Do commodity futures accurately predict commodity prices

Post on: 3 Август, 2015 No Comment

From Econbrowsers Menzie Chinn :

This paper examines the relationship between spot and futures prices for a broad range of commodities, including energy, precious and base metals, and agricultural commodities. In particular, we examine whether futures prices are (1) an unbiased and/or (2) accurate predictor of subsequent spot prices. While energy futures prices are generally unbiased predictors of future spot prices, there is much stronger evidence against the null for other commodity markets. This difference appears to be driven in part by the depth of each market. We find that over the last five years, it is much harder to reject the null of futures prices being unbiased predictors of future spot prices than in earlier periods for almost all commodities. In addition, futures prices do approximately as well as a random walk in forecasting future spot prices, and vastly outperform a reduced form empirical model.

Hit the link if you want to see the specifics. To paraphrase, this doesnt mean that futures prices are guaranteed to predict actual commodity prices, but on average they are right. For financial analysts, that may be all that they need to hear. If on average, I could hedge my bet that the commodity price will reflect the futures prices, why wouldnt traders use the forward momentum to drive prices upward? More so, when a major buyer like an oil refiner (in the case of oil) was squeezed and makes a major sell off in order to keep from paying a higher price on oil, would the momentum generated in the other direction drive prices drastically lower until a major player decided to cover their bets and drive the price up again?

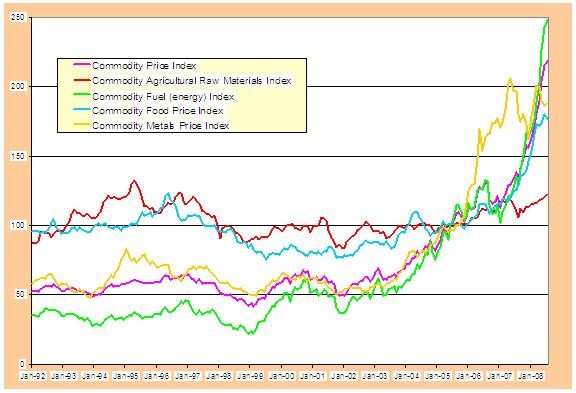

This graph (from the paper) shows the average t-stats against the trade volume:

What I take from this is that the greater the variability, the less accurate futures are in predicting prices. Seeing that oil is at the highest trading volume but the least t-stat lets me assume that the oil market isnt where a strategy could take advantage of the statistical phenomena. What could happen though is that as trading volume increases as traders try to capture the predicted commodity prices from future prices, (a la driving up the futures price) you end up with greater variability in price over all.

Thats doesnt sound too good for price stability. If it is actively known that such a statistical relationship exists, and traders cant exploit it, then one would conclude that commodity prices are accurately priced. However, if such a statistical relationship exists, traders knowingly exploit it, and variability in pricing occurs greater than its historical variation, then one can conclude that commodity prices are derived from speculation.