Does VC (fund size) matter

Post on: 16 Март, 2015 No Comment

By Tom Grossi, contributor

Many smart venture capital observers have lamented the emergence of VC “megafunds,” like those managed by my firm New Enterprise Associates. For example, the Kauffman Foundation recently issued a report claiming that “big VC funds fail to deliver big returns,” while Silicon Valley Bank said that “small funds have a better performance profile than large funds.”

Yet the trend over the past decade has been unmistakable: Even as new limited partner (LP) commitments to the overall VC market have contracted, LPs have concentrated ever more capital among fewer firms with larger funds. How can the LPs be so mistaken if the superiority of small funds is so obvious?

One challenge is that we often misframe the question. It is unambiguously true that it is easier to generate a 3x return on a $200 million fund than a $2 billion fund. According to ThomsonOne, just 3.2% of funds larger than $500 million raised between 1980 and2005 have returned >3x to date, while 11.8% of funds smaller than $500 million have done so.

But is this relevant. There is a higher probability that any given unprofitable microcap stock will pop 50% tomorrow versus Exxon Mobils likelihood of doing so. But this does not make microcaps inherently superior investments to blue chips. Perhaps smaller funds are simply less diversified and, therefore, more likely to produce either very strong or very weak results.

The question we should be asking is whether small funds collectively perform better or worse than large funds collectively. And, given the noise introduced by the massive tech boom-bust cycle over the past 20 years, we need to carefully control for time period to have any hopes of detecting a true signal.

The most obvious way to do this is to compare each fund’s performance and size to its direct competitors raised in the same year. This is not new thinking: It is exactly what LPs are doing whenever they talk about “top quartile” performers. The results may surprise you.

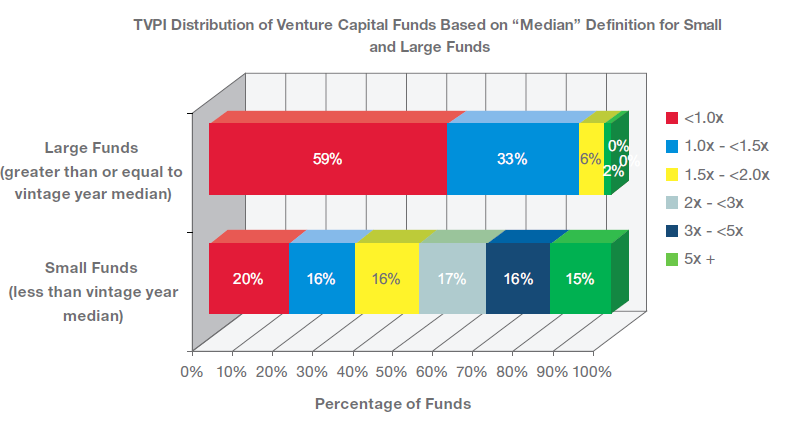

Over the last 30 years, the largest funds in each vintage have been far more likely than their smaller competitors to generate top quartile performance. Funds ranking among the 5% largest in their vintage year have been nearly twice as likely to be a top quartile performer as those from the smallest 75% in the same vintage (41% vs. 23%). Furthermore, these largest funds were only about one third as likely (10% vs. 28%) to fall into the bottom performance quartile.

And this large-fund performance advantage has proven relatively consistent over time, including over the past decade. Only during the tech bubble period of 1995-1999 was top-quartile incidence similarly (24% vs. 25%) achieved between largest 5% and smallest 75% of funds. In all other periods, the large fund group was 1.8 – 4 times more likely to perform in the top quartile than their smaller competitors.

There are other performance metrics beyond IRR quartiles. I refer interested readers to a February 2012 NBER paper that confirms that larger funds appear to be (slightly) advantaged when using other three other performance metrics:

For VC funds, when we control for vintage year, we find a strong positive relation between size and all three measures of performance [IRR, Multiple, and PME]. Funds in the smallest size quartile significantly underperform funds in the 3rd and 4th size quartiles. Fund performance, however, does not drop off with size. Controlling for vintage year, funds in the [largest] size quartile have the best performance.

All of this is not to say the industry should be completely absolved of its sins. The fact that larger funds appear to have a slight relative advantage does not change the fact that overall venture returns over the past decade have been dismal. This suggests there has been far too much VC capital chasing far too few great opportunities. The NBER paper formalizes this hypothesis:

“Vintage year performance… decreases with the level of aggregate capital…. [and] the magnitudes of these relations have been greater for VC funds [than for buyout funds].”

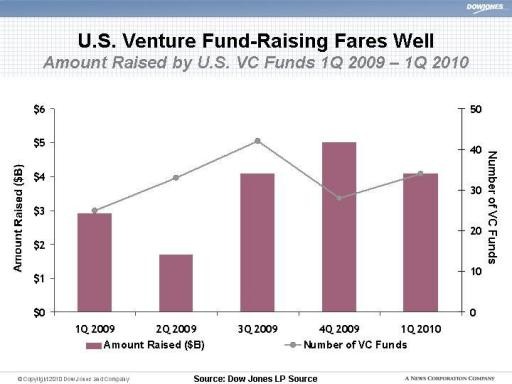

But the fact that there has been too much aggregate capital does not necessarily mean individual funds are too large. It may mean there are simply too many funds. This would explain the industry trend described in the first graphic while overall VC fundraising has contracted significantly, LPs have continued to allow the largest firms to grow.

Concluding Thoughts

This post was adapted from a more in depth piece that can be found here. I encourage readers with interest to look there and to the NBER paper for a deeper dive. As a teaser, some additional topics include:

- Statistical traps some other analyses fall into

- Is “fund size” even a meaningful metric?

- Why relative measures of fund size (e.g. largest 5% in each vintage) are more relevant than absolute measures (e.g. >$500M) when comparing over time

- Other measures of VC performance

- Is there a practical upper limit to fund size?

It is important to note that I am not advocating that VC firms seeking greater performance should just go out and raise larger funds.

First, the correlation we’ve seen may not be causal. Rather, it may simply be that the most proven managers tend to be able to raise larger funds. And it is the benefit of this experience (e.g. brand, dealflow, personal networks, …) that begets the performance advantage. Small funds raised by those same proven managers would still enjoy these benefits. Second, fund size must be interpreted within the context of the investment strategy and the organization executing it. A $1 billion seed fund would likely be difficult to deploy effectively, while a $50 million fund focused on capital-intensive biotech investments would also be ill suited to its task.

Every strategy has its tradeoffs. Smaller, focused funds can go extremely deep in one sector, building expertise without the risk of distraction from the next shiny new trend. But larger, multi-stage funds typically maintain greater reserves to support their portfolio companies during market downturns and have inherently broader networks of relationships – if they can effectively harness the power of them.

We view this as our challenge and opportunity at NEA. The limit to fund size is less about arithmetic than it is about effectively managing an organization where not everyone fits around a single table.

Tom Grossi (@tomgrossi ) is a partner with VC firm New Enterprise Associates, where he focuses on investments in enterprise technology, digital media and e-commerce.