CSOP China Ultra ShortTerm Bond ETF

Post on: 27 Апрель, 2015 No Comment

- Overview Performance Tracking Difference/ Error Holdings Distribution History Documents Index

IMPORTANT INFORMATION about the CSOP China Ultra Short-Term Bond ETF

IMPORTANT: Investment involves risks. Investment value may rise or fall. Past performance information presented is not indicative of future performance. Investors should refer to the Prospectus and the Product Key Facts Statement for further details, including product features and risk factors. Investors should not base on this material alone to make investment decisions.

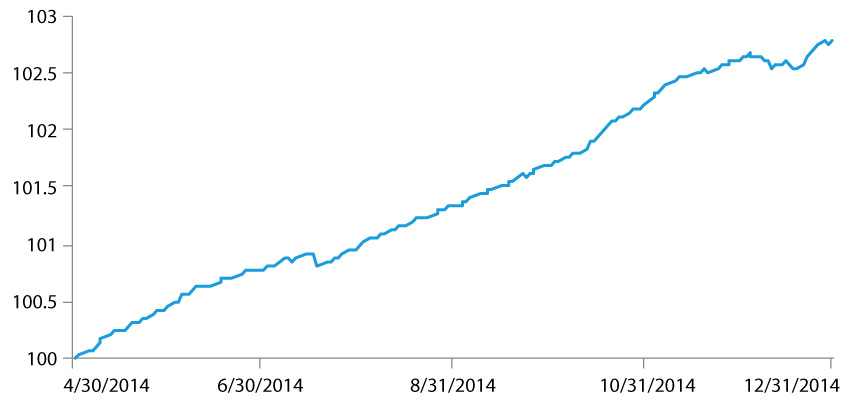

- CSOP China Ultra Short-Term Bond ETF (the Sub-fund) is a physical index tracking exchange traded fund and it aims to provide investment results that, before fees and expenses, closely correspond to the performance of the Citi Chinese Government and Policy Bank Bond 0-1 Year Select Index (the Index).

- The Sub-fund will invest directly and mainly in PRC Government and Policy Bank Bonds through the Managers RQFII status. Therefore, it is subject to interest rate risk.

- The Sub-Fund is subject to liquidity risk and valuation risk. In a thinly traded market, it may be more difficult to achieve fair value when purchasing or selling underlying securities because of the wide bid-ask spread.

- The Sub-Fund is exposed to the bond issuers credit/insolvency risk and credit downgrading risk and this may adversely affect the Sub-Funds performance.

- Investing in the PRC, involves a greater risk of loss due to greater political, social, tax, economic, foreign exchange, liquidity, regulatory risks, exchange rate fluctuations and exchange control.

- The Sub-fund may be more volatile as the index tracks the performance of a single geographical region, namely the PRC and is concentrated in bonds of a limited number of issuers.

- Investors without RMB accounts may buy and sell HKD traded Units only and distributions are made in RMB only. As such, investors may suffer a foreign exchange loss.

- The Sub-Fund may invest in bonds not included in the Index and may therefore subject to larger tracking error than other traditional ETFs that fully replicates the Index.

- Trading price of the Units on SEHK is subject to market forces and may trade at a substantial premium or discount to the NAV per Unit.

- The Manager may, at its discretion, pay dividends out of capital. Payment of dividends out of capital or effectively out of the capital amounts to a return or withdrawal of part of an investors original investment or from any capital gains attributable to that original investment. The Sub-fund may result in an immediate reduction of the NAV per Unit.

ETF’s performance is calculated on an NAV to NAV basis without any reinvestment and distribution.

Disclaimer

This website is owned and managed by CSOP Asset Management Limited (“CSOP”). CSOP reserves the right to change, modify, add or delete, any content and the terms & conditions of use of this website without notice. Users are advised to periodically review the contents of this website to be familiar with any modifications.

This webpage has been prepared by CSOP and has not been reviewed by the Securities and Futures Commission.