Commodities Archives

Post on: 18 Июнь, 2015 No Comment

Understanding The Spike In Natural Gas Prices During The Winter

What is really intriguing about trading natural gas Exchange Traded Funds is that natural gas prices tend to follow a season trading pattern, which makes it relatively easy to pick buy and sell levels to profit from seasonal fluctuations in natural gas prices. While the seasonal natural gas trade does not always work out as expected, since there are so many variables that affect natural gas prices, the averages are in the favor of natural gas traders that buy and sell natural gas Exchange Traded Funds t certain times of the year following established seasonal trading patterns. This means that a trader’s chances of profiting from the natural gas trade are much better than just guessing which direction natural gas will trade in over the next few months.

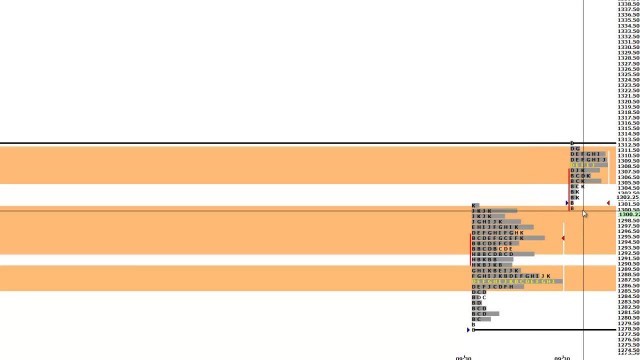

The following is an example of the typical seasonal pattern of natural gas prices follow during a typical winter season and how to trade the natural gas price spike that normally occurs during a typical winter.

There is a distinct pattern to natural gas prices when cold air arrives as expected in November and natural gas storage injections turn into storage withdraws, as demand for natural gas for heating picks up. Natural gas will typically trend downward during the early part of the fall season, as storage injections continue because the air over most of the United States is not yet cold to cause a surge in heating demand for natural gas. Sometime in November, usually during the first half of the month, the weather turns cold enough in the United States to cause an uptick in heating demand. At this point, natural gas starts its long winter withdraw season and the price of natural gas typically responds by stabilizing and eventually moving higher. To successfully trade the winter spike in natural gas prices, it is important to build a long position in natural gas as the price bottoms during the fall.

If the weather turns colder than usual in November and natural gas supplies are tight, the price move higher in natural gas can be fast and substantial. Further moves higher in the price of natural gas during the late fall and winter season depend upon how cold the late fall and winter winds up being. Of course, if winter is delayed and the cold air does not arrive as expected, natural gas can remain flat or fall in price, as demand for heating is less than anticipated.

Long Natural Gas ETFs To Trade The Winter Spike In Natural Gas Prices

If you are looking to go long natural gas to take advantage of the winter price spike, the following natural gas Exchange Traded Funds can be purchased to obtain long exposure to natural gas futures, in anticipation of an increase in natural gas prices during the winter heating season.

- 1X Natural Gas Long ETF (least risky): The United States Natural Gas (NYSE: UNG) provides the most conservative way to play natural gas on the long side, since it is designed to increase on a one to one basis (1X) in conjunction with natural gas futures contracts.

- 2X Natural Gas Long ETF (somewhat risky): The ProShares Ultra DJ-UBS Natural Gas (NYSE: BOIL) is an ETF that provides a way to hold a long position in natural gas that increases at approximately two times (2X) the value of natural gas futures contracts.

- 3X Natural Gas Long ETF (most risky): The VelocityShares 3x Long Natural Gas ETN (NYSE: UGAZ) is the most risky of the three long natural gas ETFs included in this article, and also potentially the most profitable. While it is designed to return three times (3X) the daily performance of natural gas futures contracts, its three times (3X) leverage makes it risky if natural gas futures unexpectedly go down during the winter.

Short Natural Gas ETFs To Trade at The End of The Winter Drop In Natural Gas Prices

Once the coldest of the winter weather has passed, it is time to start considering building a position in natural gas on the short side. The warmer weather coming out of winter often leads to a sell-off in natural gas futures, which causes inverse natural gas Exchange Traded Funds to increase in price. The full effect of the seasonal sell-off in natural gas futures and most dramatic increase in natural gas short Exchange Traded Funds is often felt later in the summer and early in the fall, as natural gas supplies are rebuilt.

- 2X Natural Gas Short ETF (somewhat risky): The ProShares UltraShort DJ-UBS Natural Gas Fund (NYSE: KOLD) is an ETF that provides short exposure to natural gas futures at an approximately two times (2X) rate. When natural gas futures drop in price, KOLD is designed to increase by double the percentage drop in the near-term futures contracts.

- 3X Natural Gas Short ETF (most risky): The VelocityShares 3x Long Natural Gas ETN (NYSE: DGAZ) is an ETF that provides the most aggressive and risky way to play natural gas futures on the short side. DGAZ is designed to change in value by three times (3X) the daily performance of natural gas futures contracts.