Commodity Markets Present Index Challenge

Post on: 28 Апрель, 2015 No Comment

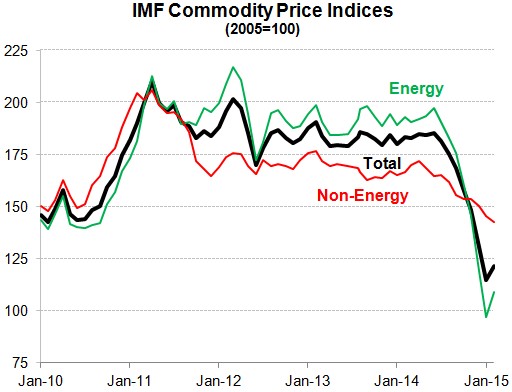

Only a decade ago the idea of institutional and retail investors allocating capital to commodities was outlandish. But the low correlation of this asset class with equities and bonds, along with its ability to hedge against inflation, has propelled commodities up the investor’s agenda.

“According to the latest survey by Barclays Capital, around 45 percent of institutional investors choose to invest in commodities because it diversifies their portfolio while 30 percent opt for the asset class to generate absolute returns,” says Daniel Ung, associate director of index research & design at S&P Dow Jones Indices.

Hand in glove with the increased interest among investors for this asset class has been the development of vehicles that made investing in commodities much easier. Investors no longer have to either be experts in futures or have the necessary storage capacity to take delivery of the physical commodity, whether that’s coffee or crude.

One of the easiest ways for an investor to gain access to the commodity universe is to buy a broad commodity index. While there are a number available in the market, the two best known and most widely tracked are the Dow Jones-UBS Commodity Index and the S&P GSCI Commodity Index. Following a 2012 merger between the indexing arms of Dow Jones and S&P, the same company operates these two indices.

There is a subtle difference between the two. The DJ-UBS CI puts a cap on how much each individual commodity and sector can contribute to the index. This prevents the index from being too heavily weighted towards one sector or one commodity, while the S&P GSCI CI does not put caps on its commodity and sector weights.

“A broad commodity index gives investors direct access to a diversified basket of assets that will cover agriculture, energy, industrial and precious metals,” says Nick Brooks, head of research and investment strategy at ETF Securities.

The diversification of a broad index can also help investors to minimise volatility. “Most of the broad commodity indices tend to have relatively low volatility. For example, the DJ-UBS commodity index’s annual volatility over the past 10 years has been 17 percent, while the S&P 500 has had a volatility of 22 percent over the same time period,” Brooks says.

While broad indices provide easy access to a wide range of commodities, there is a major downside to these products: negative roll yield often erodes profits.

Although products linked to these broad indices give direct access to commodities, they achieve this by buying a basket of futures or forwards. As investors do not want to hold the contracts to maturity and take delivery of the physical commodity, they must frequently roll those contracts.

There is no guarantee, however, that when the contracts are rolled that the price will be the same as when that contract was purchased. Depending on the market, prices will either be lower—in backwardation, or higher—in contango.

If prices are in backwardation, this will improve the investment’s profitability while contango dilutes the return.

For many years the commodities market was in backwardation but that changed around the same time as the financial crisis.

“The vast majority of commodities are currently in contango. That’s led to a very high roll cost,” says Patrick Armstrong, chief investment officer at Armstrong Investment Managers.