DoubleTrading Volatile Currency Pairs Currency Trading

Post on: 16 Март, 2015 No Comment

Double-trading volatile currency pairs is an additional method of aggressively capturing FX gains. In order to do this effectively, you would need to trade a pair that is very risk sensitive such as the AUD/USD or the USD/SEK. Both of these pairs move in an up-and-down fashion that follows the movement of the U.S. stock markets. The idea is to enter a market order at the beginning of a strong upward or downward movement. You will know the direction to take by looking at the news going into the weekend. If the news reports are stating that it will be volatile or a bumpy ride the next week, then this is the best time for this type of trade.

For example, the previous Friday the government might have issued a negative economic report regarding jobs or durable goods orders. The indication is that there will be a slowing of the economy. Over the weekend you look at your USD/SEK three-hour chart and you notice that the USD and the SEK have been like a yo-yo for months, and seem to be range bound between two points. You also notice from the chart that the USD has started to move up against the SEK and, in the last trading session on Friday, it moved up considerably.

You do your research and you notice that the Riksbank, (www.riksbank.com ), is not planning to have a rate meeting in the next few weeks. In fact, you gather from your reading that the management of the Riksbank believes that growth and inflation is on target. This information leads you to think that there will not be an interest rate hike for the next several months.

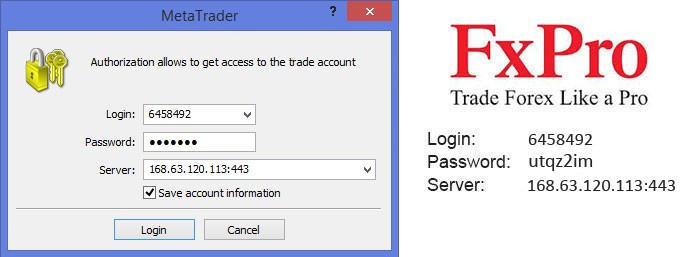

Switching to your trading platform on Sunday afternoon, you place a long USD/SEK order. This long USD/SEK order will capture profit as the U.S. and European markets open after a weekend of contemplating the bad news out of the United States. Most likely the trend of the strengthening USD against the SEK will continue. You know that this trend line will continue until the risk sentiment in traders minds rises; i.e. when the traders of the world reverse their tastes and decide to add more risk to their portfolios.

Some currency-trading software will only let you close out the first trade of a series of trades in the same currency before allowing you to close out the second and third. This closing out in order or entry means that you might have winning trades in which you are unable to realize the gains.

After placing the long USD/SEK trade, you then open up the Modify Order screen. You should then observe the peak of the trading range. Remember, the SEK has been moving up and down against the USD in a consistent up-and-down pattern that is range bound. If you program the computer to take profit at just below the range-bound peak, you will ride the trade into the profit, all while the U.S. and European markets are in turmoil.

In order to maximize your automatic trading and automatic profit taking, you would then enter in a short USD/SEK order that is set to fill just above the point that the long order is closing out. The momentum of the markets will allow you to have a trade that is long USD and capture profits during the bad market conditions. This trade will then automatically close out at the range-bound historical turning point. At this point your automated trading platform will fill a short USD/SEK order, allowing you to capture the price movement of the then strengthening Swedish krona. This trade will be held until the cycle will repeat itself.