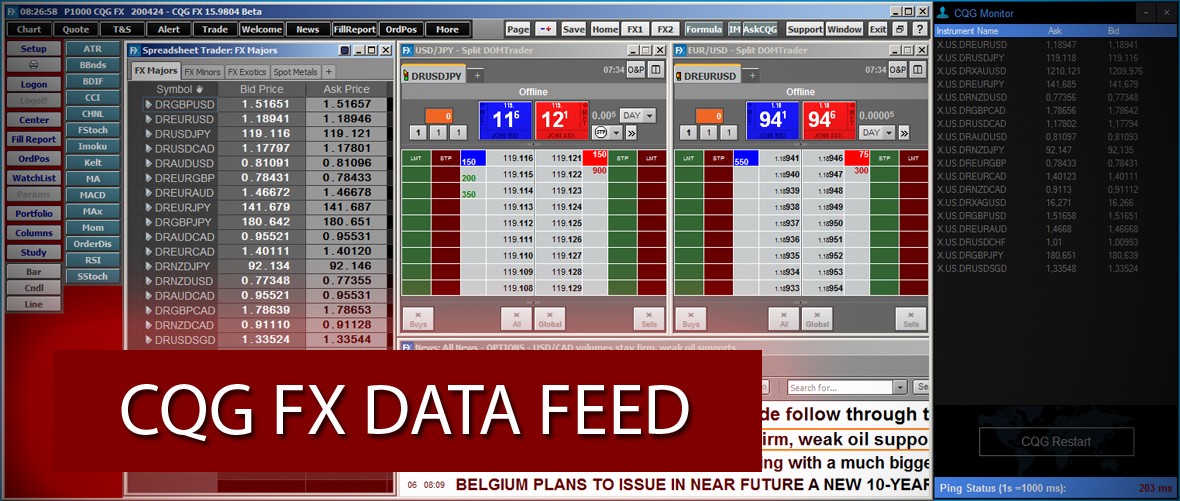

Commodities Futures Forex Trading

Post on: 24 Июль, 2015 No Comment

Forex Trading

Commodities are goods for which there is demand, but which are supplied without qualitative differentiation across a market. One of the characteristics of commodity goods is that its price is determined as a function of their markets as a whole. Well-established physical commodities have actively traded spot and derivative markets. Generally, these are basic resources and agricultural products such as iron ore, crude oil, coal, ethanol, salt, sugar, coffee beans, soybeans, aluminum, copper, rice, wheat, gold, silver, palladium, and platinum. Soft commodities are goods that are grown, while hard commodities are the ones that are extracted through mining.

Commodity Futures

Commodity futures are futures contracts between two parties to buy or sell a specified asset of standardized quantity and quality at a specified future date at a price agreed today (the futures price). The contracts are traded on a futures exchange. The party agreeing to buy the underlying asset in the future assumes a long position, and the party agreeing to sell the asset in the future assumes a short position.

Trading Futures

There are two categories of people who engage in trading futures: hedgers, who have an interest in the underlying asset (which could include an intangible such as an index or interest rate) and are seeking to hedge out the risk of price changes; and speculators, who seek to make a profit by predicting market moves and opening a derivative contract related to the asset on paper, while they have no practical use for or intent to actually take or make delivery of the underlying asset.

Traditionally, trading futures are done through live brokers. Nowadays, most people enjoy online futures trading.

Online Futures Trading

Online futures trading offers convenience to people who wish to trade futures online. Similar to online stock trading, hedgers and speculators may be able to trade futures contracts online via the Internet. Thus, choosing a good online futures trading broker will be essential for a good execution of your order. We will list some of the credible online futures trading brokers here.

Managed Futures

Managed Futures can use strategies that take both long and short positions in futures contracts, as well as options on futures contracts in the global commodity, interest rate, equity, and currency markets.

Commodity Pools

Commodity pools are financial vehicles in which many individual investors combine their moneys, and trade in futures contracts as a single entity, in order to gain leverage.