Day Trading Basics The Bid Ask Spread Explained

Post on: 3 Июль, 2015 No Comment

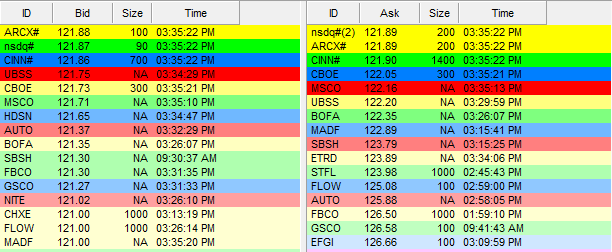

Figure 1. Understanding the bid ask spread is crucial to day trading

If youre beginning your trading journey, you may be unaware that a stock (forex pair, futures contract or option) actually has two prices at all times, and not just one. The two price are called the Bid and the Ask, and understanding the bid ask spread is crucial if you want to get into day trading.

If you view a stock quote on a website, youll usually see one price listed for the stock. This is the price where the Last transaction took place; if you went to buy or sell that stock theres a good chance you wont get that same price.

Even if the stock doesnt move between the time you get the quote and place your trade, you many not get that last price. The reason is that there are two prices for every stock, forex pair, option and futures contract. Theres the price buyers are willing to buy at, called the “bid,” and theres the price sellers are willing to sell at, called the “offer” or “ask”.

If you want to buy a stock you can place an order at the bid price and hope that someone will sell to you, or you place an order to buy at the ask price (see more on Order Types ). A person who wants to sell would do the opposite, placing an order to sell at the ask price or selling to the people who are waiting to buy at the bid price. The bid is always lower than offer price, which means if you buy at the bid youll be a getting a better price than if you buy from someone selling it at the offer price (only at that moment, since prices constantly fluctuate). Likewise, a person selling will get slightly more (higher price) if they sell it at the offer price as opposed to selling it to someone whos bidding.

If youre bidding to get into a position, someone needs to sell you their shares. Putting out a bid or offer doesnt mean youll actually get the shares. If you place a bid or offer (Offer is another word for Ask) and receive the shares, then your order is considered “filled” and your account will show you either just bought or sold shares.

The difference in price between the bid and the ask is called the bid ask spread. It can be large or small, and depends on factors such as the price of shares, and mostly volume (how many shares change hands each day). Very high priced stocks typically have a larger spread, and with low volume it can widen even more. A bid for example may be 563.28, while the ask price is 563.41; thats a 0.13 bid ask spread. A lower priced stock, with lots of buyers and sellers participating in it, will have a 0.01 spread most of the time. The bid ask spread fluctuates as the price moves (and is how the price moves) and bid and ask orders are filled by other traders.

Figure 2. Forex Level II with Order Entry

The highest bid and the lowest offers are displayed as the current price in trading platforms. Other bids which are below the current price, and other offers which are above the current price show up in a Level II screen. The Level II shows multiple levels of buyers and sellers bidding and offering, and how many shares theyre bidding and offering. Figure 1 shows bids and offers using BATS (there are also other venues traders can bid and offer on, such as the NYSE or ARCA) in Home Depot (HD ) stock. You can see the number of shares being bid/offered, as well as the price. The current bid ask spread is 90.21/90.22, a 0.01 spread.

Figure 2 shows a Level II screen for forex trading, courtesy of FXopen. This plugin allows for easy forex trading as you can set your position size at the top, know the current bid ask spread (difference between highest bid price and lowest offer price), see the current bids and offers, and set your order price/stop loss/target near the bottom.

Most stocks of companies that are households name trade with a small spread, usually one cent if they price $100 or below. Heavily traded forex pairs will typically have a spread of 2 pips or less with most brokers (in figure 2 the spread is less than half a pip).

When possible, and depending on the day trading strategy being employed, its ideal to get the best price possible; if its likely youll get filled on the bid side then it is best to buy at that lower price (the bid). Buying at the offer price (or selling at the bid price) is called “paying the spread. If you do it on every trade, the amount it takes out of profits can become significant. Be frugal and try to get the best price whenever possible. That isnt always the best option though. In fast moving markets, where you need to get into or out of a position quickly youll likely need to pay the spread (buy at the offer or sell at the bid), because if you dont you likely wont get into or out of your position. Most forex brokers, although not all, require that you pay the spread when entering and exiting a position. Its for this reason forex day traders seek forex brokers with low spreads (low bid ask spread).

Over 300 pages of Forex basics and 20+ Forex strategies for profiting in the 24-hours-a-day Forex market. This isn’t just an eBook, it’s a course to build your skill step by step.

You May Also Like: