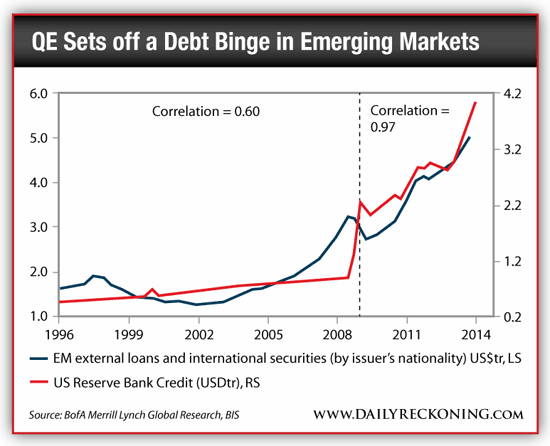

Periods of dollar strength are typically not favorable for inflows into emerging markets. As an extreme example, the 1990s, overall, was a bad period for EMs – especially those with current account deficits – but a good one for the United States. EMs, which typically do not borrow in their own currency, see their real debt burdens increase when their currencies are weak

against the dollar. Additionally, many EMs are net resource exporters. China growing at a structurally slower pace and the dollar being strong are not positive developments for commodities and many EM countries’ terms of trade.

And a rising dollar will be particularly painful for countries with current account deficits, inflation and low interest rates.

there are good reasons to believe that a curtailment of asset purchases by the Fed could lead to trouble for some EM currencies. Take, for example, two of the worst current-account deficit EM countries: Turkey and South Africa. Turkey has a current account deficit at 6% of GDP, interest rates at 5.5% and inflation at 7%. South Africa has a current account deficit at 6.5% of GDP, interest rates at 5% and inflation at 6%. In both cases, we are in the presence of large current account deficits and easy monetary policy in the presence of high inflation (negative real

policy rates). This is a precarious equilibrium that requires a steady stream of foreign capital inflows, without which the situation of these two countries is not entirely sustainable.

Turkey, in particular, looks worrisome. The iShares MSCI Turkey Investable Market Index ETF (TUR ) has gained 38% during the past 12 months, to the iShares MSCI Emerging Markets Index ETFs (EEM ) 0.4% gain, even as its currency has gone nowhere. (The iShares MSCI India Index ETF (INDA ) has gained 1.5% during that period, while the iShares MSCI South Africa Index ETF (EZA ) has dropped 5%.)

The upshot: Be vigilant for a selloff, Pavilion says.