Clean Or Green Technology Investing

Post on: 16 Март, 2015 No Comment

Cleantech: Whats In a Word?

Wednesday, September 5th, 2012

At SJF Ventures this summer, we have been debating the words we use for our investment strategy. After more than a dozen years, three funds and 35 portfolio companies. our strategy is more refined than ever. However, we are encountering confusion or negativity around the word “cleantech”, particularly among U.S. institutional limited partners.

We chose the byline “high growth, positive impact” four years ago and it has served us well especially with the surging interest in impact investing and recognition of SJF Ventures as an early leader in the space. However, at the next level down, when we describe our sectoral focus areas as “asset recovery including reuse and recycling, renewable energy, efficiency and infrastructure, sustainable agriculture and food safety” we have encompassed those verticals under the word “cleantech”. (We also focus on “technology-enhanced services” with positive health, wellness, education, and societal benefits.)

‘Cleantech’ as a brand for an investment and entrepreneurial theme was developed more than a decade ago by Nick Parker and Keith Raab with the formation of the Cleantech Group . SJF Ventures was an early member of the Cleantech Group and the SJF Institute helped popularize the term with our Cleantech CEO Panels, CleanLinks events in NYC and RTP, and Cleantech Mentorship Programs. In the early 2000s, the term was used to define a new approach distinct from the prior “envirotech, end-of-the-pipe pollution clean-up” investment approach. Here is how the Cleantech Group defines the theme today:

“Cleantech represents a diverse range of products, services, and processes, all intended to:

- Provide superior performance at lower costs , while

- Greatly reducing or eliminating negative ecological impact , at the same time as

- Improving the productive and responsible use of natural resources”

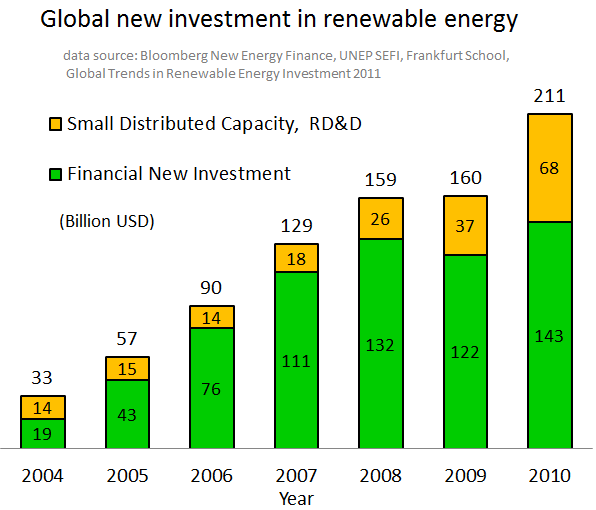

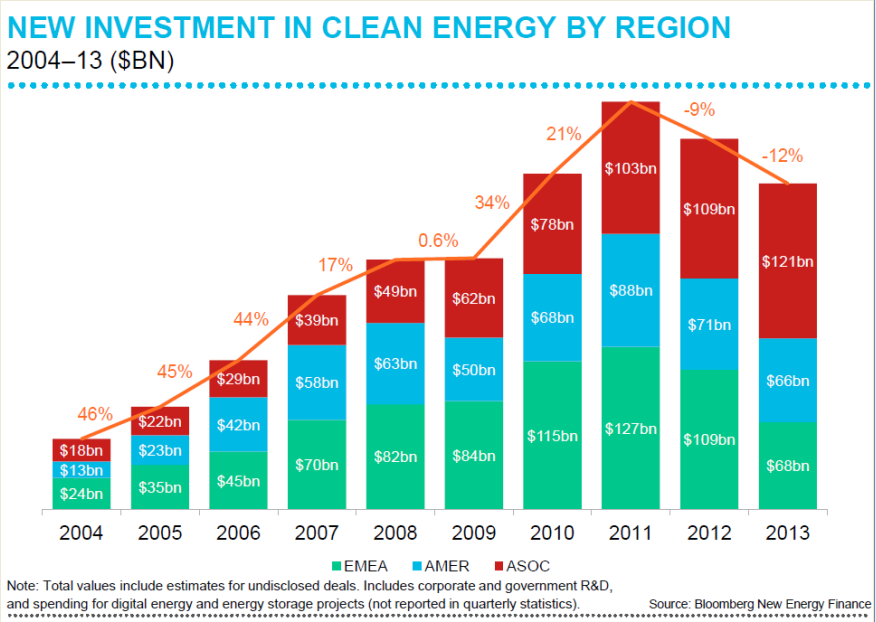

The new conceptual approach called ‘cleantech’ arrived with great timing in 2000-2002 with the increasing awareness of climate change, volatile and rising energy prices, accelerating global population and resource constraints. CalPERS and other large limited partners began allocating for a cleantech strategy and many large technology venture capital funds adopted ‘cleantech’ or ‘greentech’ as an additional investment vertical. While there have been up and down cycles over the last decade, the theme has proven enduring, with the Cleantech Group reporting $1.61 billion in cleantech investments in 155 transactions in the second quarter of 2012, with solar, transportation, efficiency, biofuels and water companies receiving the most investment respectively.

When we started our first fund thirteen years ago we called our investment verticals ‘sustainability’ and ‘business services’ but with our support of the cleantech brand starting about a decade ago we have used ‘cleantech and sustainability’ and ‘technology-enhanced services.’ However, now in mid-2012, as we are raising the remainder of our third fund, we are encountering widely held skepticism or negative views of ‘cleantech’ by U.S. institutional investors. (Interestingly with LPs in Europe and other countries, ‘cleantech’ seems continue to be a more accepted and positive term.)

What is the source of the negative view of cleantech that has arisen in the U.S. in the last year? Certainly the controversy over the Solyndra bankruptcy in September 2011 was the biggest headline news that triggered attacks on ‘clean energy’ and ‘cleantech’ as we lead into an election year. Prior to the news storm surrounding Solyndra we wrote a piece in March 2010 “Two Cleantech VC Strategies: ‘Today Markets’ and ‘Tomorrow Markets” in which we distinguished SJF’s approach from the capital and technology intensive strategies of much larger funds. Following the Solyndra bankruptcy announcement, we wrote ‘After Solyndra: Cleantech Investing Still Makes Sense’ to articulate the ‘capital efficient expansion’ strategy of SJF Ventures in multiple sectors of the economy in need of efficiency innovation.

We certainly think the deep technology innovations financed in part by large funds is also needed for the global economy’s rapid transition to more efficiency and sustainability. For example, funds like Khosla Ventures has made more than 40 portfolio investments in twelve industry verticals in need of new technological solutions, such as batteries, cellulosic alcohol, and efficiency.

Unfortunately, however, thoughtful cleantech investment strategies have become conflated in the public’s mind (and with some limited partners) with ‘regulatory dependent, subsidized clean energy and green jobs government programs.’ This sentiment has coincided with the reduction in natural gas prices due to new fracking methods to cause many to assert that renewables and efficiency initiatives are not needed.

At SJF Ventures we find this disenchantment cycle with ‘cleantech’ quite familiar, having been active in the field through our funds, previous venture capital funds and entrepreneurial firms in the field since the 1970’s. We have been through at least three waves of ‘green’ venture investing as summarized below: