Currency Swap Example

Post on: 21 Апрель, 2015 No Comment

What are basis swaps? How does it works and how do u price them ?

how do u price a single currency basis swaps. for example 3 against 6 mths basis for 5 years. How does cross currency basis swaps works and how do u price them.

$54.95

Self-Clearning Pre-Rinse Spray Valve with Rubber Bumper and 1.42GPM Flow Control Spray Face With a steadfast commitment to quality, T&S Brass and Bronze Works, Inc. has set plumbing industry standards for half a century. Founded in 1947, T&S originally developed food service plumbing equipment, including the markets first pre-rinse unit, which became the industry standard. Today, T&S Brass manufa

Currency Swap Example

Swap trading is a term and it means a real-time buying and selling the same quantity of a selected currency for two different dates for the sale and purchase of another currency.

Currency swap is a type of borrowing facility. Basically, you get a room money and the other for loans selected period. In other words the exchange rate is interesting for the currency pairs for sale or purchase. According to the couple, you can earn or pay interest on trade.

currency swap, buy or sell a base currency today and sell / buy foreign currencies in the future. For example, say you bought a fixed amount of euros for dollars and sell the 3 Euro months after the euro. It is defined as the exchange euros.

So how can help currency exchange benefits? Consider a example:

We will change the U.S. Dollar and Euro. Forex trader enters a trade and buy $ 100,000 typed exchange of 0.1 dollar per euro (yes! is just one example!). At the same time, another trader agrees to sell in three months the same amount of $ 100,000 dollars to buy euro at the exchange rate of $ 0.09. In this profession, the professional income is 50,000 euros as the dollar has changed.

In other terms, currency trading is the trader and the broker of a currency against another at an agreed rate, then convert the currency selected in a selected date in the future the exchange rate to be arranged. The common currency swap involves the combination of a cash transaction and a futures transaction.

Already learned that nothing comes cheap and, of course, there are fees for changes. It is defined by the difference in interest rates of two currencies. The interest rate can be gained during the trading period is the agent uses to calculate the price of the swap.

The method of calculating the cost of trade is the type and setting the interest rate differential between the currencies chosen by the amount of trading period. This gives the broker forex loans and lending rates. That does not stop there. The next step is to exchange Points are added or subtracted from the price.

Offers currency trading in the interest exchange one currency for the same interest in another currency. It is known as a transaction currency.

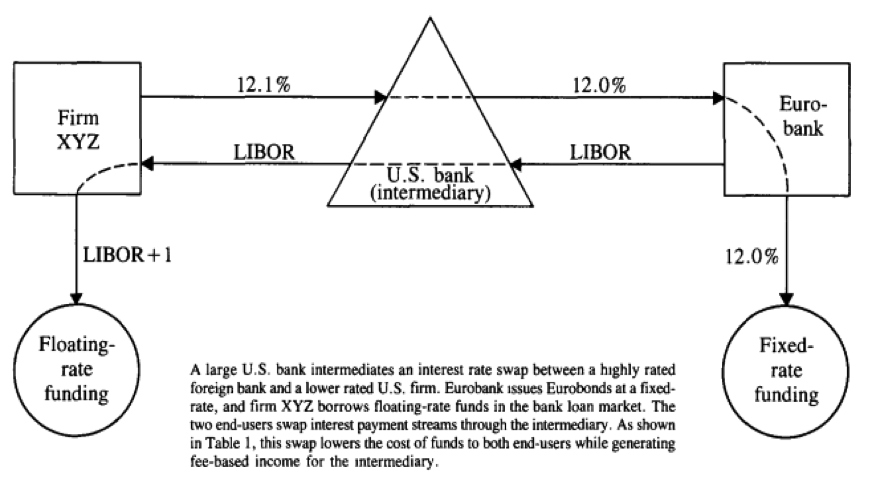

interest rate swap is an agreement in a stream of interest payments is traded against another. In other words, is the exchange of money for another set of conditions on the basis of interest rates. swap interest rate is used to manage exposure to volatility in interest rates or for the interest margin lower.

What if you are not interested in sharing? Most forex brokers provide free exchange and sharing of accounts. Exchange accounts are designed for traders who do not wish to use this option or can not use the exchange, because of their religious beliefs. Many Traders refer to accounts of free trade as Islamic accounts.

Using a forex trading account allows you free roll over the position of night, without winning or losing any amount. farm trade agreement for a longer time also ensures that the merchant only the rates for the period of time affect the outcome of the operation.

How to exchange it? Negotiating positions a currency trader stays open after a specified time by an agent (usually after 11:59:59 p.m. Hamburg) is subject to exchange rate or credit. Examples of how exchange rates can be similar.

Currency Pair: EUR / USD long: -0.53 Short pips: -1.52 Pips

Currency Pair: EURGBP Long: -1.30 pips Short: -1.79 pips

Currency Pair USD / JPY Long: -0.47 pips Short: -1.59 Nuggets

Remember the weekend. If you roll over the position from Wednesday and Thursday after the date of the next value is Monday, the transfer rate is presented as an example in the table above must be multiplied by 3. It is also important to realize that exchange rates are not fixed and is updated daily.

What is the rate of spot, forward and exchange rates? Some examples?

The rate of the spot price or spot a product or a title of a currency is the price quoted for immediate (spot) settlement (payment and delivery). The rate of futures prices or the term agreed on a price assets in a futures contract. Using the hypothesis of rational pricing, we can express the forward price in terms of price and all cash etc. dividends, so that no arbitrage opportunity. A currency swap is an exchange agreement between two parties to exchange a certain amount of one currency against another, then a period of time, to return the original amounts changed.

Foreign Exchange: Off balance sheet hedge