Dissecting VIX Volume in January

Post on: 13 Июль, 2015 No Comment

February 1, 2015 — 10:22 pm

I was lucky enough to join The Options Institute at the Chicago Board Options Exchange in April 2009. This has been a wonderful place to work as each day is different and almost every day I learn something new. Back in high school, a discipline heavy all-boys school, the head football coach was my homeroom teacher for freshman year. Coach Nix would send us off with the same words each day, “If you learn one new thing each day this year you will know a lot of new things at the end of the year.” I always liked that.

One thing I have learned about trading VIX is that it is completely unique from any other listed market in the world. VIX, VIX Futures, VIX Options and the volatility oriented exchange traded products (think VXX) all have price behavior that leaves neophytes scratching their heads. For those that put in the effort to get a handle on how VIX trades there can be substantial rewards.

Something else that is interesting is what happens with VIX trading volumes. One would expect higher than average VIX results in higher trading volumes. That is initially true, but because a common use of VIX is having a long position to benefit from a volatility pop. That long position can either be a speculative trade to try to profit from a quick move to the upside or as a hedge. When VIX is already high, hedging with VIX calls may not appear as attractive. There are a variety of reasons for this. Before some explanations, take a look at the side by side charts below. On the left is the average VIX closing price by month for January and all of 2014. Do note that January’s average was higher than all months last year. On the right side is (unofficial) average daily VIX option volume by day over the same time period. Note the highest bars for both are October and then there is lighter VIX option volume for the following three months.

This drop in VIX option volume is common after a volatility event such as the market action in October the last time VIX made a move higher was August 2011 when VIX ran from 32.00 to 48.00 in a single day. The result was August 2011 average volume came in at 590,395 which was a record at that time. It took several months for a new volume record to be set, but the year over year averages continued to grow at impressive rates.

A similar, but not as dramatic impact shows up in VIX futures. The chart below shows the average close by month for VIX again but the right side is average daily volume in the VIX futures market by month. October was a strong volume month, but believe it or not February of last year is the record holder in daily volume for VIX futures.

Again, unofficially as we do not have the final January tabulations, average daily VIX futures volume was just over 228,000 contracts last month. This is down from October, but actually 14% higher than the average daily volume in 2014 of just over 200,000 contracts. This is impressive in any environment, but even more so considering the historically normal drop in volume the comes after an extra volatile month like October 2014.

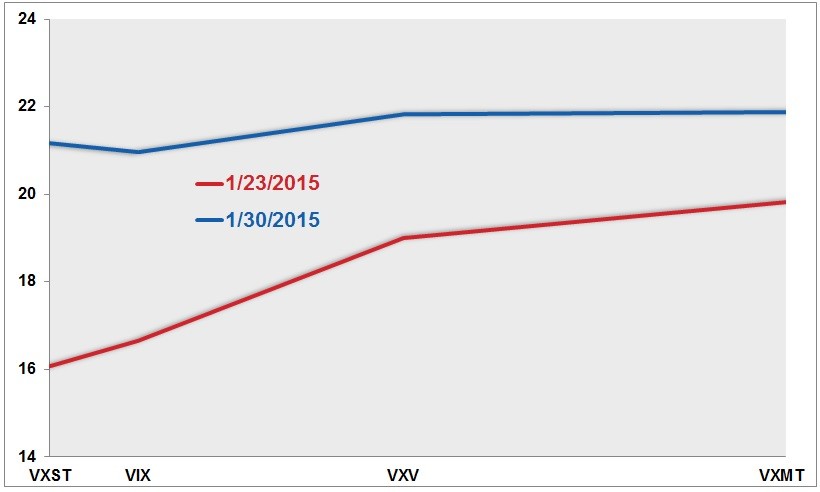

Finally, I want to shift gears a little. A common question I get when traveling around is, “Why should I hedge with VIX instead of SPX?” My initial response is, “you shouldn’t” which is followed by a quick, “it depends”. The short statement that follows is that SPX or VIX is an either – or question. The choice may depend on whether VIX is high or what sort of stock market pull back are you expecting. The more dramatic a drop in the stock market, the higher you would expect VIX to be as the dust settles. Another thought will depend on where VIX is trading. If VIX is at 13.00 the calls may make sense. VIX at 20.00 is another story, with VIX at 20.00 SPX options may be more attractive. Looking at (once again unofficial) average daily volume for SPX last month it appears that may have been the hedging choice of several market participants that would go through the either – or exercise.

Average daily volume for SPX was about 975,000 contracts a last month. This is a drop from 1.3 million in October, but about 10% higher than the average daily volume in 2014.

Light VIX option volumes over the past couple of months are a headline grabbing story. However, buying calls on VIX is not necessarily an attractive trade with VIX hovering around 20.00. It does appear that traders are taking advantage of recent VIX gyrations through VIX futures trading, which was pretty strong last month and hedgers are turning to strategies using SPX options while VIX remains fairly elevated.