Choosing An Emerging Market ETF

Post on: 16 Март, 2015 No Comment

Summary

- There are many ETFs available to investors.

- ETF holdings and expense costs are two quick ways to narrow down the field of ETFs.

- I invest in VWO by Vanguard because it gives me emerging market exposure and fits my portfolio best.

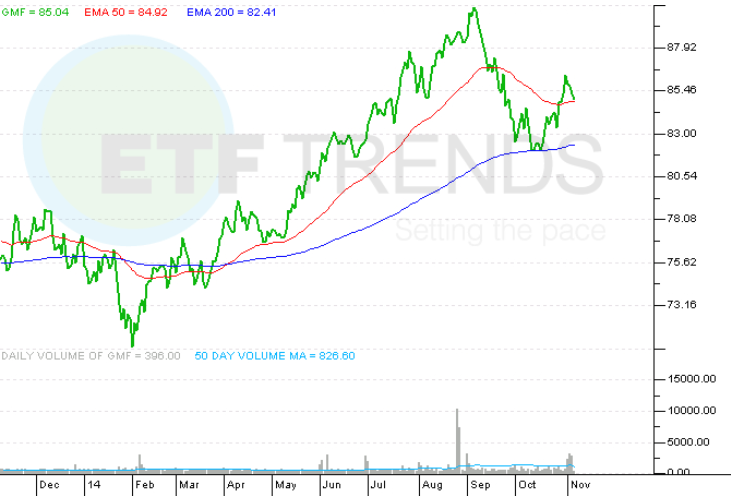

In my previous ETF (exchange traded funds) article I discussed how I could replace my entire diversified retirement portfolio with 5 ETFs. My idea was that once this portfolio was set up, I could just revisit and adjust it periodically. Time savings through simplicity was the big benefit. You can read that article by clicking this LINK. but I came away wondering the best way to pick from the thousands of similar ETFs on the market. There can even be dozens of ETFs chasing a given index. Today we’re going to look at Vanguard’s FTSE Emerging Market ETF (NYSEARCA:VWO ), iShares Core MSCI Emerging Markets ETF (NYSEARCA:IEMG ), and SPDR’s S&P Emerging Markets ETF (NYSEARCA:GMM ), in the emerging market equities space. Then we are going to compare those ETFs to Vanguard’s FTSE All-World ex-U.S. ETF (NYSEARCA:VEU ) and iShares’ Core MSCI Total International Stock ETF (NYSEARCA:IXUS ). You can find links to the respective fund family’s websites for any of these ETFs at the end of this article. The two ways I decide between competing ETFs are by comparing each ETF’s costs and each ETF’s mix of stock holdings.

With Investing, you get what you don’t pay for

John Bogle

Costs

The expense ratio of investments can be a huge drag on returns over long periods of time. The differences in returns probably aren’t noticeable over one or two year time periods, but these costs compound and become very significant over longer periods of time (like 10, 20, or 30 years). One of the best discussions I’ve ever read on the compounding of costs, can be found in John Bogle’s Little Book of Common Sense Investing. In the book, Bogle provides his own studies of the negative impact costs can cause on portfolio returns. In fact, the difference between a 7% and a 5% average annual return (because of a 2% annual fee) would reduce the 40 year total return by essentially half .

Portfolio managers have a much easier time charging high fees for actively managed investments than for index style funds. With index funds, the whole purpose of the ETF or mutual fund is to mimic the underlying index as closely as possible. That goal keeps portfolio turnover to a minimum and greatly reduces the portfolio manager’s need to strategize and trade. Instead the fund’s portfolio is rebalanced on some periodic interval, typically every three months. As a result of this simplicity, the cost differential is fairly small, although not as small as many domestic U.S. ETFs. Among the 5 funds I’m looking at today, the range of annual expense ratio is 0.15% to 0.59%. Some investors will tell you that a fund’s expense ratio doesn’t tell the whole story, which is true, but it does give you a good representation of the costs associated with owning the fund.

Fund Holdings

A better way to differentiate between ETFs is based on its mix of holdings. Take a look at the five ETFs listed in the table. The number of holdings vary quite widely, as does the returns. The last two are intended to mimic the an aggregate of international stock markets. Therefore, they invest in stock markets of emerging

The results reported above are for a fairly short time period, because some of the ETFs have only been around since October of 2012. I am usually seeking diversification when I invest in an index ETF, but because these ETFs are market weighted (meaning larger companies in more developed countries get more exposure) I will shy away from the two ETFs on the right, and go for direct emerging market exposure. My reasoning is two fold:

I feel emerging markets represent a better value at this time. They have struggled the last few years and although I’m sure they will have their setbacks along the way, I want exposure to emerging markets for their economic and population growth.

Direct exposure to emerging markets fits in better with my overall portfolio. Most of my portfolio is invested in individual dividend growth companies. These companies tend to be large and have more exposure to developed markets, like the U.S. and western Europe.

Conclusion

Vanguard’s FTSE Emerging Market ETF fits best with my overall portfolio. I have owned VWO for a couple months now and have been pleased. At the beginning of February I wrote an article about how I was investing in the emerging markets sell off and why I was optimistic about the future of emerging markets. (You can read that article by clicking this LINK .) In the past I have invested mostly in individual companies, but getting reliable information is a real problem with many companies in many foreign countries. I don’t feel that I can adequately pick the winners and losers in these smaller foreign markets, and therefore I rely on Vanguard’s FTSE Emerging Market ETF for my exposure. With low costs and direct exposure to the emerging markets, VWO is the best fit for my portfolio.

Clearly, the investments in your portfolio are an individual decision. I’m certain that if you look, you will find just the right ETF you and your financial professional have been searching for. There are literally thousands of different ETFs, so selecting one can be a difficult decision. Take your time and remember to keep it simple. The goal is to keep the same (simple) investments for a long period of time, and thereby reduce costs and aggravation. Focus on the costs and the countries (or companies) whose stock is owned by the ETF, and you will do just fine.

Disclosure:

I own VWO. This article is for informational purposes only and should not be considered a recommendation for anyone to buy, sell, or hold any specific securities. I am not a financial professional. The information above is provided by each ETF’s fund company website (Vanguard’s VWO. iShares’ IEMG. SPDR’s GMM. Vanguard’s VEU and iShares IXUS )

Disclosure: I am long VWO. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.