Crude Oil Corporate Bond ETFs

Post on: 6 Апрель, 2015 No Comment

ETF providers rolled out two new ETFs in the first week of June: One tracks Brent crude futures, the other foreign corporate bonds. Claymore on Monday introduced target-date bond ETFs.

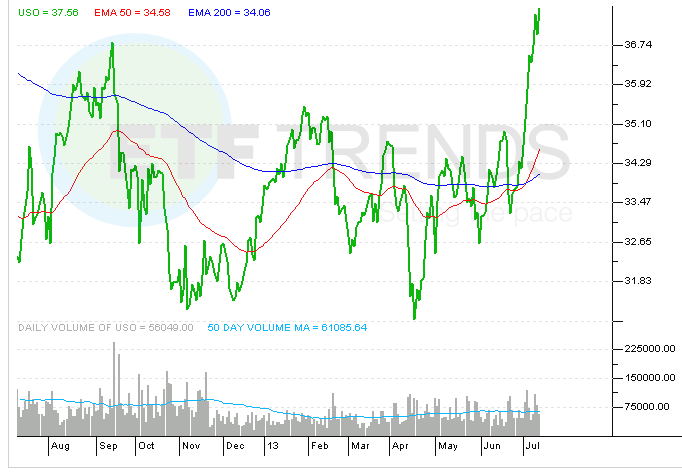

United States Commodity Funds, provider of the most popular oil and gas ETFs, such as United States Oil Fund (ARCA:USO ) and United States Natural Gas Fund (ARCA:UNG ), on June 2 unveiled the first ETF to track Brent crude oil futures.

United States Brent Oil (ARCA:BNO )tracks the near-month price of Brent crude futures traded on the ICE Futures Exchange. But when the near-month contract is within two weeks of expiration, the ETF will track the next month’s contract.

BNO buys Treasuries and monthly futures contracts of the underlying commodity. Because it rolls the near-term contract over to the next-month contract, the fund’s returns could be positively affected by backwardation or negatively affected by contango.

Backwardation arises when the front-month contract costs more than the next-month contract. In such a situation, the fund’s NAV could track higher than the crude’s spot price.

Contango is the opposite. The next-month contract costs more than the near-month contract. In this case, the fund’s NAV could track lower than the spot price.

Brent crude is the second-most-widely traded commodity after West Texas Intermediate crude oil. They’re among some 161 different types of crude oils traded globally.

Brent generally costs $1 to $2 less a barrel than WTI. Brent comes from 15 different oil fields in the North Sea, bounded by England and Scotland to its west and Norway and Denmark to the east. It serves as the benchmark for European crude, while WTI serves as a benchmark for North American crude.

BNO charges 0.75% of assets a year to cover expenses.

Crude oil traded on the NYMEX as of June 4 had dropped 6% year to date but rose 8% in the past 12 months. It rallied 78% in 2009 after cratering 54% in 2008.

Foreign Corporate Bonds

Invesco PowerShares introduced PowerShares International Corporate Bond Portfolio (ARCA:PICB ) Thursday.

PICB tracks the S&P International Corporate Bond Index. The index includes investment-grade corporate bonds from developed countries in the following G-10 currencies: Australian dollar, British pound, Canadian dollar, euro, Japanese yen, Swiss franc, Danish krone, New Zealand dollar, Norwegian krone and Swedish krona.

Holdings are weighted based on their yields. The fund rebalances monthly and no currency can ever make up more than 50% of the fund.

To be included in the index, bonds must be rated investment grade by Standard & Poor’s or Moody’s Investors Service. PICB now holds 19 bonds with an average coupon rate of 4.54%.