Does the Oil Futures Market Accurately Predict Energy Prices

Post on: 3 Август, 2015 No Comment

Michael R. Pakko

Although the official 2005 hurricane season is behind us, the ripple effects of this year’s storms will be felt for some time. One of the more widely felt economic impacts is on energy prices, resulting in gasoline costing more than $3 per gallon at times. The good news is, as refineries are brought back online, temporary supply constraints have been alleviated, and prices are beginning to recede to pre-hurricane levels.

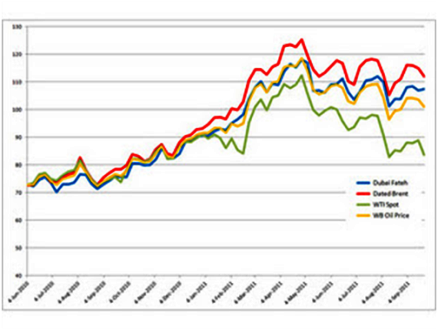

In the longer term, however, the outlook for energy prices is not so easy to forecast because it is dependent on conditions in world oil markets, rather than on current events. Even before the hurricanes impaired domestic production, world oil prices were at historic highs. At its peak, oil was trading at well over $60 per barrel, up from about $25 per barrel in early 2002. This rapid run-up in prices has generated uncertainty about the long-term outlook: Will recent high prices persist, or will world oil prices moderate as supply and demand continue to adjust?

Some analysts look to the market for oil futures as a source of information on prospective prices. Futures markets provide a direct reading on the price of a contract to deliver oil at a specified future date. Although we might expect that prices on these contracts would provide information about future spot prices, futures prices have not historically provided very accurate predictions. That’s because the spot price of oil, which is the price of oil available for immediate delivery, reflects information about both current and expected future supply and demand conditions. Futures prices reflect the same information; so, the spot and futures prices tend to move closely together.

To examine this further, let’s look at the recent history of the futures market. As oil prices rose during 2004, prices of oil futures contracts were persistently lower than spot prices. Were futures markets erroneously predicting a reversal before news of the hurricanes hit? More recently, as prices approached their current highs, this pattern reversed: Futures prices now lie above spot prices. Are the markets now predicting even higher oil prices in the future?

Not necessarily. These apparent mis-projections are actually indicative of some particular details of the spot and future markets for oil; interpreting the patterns as predictions of future spot prices can be misleading.

In general, there is a marked tendency for futures prices to lie below spot. In the jargon of commodity futures markets, this is known as backwardation. Backwardation in the oil futures market is related to a consideration known as convenience yield, the marginal benefit of holding a commodity in reserve. For oil, the convenience yield lies in the option-value of allowing oil to remain in the ground. By not pumping oil in the first place, the owner of an oil field retains the option of increasing production at a later date. An unanticipated need for oil in the future is often more conveniently and less expensively met by pumping additional oil, rather than buying it on spot markets. The presence of a convenience yield acts to push futures prices below spot prices.

Storage costs and interest costs provide an opposing effect on the relationship between spot and futures prices. Unless one has direct access to an oil production facility, a promise to deliver oil in the future requires the purchase of oil on the spot market, the interest cost of borrowing to finance that purchase, plus storage costs. The interest costs and storage costs comprise the total carrying cost of oil. When carrying costs exceed convenience yields, futures prices should exceed spot prices-and vice versa.

Backwardation characterizes the oil futures market more than two-thirds of the time, implying significant convenience yields in the oil market. Recently, however, futures prices have risen above spot prices-a situation known as a contango market. One possible explanation for the emergence of this pattern is that futures prices are signaling an expectation of rising spot prices. On the other hand, the current high price of oil for immediate delivery might be suppressing convenience yields-a development that would be consistent with lower oil prices over time as producers increase their output.

When considering the convenience yield factor, we are left with the conclusion that prices of futures contracts convey little exploitable information about future spot prices.