Demystifying FX What Is Foreign Exchange Market Forex Blog

Post on: 13 Май, 2015 No Comment

The Foreign Exchange market refers to the market-place where the various currencies of different countries are exchanged against one another at specific exchange rates or prices which change over time, and combines to form the largest financial market ranked number one by daily trading volume. This article will aim to best provide an overview of what is foreign exchange market in easy to understand terms while explaining important details often missed in other literature.

The Foreign Exchange market enables the value of one countrys currency to continually be priced against the value of another countrys currency to determine a fair price at any given time where the two currencies can be exchanged for one-another (this also known as trading). Trading is done between two parties, as every transaction includes both a buyer and seller, each on their respective side to the trade. Parties to the trade can be individuals, corporations, other entities, including governments, and either of these can be on both sides (i.e. government to government, or individual to individual,etc..).

Money from one country, is sold (or bought) in exchange for money bought (or sold) from another country. This trading of currency, occurs both ways, where a currency can be either bought while paying for the trade with the currency being sold, or a currency can be sold and paid for with the currency being bought. Unlike the securities markets where participants are mostly buying expecting markets to rise or appreciate, and selling stocks short can often have local regulatory or exchange restrictions, in Foreign Exchange there is no difference between the two (buying or selling) to establish a trade.

Currencies are traded in Pairs, at Exchange Rates reflective of Their Values

Just as you cant use US Dollars to buy (or sell) US Dollars, since one dollar is always worth one dollar, when you bring in a second countrys currency into the equation, the pricing of rates is made possible. This is what is being referred to when you hear about what is foreign exchange market.

This trading of foreign exchange occurs as an underlying driver of the world economy and occurs incidentally as the flow of capital enters and exits various financial systems, whether acting as a payment for goods or as an investment from day-to-day transactions at both the retail and institutional level as well as governmental institutions such as Central banks carrying out their countrys monetary policy.

Trading in Foreign Exchange does not occur solely at a single venue or location but instead is mostly decentralized and scattered across various smaller market-places and venues that collectively make up the whole market structure.

On-Exchange and Off-Exchange: A Scattered Decentralized Market Place

That is, while currency trading on regulated exchanges exists, and offered as futures contracts or currency futures, this represents a very small portion of the overall market-share, as most FX trading is conducted over-the-counter (OTC). also known as in the off-exchange market.

One of the most popular ways to trade currency involves Spot transactions which are made on the spot, at the current market price, at any time, and thus is the most real-time of the other available methods such as options, swaps and forwards which include contigent future elements that help serve other purposes such as to hedge costs for suppliers and users of imported or exported goods, and manufacturers, as well as for speculators just as FX spot transactions also have non-investment related uses.

This market is also known as the currency market, and foreign exchange is often abbreviated into either Forex (short for Foreign Exchange) or FX (also short for referring to either Forex or Foreign Exchange).

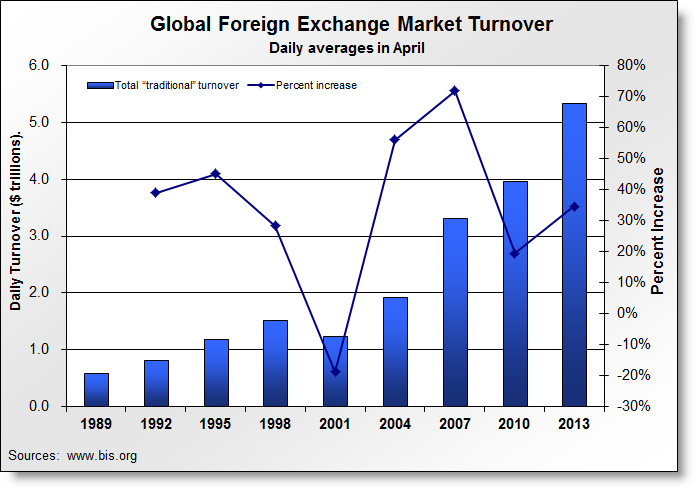

A $5.3 Trillion Dollar a day Industry

When comparing the various financial markets of the world, such as national stock exchanges in developed economies against the foreign exchange market, the size of the FX Market by volume far exceeds every other market thus making Forex the largest financial market by a long shot. Recent estimates by the Bank for International Settlements (BIS) measures Foreign Exchange volumes in April 2013 and calculated an average daily value during that month of roughly $5.3 trillion USD dollars.

Foreign Exchange prices are mostly floating rates (while some currencies are pegged or have fixed prices with small trading bands and not fully free-floating) and less volatile than the daily fluctuations of the stock markets and other asset classes and thus appeals as a major asset class for investment managers, pensions, and other investment vehicles.

For reasons like these, large degrees of leverage are available making it easier for investors and traders to access extremely low margin rates, and leverage their capital which increases their risk/reward proportionately.

Underlying Drivers of FX Markets

Aside from geo-political events and the monetary policy carried out by each countrys central bank, the main drivers of Forex rates and values are the underlying economic performance of the country behind the currency, including its fundamental financial and socio-economic condition as it integrates into the world economy.

These drivers can be significantly influenced by changes that help or hinder the flow of capital such as

- interest rates

- political changes

- including reforms

- stimulus

- quantitative and qualitative easing

- the rating of sovereign bonds

- new rules or regulations

At a more subtle yet equally effective level, the day-to-day behavior of consumers on a mass scale also drives economic progress and will therefore determine economic performance to which forex markets will price in values into the exchange rate of that country versus other countrys currencies. A list of rankings for various currencies, as well as currency pairs, noted by their respective symbols can be seen as excerpted from the latest triennial survey of central banks from April 2013.

Foreign Exchange rates, while they may vary from one provider to the next, are mostly automatically determined based on the phenomenon of supply and demand and its effect on the perception of market values, as the combined effect of all real-time trades made at available rates will dictate the market direction and subsequent available prices even if there are small variances across the available prices in the market-place at any given time. This highlights how efficient the FX market is, thanks in part to the advanced of technology and the shift to electronic trading, (versus phone brokering) and other old-fashioned methods which are quickly becoming obsolete.

Perception of the market is a crucial part, not just for fundamental news analysis, but also looking at historical rates to gauge current and future price expectations, this is known as technical analysis, and plays a key role as foreign exchange markets are observed in a similar manner by a vast number of people who together have a combined amplifying affect.

Supply and Demand drives forex, just like any other market

In terms of supply and demand, and the basics of establishing prices for any market. For example, a just as a seller of a property may often look for a higher price when the local market around the property location is in high demand (and short supply of properties for sale), this will drive prices higher, whereas a buyer that is interested in purchasing a property in a location with an abundance of supply may find a lower price available.

The difference chiefly with Foreign Exchange, aside from the obvious (when compared to property), unlike other financial market transactions, is that each trade is an exchange of two instruments, rather than the purchase or sale of just one. For example, an investor interested in speculating on the EURO currency will need to decide against which currency the investment will be made with.

For example the rate for EUR/USD (EURO versus the US Dollar) will be very different from the rate for EUR/GBP (Euro versus the Great British Pound), as these are both two different currencys each priced against the Euro (in each currency pair).

Currencies are therefore traded in pairs, as in the example above, and the most widely traded currency pairs happen to be based on the most stable and largest economies. Many traders focused on day trading in the US Stock markets or other markets around the world, even with years of experience and trading professionally may be unaware of the potential advantages of trading FX.

Why FX is Appealing to Investors

Often new traders ask: What is Foreign Exchange market? As described above the FX market is the largest, and also the most liquid market, it has deep volume and less volatile when compared on a percentage basis, to markets like the exchange traded securities, and one of the key appealing factors to international investors is this market is operational 24 hours a day from Sunday afternoon (forex trading hours Sunday, when the market opens) to Friday Afternoon when the market closes, nearly 6 days a week.

For the purpose of trading forex, or learning the best ways to approach investing in the worlds largest market, there is a lot of misconception on how to approach foreign exchange, on the internet, such as get-rich quick schemes and claim to offer forex trading secrets revealed, and companies that are only interested in profits and not in building a sustainable business to help people, and even worse scams from firms that lack credibility and/or regulatory licenses.

Research And Education is Key to a Successful Forex experience

The applicability of any Forex Law, such as local rules or regulations and government mandates pertaining to FX market operators often various throughout different jurisdictions around the world either where forex brokers are based and/or where they offer their services to clients.

For this reasons Forex Blog aims to help traders access high quality research and information on how to best make sense of Foreign Exchange while learning how to navigate this landscape effectively, for example.

Overview of what is Forex Exchange Market:

- Financial Market-Place for Exchanging Currency at Exchange Rates

- Largest Market in the World at $5.3 trillion daily

- Operates 24 hours nearly 6 days a week

- Less Volatile Than Stock Markets

- Available Leverage Can Enhance Targeted Yields and Performance

- Appealing Asset Class for Traders and Investors to Speculate and Diversify

Traders can also find access to world-class brokerages such as worldwidemarkets.com where they can open forex accounts and establish live and forex trading demo account as they learn to trade forex. This also enables beginners and even professional trades the chance to try-out and test the software with a hands on approach and apply theory in practical terms. A section is dedicated for this reason on Forex Blog, trades can learn more here including accessing free forex trading tutorials for beginners.