Divergence Trading Strategy How To Trade Divergence Like A Pro

Post on: 16 Март, 2015 No Comment

Have you ever wanted to know how to trade divergence? I use divergence trading strategies often, according to the Top Dog Trading system.

Learning a divergence trading strategy that works should be a top priority for any technical trader. In this article Im going to show you what divergence is, and how you can use it to take your trading to the next level.

What is divergence?

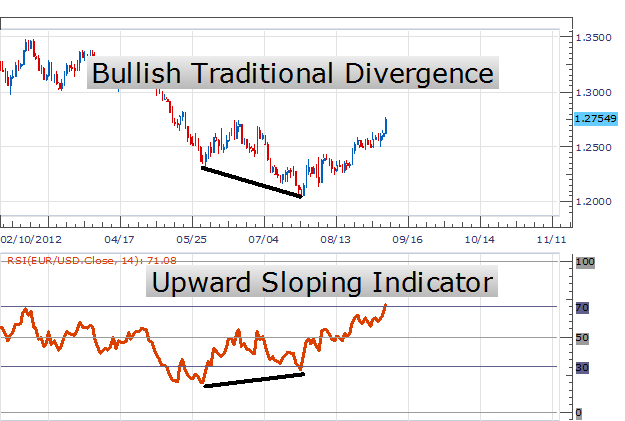

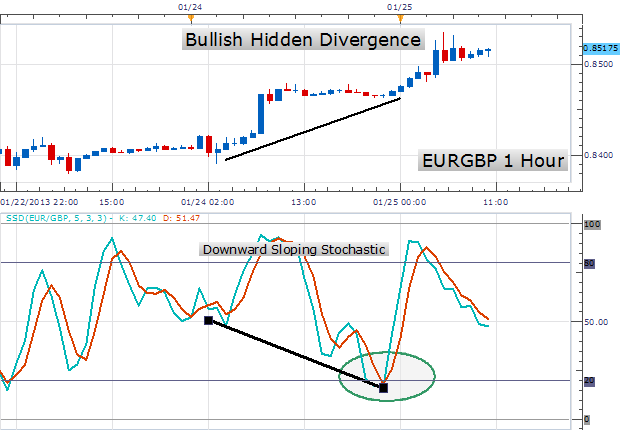

Divergence in trading charts is when price action differs from the action of various indicators e.g. stochastic oscillator, MACD, RSI and others. I mostly use divergence between price and my stochastic oscillator in my own trading, and sometimes divergence in MACD. For the purpose of this article, we will focus on stochastic divergence.

In the example below, price action made a lower low while stochastic %k made a higher low. Using divergence as a leading indicator, a trader could have made a good profit by placing a buy order after the signal on %k was given. As you can see from the example, price shot up sharply after that signal.

Lower low in price Higher low in stochastic k

In the next example below, price action made several higher highs while %d and %k were making lower highs. Again, this is another example of how a trader could have made a nice profit by simply entering a sell position after the signal on %d or %k. As you can see from the photo below, price dropped off sharply after that signal.

Higher highs in price Lower highs in stochastic

Another important thing to remember is that price action is less likely to follow a divergence signal that is against the trend. In other words a divergence signal that indicates a buy in a downtrend will find less traction than a signal that indicates a sell in a downtrend.

Note: Divergence signals against the trend can still be helpful in determining exit points for open trades.

Learning a reliable divergence trading strategy can be an invaluable tool to add to your trading repertoire. Many professional traders use these strategies daily to help qualify profitable entries and exits.

Of course most traders dont rely on divergence alone, but add divergence trading strategies to their existing trading system. I personally use the Top Dog Trading (TDT) system, which teaches a whole catalog of stochastic patterns, called Second Chance patterns one of which is the mini-divergence pattern.

These cycle triggers are great, but the TDT system also measures other supporting market energies, e.g. trend, momentum, support/resistance. These divergence signals should be seen as evidence of a successful trading possibility not as buy or sell signals in and of themselves.

Successful trading is the act making better trading decisions than about 95% of other traders. That takes a profitable trading system, great psychological discipline. and impeccable money management. Learning how to trade divergence like a pro might just give you the edge over typical losing traders.