Dax Mechanical Trading System

Post on: 27 Июль, 2015 No Comment

Free Breakout Strategy Download

Here is my own Dax mechanical trading system I wrote late last year (2008). Very similar to my Hooya bands concept.

Enjoy

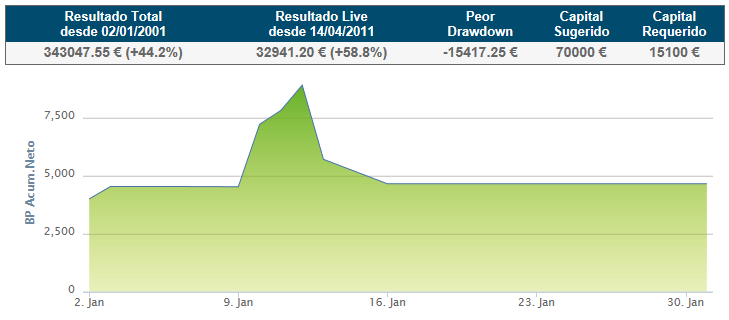

Dax 25 is a very straight forward mechanical trading system that allows the trader to place a order to buy or sell with both stops and limits in place and leave the position in place until end of day. It is called Dax 25 because is uses both a 25 point stop and a 25 point limit. This gives the system a 1:1 Risk to Reward ratio, which along with the positive strike rate is how the system is profitable.

Below outlines the simple steps of knowing which orders to place and in which direction:-

Trading Dax 25

Step 1

Identify the open price of the Dax index. This is shown on my charts below as white line. This is probably most key part of the system as you need to make sure you have the correct price level.

If you are trading using spreadbetting do not use the price quoted by your SB at the open as this will not only be based on futures prices but most likely will not show the first tick of day on the index which is what we need to determine the actual open price level. Best to use a Dax chart from a metatrader supported data feed.

Step 2

Once you have the open price level. Calculate two new price levels, one at Open Level +25 points and the other Open Level -25points. Thus in essence you have two bands 25 points away from the the open price level. Now you have all 3 price levels you need to trade.

Step 3

Assuming the market is open and you have your price level bands, you now wait for one of the bands to be hit. This usually happens within the first hour of the session so be ready for it.

Once a band has been hit we move to place our orders. If the lower band has been hit we place a buy order at the Open price level and place our limit to close for +25 at the top band and place our stop at the the lower band.

If the upper band has been hit we place a sell order at the Open price level and place out limit to close for +25 at the bottom band and place our stop at the upper band. So the we wait for the price to return to the open level to open a position.

Once in a position do nothing. Leave the orders to play out. There will be quite a few days where your orders dont get triggered to open a trade, just make sure you cancel them at the end of day or if you have option with your brokers/ SB provider, make sure they are only good for the day and get cancelled automatically.

Also you need to check back at the end of day to make sure that you are not in a position that has not been stopped or limited out. There are only a few days in the sample period where this happened but best to check. Again your initial buy/sell order maybe able to be placed with a close at the end of day instruction but that will

depend on your provider.

_______________________________________

So that is it. A very straight forward trading method which is easy to trade and which does not require any decision making on when to open/close a position. Below, you can see two actual trades and the trades that were triggered and how they were closed out.

Chart 1 shows a trade that was triggered to buy the open price level with the trade being closed out for 25+ points profit.

Chart 2 shows a trade that was triggered to sell the open price level but which was stopped out for -25.

Chart 1

Chart 2

There are two things I would like to highlight. Firstly is, that as it is a mechanical system any changes you may make to it, like deciding to close a trade early, will effect the outcome of the system as a whole. By all means take the idea and play with it and change it if you wish but the results suggested are based on a trading it as it is above.

Personally, I am currently looking at increasing the limit target to 30pts and also taking a second trade if stopped out. Although I do not have the stats on this at the moment, it might be something you might want to look into.

Secondly, is the old adage of only trade with what you can afford to lose. Despite what some people would like you to believe trading by nature is a game where you are exchanging money for risk. If you do not want to take on the risk do not trade. I have traded in one form or another for the last 6 years and my eyes are wide open to the risks involved. Make sure you are. This system whilst profitable at the moment may not be in the future. There are no guarantees in this game. The reason why I like to trade these mechanical type systems is that they are relatively consistent over a basket of trades but you have to be able to ride out the bad times as well as the good

one. So trading full margined on each trade for example will not result in a happy ending.

I hope I have shown you a simple way to trade and wish you all the best in your trading.

Here is an MT4 indicator for the three lines needed for the DAX 25 Trading System

_________________________________________________________________

Please be aware you use this system at your own risk, it is for information purposes only and forecasts are not a recommendation to buy or sell a stock, index or future contract. The decision to trade this system is yours and yours alone. At no stage will I be liable to any profits or losses you make in your trading.