Currency Hedged ETFs Top International Picks ETF News And Commentary

Post on: 17 Июль, 2015 No Comment

Share | Subscribe

Over the past decade, globalization has led to innovation and novelty in the fields of cross border trade and investments; they are no longer limited to the geographical boundaries and jurisdiction of a particular nation.

While this has opened a door of vast opportunity for individual investors, fund managers and corporations, in terms of risk return tradeoff this falls in the high risk high return category which might not be suitable for everyone. Coupled with lack of understanding of most financial products, it has led to many investors getting burned.

International investments and trade are subject to a series of risk factors which actually involves much more than investing or carrying out business in one’s own country. While there are a host of ‘extra’ risk factors that investors have to take care of while investing outside their respective countries (example geo-political risk, environmental risk, government regulations etc), one factor which pretty much stands out from the rest is currency risk (read Three Currency ETFs Outperforming The Dollar ).

This is a recurring phenomenon, as exchange rates are continuously changing and are functions of macroeconomic factors such as central bank regulations, interest rates, inflation, fiscal deficit, and trade deficit. Thus, investors have to keep in mind a host of other factors (apart from the asset class they have invested in) before considering international investments.

Basically international investments are subject to 1) Volatility of the asset class they have invested in, i.e. equity market volatility for equity investments, credit rating and effective duration to measure credit and interest rate risk in case of fixed income investments (see Forget Interest Rate Risk with These Bond ETFs ), and 2) Volatility of the currency in which the invested assets are denominated (i.e. exchange rate of asset denominated currency versus the domestic currency).

This is particularly important as negative currency fluctuations can virtually wipe out the entire returns from investment abroad even if the asset class has been able to provide the desired rate of return. In other words, the rate of return for a U.S investor who has exposure in Brazilian equities (denominated in Brazilian Real) is 8% which is in alignment to his/her expected returns.

However in that time period if the U.S. dollar appreciates by 6% against the Brazilian Real, the effective rate of return on the Brazilian investment will be 2% (8%-6%), wiping out almost all of the returns. Conversely, if the Brazilian Real appreciates 6% versus the USD, the rate of return will be 14% (8%+6%) (see more in the Zacks ETF Center ).

Thus we see that currency movements do play a very important role in determining the return on international investments. However, for investors seeking a basket approach to international investments without being subject to the currency risk factor, we have the Currency Hedged ETFs .

These innovative products provide investors the pure exposure in foreign assets less currency risk. These currency hedged ETFs provide exposure to the equity markets of the countries/broad regions they track at the same time maintaining U.S. dollar neutrality with the help of currency futures.

Therefore, the investors are only concerned about the core returns from their investments as the currency risk (against a probable U.S dollar appreciation) is mitigated (read Is It Time to Buy the Hedged Currency ETFs? ).

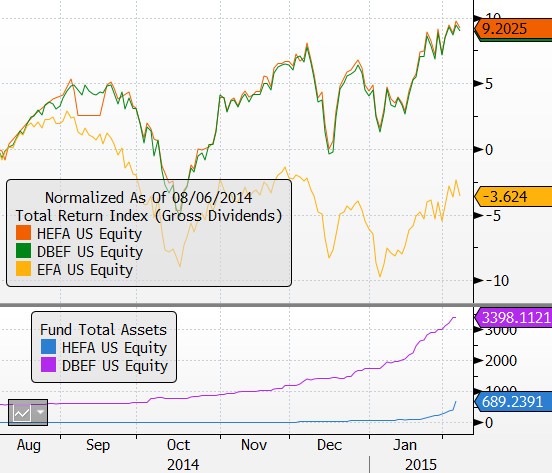

Sounds interesting? Maybe it does, but these intriguing products have been unable to capture the interest of the investors and have been extremely unpopular. The following table shows various characteristics of the Currency Hedged ETFs.