Dow Futures

Post on: 14 Август, 2015 No Comment

Dow Futures. Importance of Dow Future Contracts

Every morning before North American stock exchanges begin trading, TV programs and websites providing financial information will give the quotes for the Dow Futures contract. The quoted price movements of the Dow Futures contracts in early trading is used by some traders as a gauge for how the overall exchanges will perform at market open and over the trading day.

If Dow Futures is trading higher before the market opens, it generally means that the actual Dow index will trade up in the early part of the day.

This is because the Dow Futures are closely tied to the actual Dow Jones Index. Dow Futures contracts mirror the underlying index and act as a precursor of the actual Dow Jones Exchange indexs direction.

Dow Futures contract represents a legally binding agreement between two parties to pay or receive the difference between the predicted underlying Dow Jones Index price set when entering into the contract and the actual Dow Jones Index price when the contract expires.

Because the Dow Jones Index and the Dow Jones Futures contract are so closely related both in price movement and value change, Dow Future are used to gauge the direction of the market. DJIA futures contracts begin trading on the Chicago Board of Trade at 8:20am EST, an hour before the Dow Jones Index opens for trading.

Major events can occur during this one-hour; this news usually gets priced into the futures contracts. This allows investors to use the Dow Futures prices to get a view of market sentiment, and to position trading strategies before equity markets open.

Dow Futures trade with a multiplier that inflates the value of the contract to add leverage to the trade. The multiplier for the Dow Jones is 10, essentially meaning that Dow Futures are working on 10-1 leverage, or 1,000%.

If the Dow Futures are trading at 7,000, a single futures contract would have a market value of $70,000. For every 1 point the Dow Jones Industrial Average fluctuates, the Dow Futures contract will increase or decrease $10.

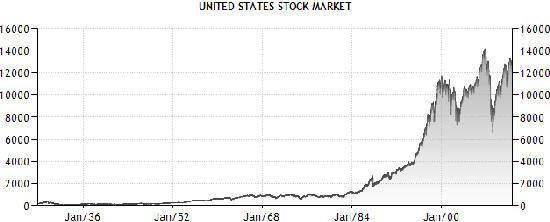

The result is that a trader who believed the market would rally huge could simply acquire Dow Futures and make a huge amount of profit as a result of the leverage factor; if the market were to return to 14,000, for instance, from the current 10,000, each Dow Futures contract would gain $40,000 in value (4,000 point rise x 10 leverage factor = $40,000).

Following are our.

You may contact us here :