Difference Between Selling a Put Option Buying a Put Option

Post on: 24 Апрель, 2015 No Comment

Put Contract Features

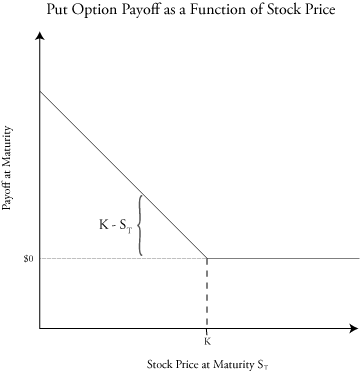

Each put option contract includes the underlying stock, the strike price and the expiration date. The put option owner has the right, until the expiration date, to exercise the put and sell 100 shares of the underlying stock for the strike price. Options on a particular stock are available in a range of strike prices above and below the current value of the stock. Expiration dates include the current month, the following month and at least every third month out to nine months in the future.

Selling Put Options

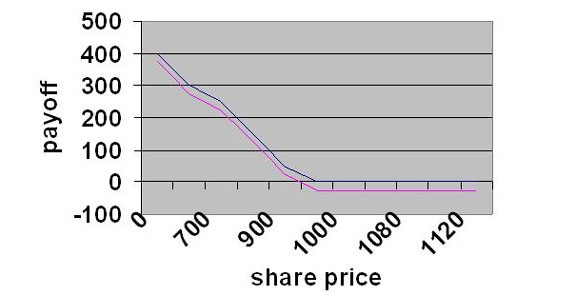

The trader who sells put options wants the stock price to stay level or go up. The put seller receives the price or premium paid by the put buyer and must be ready to buy the stock shares if the option is exercised. The profit for the put seller occurs if the option reaches expiration out-of-the-money. The maximum amount of profit is the money received from selling the put option. If the stock price goes in-the-money, the profit on the sold put will be reduced by the amount the stock is ITM.

Rewards and Risks

References

More Like This

Put Option Vs. Call Option

You May Also Like

Options are contracts between two investors which give the owning investor the right to buy or sell the option's underlying security at.

The Difference Between Puts & Calls in Stock Trading. Stock options (puts and calls) give an investor the opportunity to buy or.

There are 2 different options, call option and put option. Buy call option gives you the right to buy underlying stock at.

PayPal is an online website and system that allows users to securely pay for items online using their credit card or check.

Our closets are full of items that, for whatever reason, we no longer wear. Maybe we lost weight or bought on impulse.

Put options are important to many stock investors/traders. In general, a put option is used to profit in a declining market. You.

Buy stock prices (the bid) and sell stock prices (the ask) represent two-sides of a financial transaction. The essence of an open.

Ownership of one call or put option contract gives an investor the right, but not the obligation, to buy or sell 100.

Making signs for selling a house on the real estate market and putting them up around the neighborhood in this free real.

Comments. You May Also Like. Difference Between a Call Option & a Put Option. Ownership of one call or put option contract.

Many have wondered about the difference between a customer and a consumer, especially given that so often people use the terms interchangeably.

Options trading has the reputation of being difficult to understand, and even more difficult execute in a way that produces a profit.

Buying call refers to an option to buy, whereas a put is an option to sell. Find out why going long options.

Selling put options can bring a steady stream of income into your brokerage account. Put selling is a strategy suited to a.

Options and futures are two types of derivative securities, meaning their value depends on the market price of some other item of.